June 15, 2023

April Retail Sales - Soft YoY; Resilient MoM

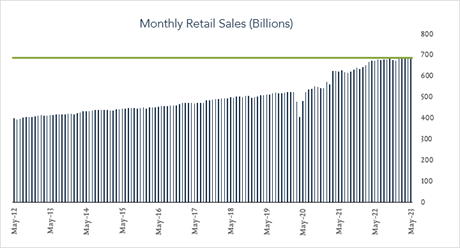

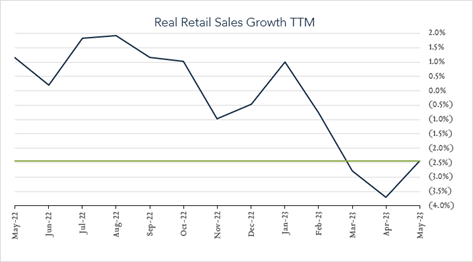

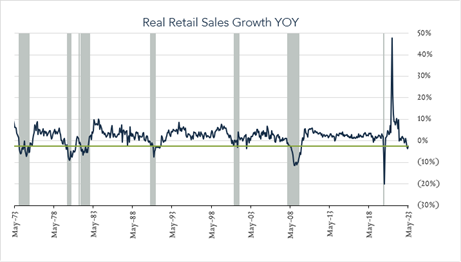

U.S. retail sales were stronger than expected on a month-over-month basis, but remain lower on a year-over-year basis. In real terms, retail spending increased 0.2% compared to April and declined 2.4% year-over-year. Monthly data helps to highlight current trends, however we focus more closely on year-over-year results as a recession indicator. Real (inflation adjusted) declines in retail spending can indicate increased recession risk as the consumer represents the lion’s share of the U.S. economy. Over the last three months, real year-over-year spending has declined an average of 3.0%. Today’s result (-2.4% YoY) suggests moderating consumer demand as inflation persists and monetary policy continues to tighten.

- Real (inflation adjusted) retail sales down 2.4% year-over-year. In May, retail sales grew 1.6% nominally and declined 2.4% after adjusting for 4.0% inflation. Today’s result marked a fourth straight month of real declines with an average annual decline of 3.0% over the last three months. Higher spending on restaurants (+8.0%), health and personal care stores (+7.8%), and non-store retailers (+6.5%) was partially offset by lower spending at gas stations (-20.5%) and furniture stores (-6.4%). Eight out of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales up 0.2% month-over-month. In May, retail sales levels increased 0.3% compared to April (consensus -0.2%) netting 0.2% growth in real terms. Increased spending on building materials (+2.2%) and motor vehicles & parts (+1.4%) was partially offset by lower spending at gas stations (-2.6%) and brick and mortar retailers (-1.0%). Nine out of thirteen categories showed growth in real terms.