December 13, 2022

November Inflation - Lower Than Expected

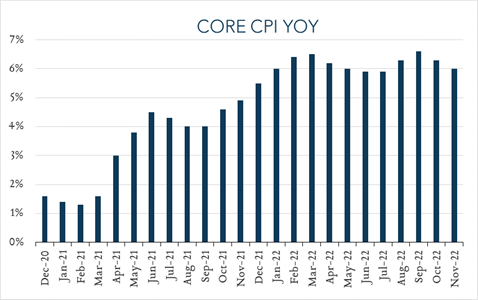

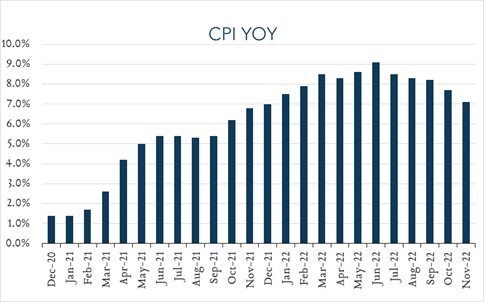

November inflation data surprised positively this morning for the second month in a row offering hope that decades high price increases are easing and perhaps giving Fed policymakers additional breathing room in the months ahead. The Consumer Price Index rose 7.1% from the same period a year ago compared to expectations of +7.3%. In addition to beating expectations, November CPI was the lowest print this year, and marked deceleration from +7.7% in October and a peak of +9.1% in June. Core CPI rose 6.0% decelerating from +6.3% in October and a peak of +6.6% in September.

- Consumer prices (CPI) increased 7.1% year-over-year. In November, the consumer price index (CPI) increased 7.1%, decelerating from 7.7% in October. Expectations ranged from 7.1% to 7.5% with a median of 7.3%. Food (+11%) and energy (+13%) remained the largest contributors to the overall increase. Core CPI (excludes food and energy) increased 6.0% year-over-year (vs. expectations of +6.1%), decelerating from 6.6% (40-year high water mark) in September.

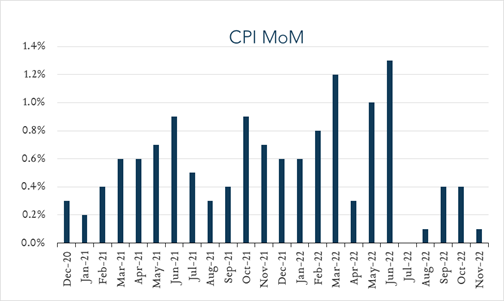

- Consumer prices (CPI) increased 0.1% month-over-month. In November, consumer prices increased 0.1% compared to October. Expectations ranged from -0.1% to +0.4% with a median of +0.3%. Shelter costs, which represent nearly one third of the consumer price index and tend to increase with a lag, increased 0.6% for the month, down from +0.8% in October and +0.7% in August and September. Core CPI (excludes food and energy) increased 0.2% compared to October – below expectations of +0.3%.