December 2, 2022

November Jobs - Stronger Than Expected Despite Fed Efforts

Good news is bad news. Continued job gains highlight strong demand, but offer little relief for the Fed. U.S. employers again added more jobs than expected in November and wages increased more than expected underscoring continued labor market strength despite rising interest rates and concerns of an impending recession. Continued labor market strength supports consumer spending , but also drives wage growth (and inflation) as businesses compete for a limited pool of workers. Earlier this week Fed Chair Jerome Powell said that a moderation in demand for labor is needed to bring the jobs market back into balance and the FOMC has only seen “tentative signs” of that so far. Today’s report is consistent with his comment.

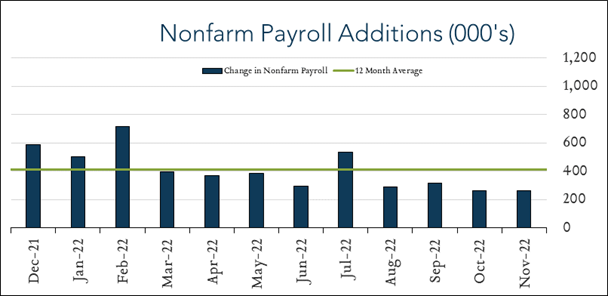

- 263K jobs added in November – stronger than expected once again. The U.S. labor market added 263k jobs in November compared to forecasts ranging from +60K to +270K with a median of +200K. Job gains were consistent with the prior 3-month average, but below the year-to-date average of +392K. payroll additions were relatively broad-based with notable gains in Leisure & Hospitality (+88K), Health Care (+45K) and Government (+42K) offsetting declines in Retail Trade (-30K) and Transportation & Warehousing (-15K).

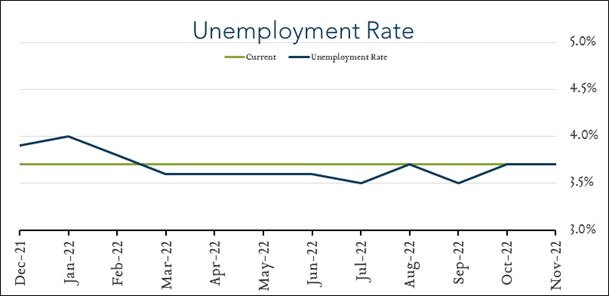

3.7% unemployment – unchanged The U.S. unemployment rate held steady at 3.7% in November. Forecasts ranged from 3.6% to 3.9% with a median of 3.7%. Labor force participation edged down to 62.1% compared to 62.2% in October. Hourly earnings increased 5.1% over the last year (compared to expectations of +4.6%) and rose 0.6% month-over-month – double the forecasted rate of +0.3%.