June 14, 2023

FOMC Update: No Surprise on Pause, but a Slightly Hawkish Dot Surprise

Fed Statement Side-by-Side: https://file.ac/ESaULDW0GNw/

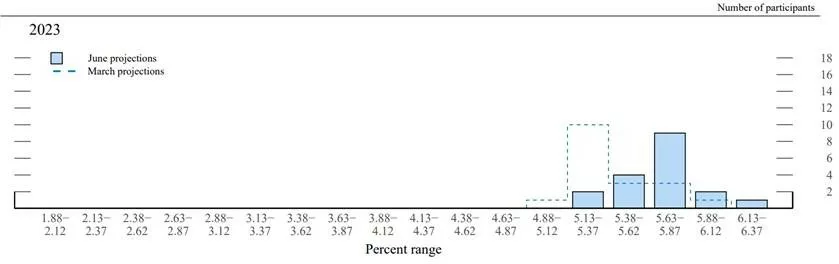

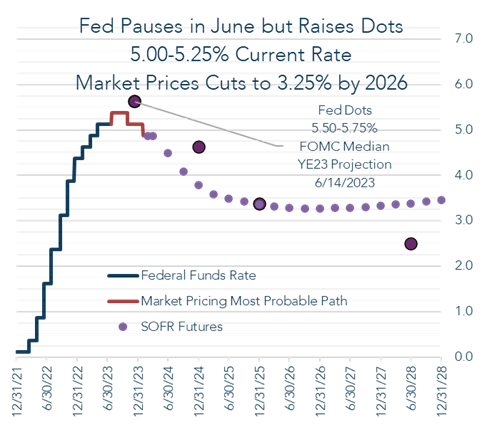

Fed pauses, maintains the Fed Funds Rate at 5.00-5.25%, but raises projections for future hikes. The Dot Plot shows two additional hikes in 2023.

The odds of a hike in July rose to over 80%, however the market continues to price in a cut by January, 2024 back to the current rate.

Key takeaways:

- The Fed paused its rate hikes to allow for additional time to assess incoming economic data.

- Fed projections for the 2023 year-end rate rose 0.50% to 5.50-5.75%. Projections for 2024 show 1.00% of cuts.

- The bond market is pricing in a high-point of 5.25-5.50% followed by one cut in the back half of 2023 and a series of cuts down to around 3.25% in 2026.

- The banking stress which was a major focus in March has receded into the background.

At its meeting today the FOMC voted unanimously to leave the Federal Funds rate unchanged at 5.00-5.25% and to continue its quantitative tightening plan.

The statement noted this pause and the need to assess incoming information.

In its summary of economic projections, the Fed updated projections to show an uptick in 2023 real GDP growth, lower unemployment in 2023, and slightly lower inflation in 2023.

The 2023 forecast continues to show Core PCE Inflation exceeding headline PCE inflation, reflecting inflation broadening into stickier areas of the economy.

The Summary of Economic Projections showed the following changes to the median Fed Funds Target Rate forecast:

By year-end 2023: 5.6% (up 0.50%)

By year-end 2024: 4.6% (up 0.30%)

| Variable | ||||

| 2023 | 2024 | 2025 | Longer Run | |

| Change in real GDP | 1.0 | 1.1 | 1.8 | 1.8 |

| March projection | 0.4 | 1.2 | 1.9 | 1.8 |

| December projection | 0.5 | 1.6 | 1.8 | 1.8 |

| September projection | 1.2 | 1.7 | 1.8 | 1.8 |

| Unemployment rate | 4.1 | 4.5 | 4.5 | 4.0 |

| March projection | 4.5 | 4.6 | 4.6 | 4.0 |

| December projection | 4.6 | 4.6 | 4.5 | 4.0 |

| September projection | 4.4 | 4.4 | 4.3 | 4.0 |

| PCE inflation | 3.2 | 2.5 | 2.1 | 2.0 |

| March projection | 3.3 | 2.5 | 2.1 | 2.0 |

| December projection | 3.1 | 2.5 | 2.1 | 2.0 |

| September projection | 2.8 | 2.3 | 2.0 | 2.0 |

| Core PCE inflation | 3.9 | 2.6 | 2.2 | |

| March projection | 3.6 | 2.6 | 2.1 | |

| December projection | 3.5 | 2.5 | 2.1 | |

| September projection | 3.1 | 2.3 | 2.1 | |

| Fed funds rate | 5.6 | 4.6 | 3.4 | 2.5 |

| March projection | 5.1 | 4.3 | 3.1 | 2.5 |

| December projection | 5.1 | 4.1 | 3.1 | 2.5 |

| September projection | 4.6 | 3.9 | 2.9 | 2.5 |

Messaging at the press conference:

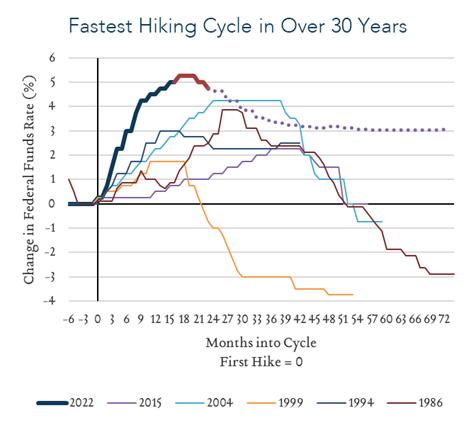

Chair Powell noted the amount of policy tightening that has been delivered since this rate hiking cycle began in March 2022.

Powell did not comment on the banking system in his prepared remarks, which is a change since the banking stress materialized in March 2023.

Powell characterized the impacts of policy tightening as already affecting the most interest rate sensitive sectors of the economy like housing, but that it would take time for the full impact to be felt through the broader economy and to impact inflation.

In Q&A many questions focused on the benefit of pausing now while also raising the dot plot projections for additional hikes in 2023.

- Chair Powell responded to these questions by trying to separate the decisions between the pace of hiking from the ultimate level of interest rates.

- He stated that the benefits are primarily that the FOMC will get additional information about the impacts of the current policy stance as well as the potential impacts from the banking stress.

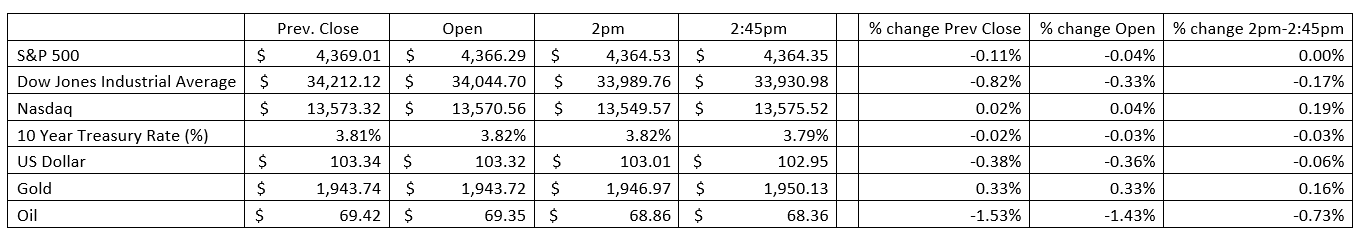

Market reaction:

The market was up for most of the morning, fell on the release of the statement and began recovering late in the press conference.

The bond market was perhaps surprised by the move higher in the dot plot. Rates were lower for most of the morning but moved back to yesterday’s levels upon the release of the statement before drifting down slightly during the press conference.

The dollar and oil both fell slightly. Gold strengthened slightly.