December 15, 2022

November Retail Sales - Demand Softens

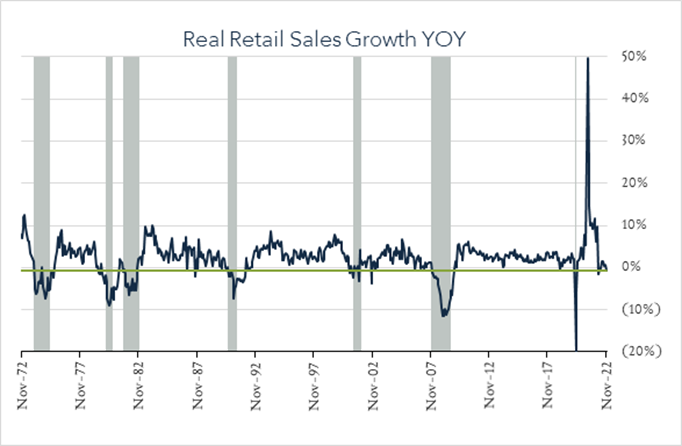

U.S. retail sales posted the largest month over month decline in nearly a year reflecting softness in a range of categories that suggest some easing in American’s demand for goods. The report suggests some loss in momentum in consumer demand for goods amid high inflation and a shift in preferences favoring services. While rising wages and excess savings built up during the pandemic have helped support spending, consumers are feeling more pressure. While real year-over-year retail sales declines can be a leading indicator of a recession, softness is also an indication that Fed efforts to reduce consumer demand, and in turn inflation, is having an impact.

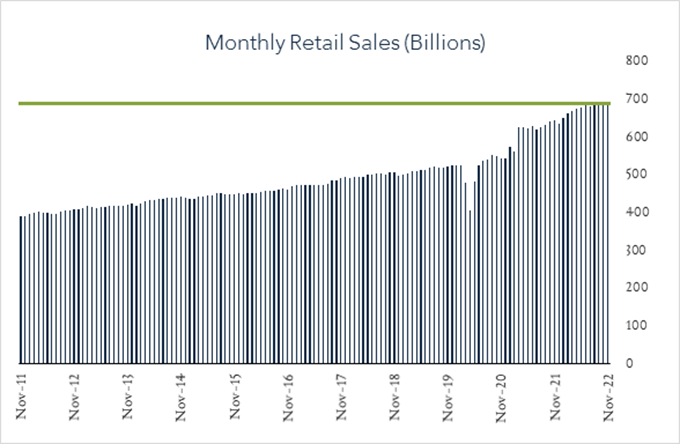

- Real (inflation adjusted) retail sales declined 0.6% year-over-year. In November, retail sales grew just 6.5% compared to a year ago netting -0.6% real growth after adjusting for 7.1% inflation. Higher spending on gasoline compared to a year ago (+16%) accounted for a large portion of the nominal increase though real gains were also evident in restaurants (+14%), the primary service-oriented metric in the report. On the flip side, the report showed real declines in nine of thirteen categories.

- Real (inflation adjusted ) retail sales fell 0.7% month-over-month. In November, retail sales levels contracted by 0.6% compared to October (consensus -0.2%) netting -0.7% growth in real terms. Nine of thirteen categories fell last month, including furniture stores (-2.6%), building materials (-2.5%), auto/parts dealers (-2.3%) and electronics stores (-1.5%).