December 14, 2022

Fed Raises 0.5%; Signals More Hikes in 2023

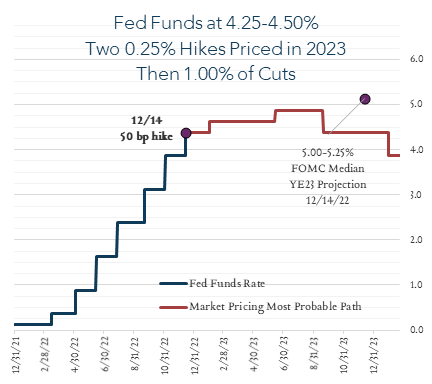

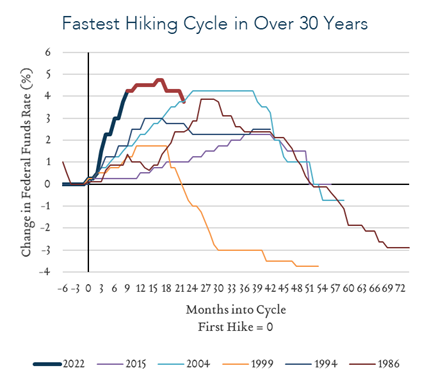

Fed raises interest rates by 0.50%, bringing the Fed Funds Rate range to 4.25-4.50%. It raised projections for the 2023 rate by 0.50% to a top rate of 5.25%. The market is now lower than the fed, pricing for a terminal rate of 5.00% before pricing in 100bps of cuts in late 2023 & early 2024.

Key takeaways:

- The Fed raised interest rates 0.50%, as expected, to a range of 4.25-4.50%.

- Projections for the rate next year were revised upward by 0.50%, from 4.50-4.75% to 5.00-5.25%. This was a hawkish surprise and is impacting risk assets.

- The bond market is unconvinced, and continues to price in a high-point of a 4.75-5.00% rate and then cuts of 1.00% by early 2024.

- Chair Powell noted that the economy appears to be slowing, but continued to characterize the labor market as out-of-balance, and risks to inflation as skewed to the upside.

At its meeting today the FOMC voted unanimously to raise the Federal Funds rate to 4.25-4.50% and to continue its quantitative tightening plan.

The statement was largely unchanged from September.

In its summary of economic projections, the Fed updated their projections to show slower real GDP growth, particularly in 2023, faster 2023 inflation, and higher policy rates.

In addition, the 2023 forecast show Core PCE Inflation exceeding headline PCE inflation, reflecting inflation broadening into stickier areas of the economy.

The projections also show an increase in the unemployment rate in 2023 and beyond.

Participants nearly-uniformly assessed uncertainty about projections for GDP growth to be ‘Higher’ and risks to GDP growth to be weighted to the downside & risks to unemployment & inflation weighted to the upside.

The Summary of Economic Projections included increases to the median Fed Funds Target Rate forecast:

By year-end 2023: from 4.6% to 5.1%

By year-end 2024: from 3.9% to 4.1%

| 2022 | 2023 | 2024 | 2025 | Longer Run | |

| Change in real GDP | 0.5 | 0.5 | 1.6 | 1.8 | 1.8 |

| September projection | 0.2 | 1.2 | 1.7 | 1.8 | 1.8 |

| June projection | 1.7 | 1.7 | 1.9 | 1.8 | |

| March projection | 2.8 | 2.2 | 2 | 1.8 | |

| Unemployment rate | 3.7 | 4.6 | 4.6 | 4.5 | 4.0 |

| September projection | 3.8 | 4.4 | 4.4 | 4.3 | 4.0 |

| June projection | 3.7 | 3.9 | 4.1 | 4.0 | |

| March projection | 3.5 | 3.5 | 3.6 | 4.0 | |

| PCE inflation | 5.6 | 3.1 | 2.5 | 2.1 | 2.0 |

| September projection | 5.4 | 2.8 | 2.3 | 2.0 | 2.0 |

| June projection | 5.2 | 2.6 | 2.2 | 2.0 | |

| March projection | 4.3 | 2.7 | 2.3 | 2.0 | |

| Core PCE inflation | 4.8 | 3.5 | 2.5 | 2.1 | |

| September projection | 4.5 | 3.1 | 2.3 | 2.1 | |

| June projection | 4.3 | 2.7 | 2.3 | ||

| March projection | 4.3 | 2.7 | 2.3 | ||

| Fed funds rate | 4.4 | 5.1 | 4.1 | 3.1 | 2.5 |

| September projection | 4.4 | 4.6 | 3.9 | 2.9 | 2.5 |

| June projection | 3.4 | 3.8 | 3.4 | 2.5 | |

| March projection | 1.9 | 2.8 | 2.8 | 2.4 | |

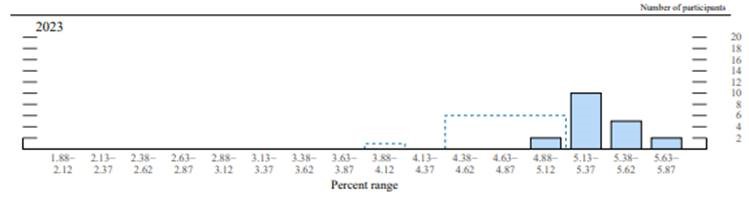

2023 Year End Dot Plot Evolution:

Messaging at the press conference:

The main justification provided for increasing the projected rate for 2023 and beyond was the strong labor market. Chair Powell characterized the labor market as impacting over 50% of the core PCE inflation basket, and noted that the labor market appears to be out-of-balance, with many vacancies and with low unemployment.

Chair Powell stated that it feels like we have a structural labor shortage, with a gap between vacancies and unemployed workers of 4 million people.

The ‘big question’ is how much inflation will occur in non-housing services, where Powell believes there needs to be a better balancing of supply and demand in the labor market.

If you factor in productivity estimates, wage growth can only be 3-4% to be consistent with 2% inflation. The latest wage growth numbers have been 5-6%.

Market reaction:

The market was up for most of the morning but fell promptly after 2pm on the release of the statement and continued falling throughout the press conference.

The bond market was largely unconvinced by the Fed’s new projections, with yields mostly stable.

The dollar strengthened. Gold fell. Oil fell a touch, but is up for the day.

| Prev. Close | Open | 2pm | 2:45pm | % change Prev Close | % change Open | % change 2pm-2:45pm | ||

| S&P 500 | $ 4,019.65 | $ 4,015.54 | $ 4,030.85 | $ 3,993.00 | -0.66% | -0.56% | -0.94% | |

| Dow Jones Industrial Average | $ 34,108.64 | $ 34,086.07 | $ 34,177.42 | $ 33,821.01 | -0.84% | -0.78% | -1.04% | |

| Nasdaq | $ 11,256.81 | $ 11,248.09 | $ 11,251.58 | $ 11,147.19 | -0.97% | -0.90% | -0.93% | |

| 10 Year Treasury Rate (%) | 3.50% | 3.50% | 3.55% | 3.51% | 0.01% | 0.01% | -0.04% | |

| US Dollar | $ 103.98 | $ 104.07 | $ 103.55 | $ 103.87 | -0.10% | -0.19% | 0.31% | |

| Gold | $ 1,810.80 | $ 1,810.80 | $ 1,820.20 | $ 1,803.14 | -0.42% | -0.42% | -0.94% | |

| Oil | $ 75.39 | $ 75.27 | $ 77.58 | $ 77.33 | 2.57% | 2.74% | -0.32% |