December 9, 2022

You Can Save More to Your Retirement Plan and IRA in 2023

The Internal Revenue Service (IRS) recently announced the increase to the maximum retirement plan benefit and contribution limits for 2023. Employee contributions to 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan will rise to $22,500 – a $2,000 increase from the $20,500 cap for 2022. Plan participants age 50 and older in 2023 can contribute an additional $7,500 for a maximum of $30,000, up $1,000 from this year.

Inflation is at its highest level since qualified retirement plan indexing began, causing 7% to 11% increases for most 2023 contribution limits. The annual employee contribution limit typically goes up by $500 increments; however, higher inflation is making it jump up four steps in one year.

For the first time since 2019, the individual retirement account (IRA) contribution amount will go to $6,500 – a $500 bump from the $6,000 cap for 2022. The catch-up limit for IRAs will remain at $1,000, meaning those age 50 and older can put away $7,500 in 2023.

Additionally, more Americans may now qualify for Roth IRA contributions in 2023, with the income phase outs rising to between $138,000 and $153,000 for single and head of household filers (up from $129,000 and $144,000) and between $218,000 and $228,000 for married couples filing jointly (up from $204,000 and $214,000).

In an attempt to keep up with the ongoing impact of inflation on seniors, the Social Security Administration (SSA) announced that benefits are set to rise by 8.7% in 2023. This will increase the “average” monthly benefit amount to $1,827, up $146 from the $1,681 this year.

The Social Security taxable wage base jumps nearly 9% for 2023 to $160,200, up from $147,000 this year. The Social Security tax functions very much like a flat tax. The taxable wage base caps the amount of employee compensation subject to the 6.20% Social Security tax rate imposed on both employers and employees. In 2023, employers must withhold Social Security tax on each employee’s first $160,200 of compensation. This means that the employer and employee must each pay $9,932 (the self-employed pay both sides of the tax). Compensation above the $160,200 is not subject to Social Security taxes.

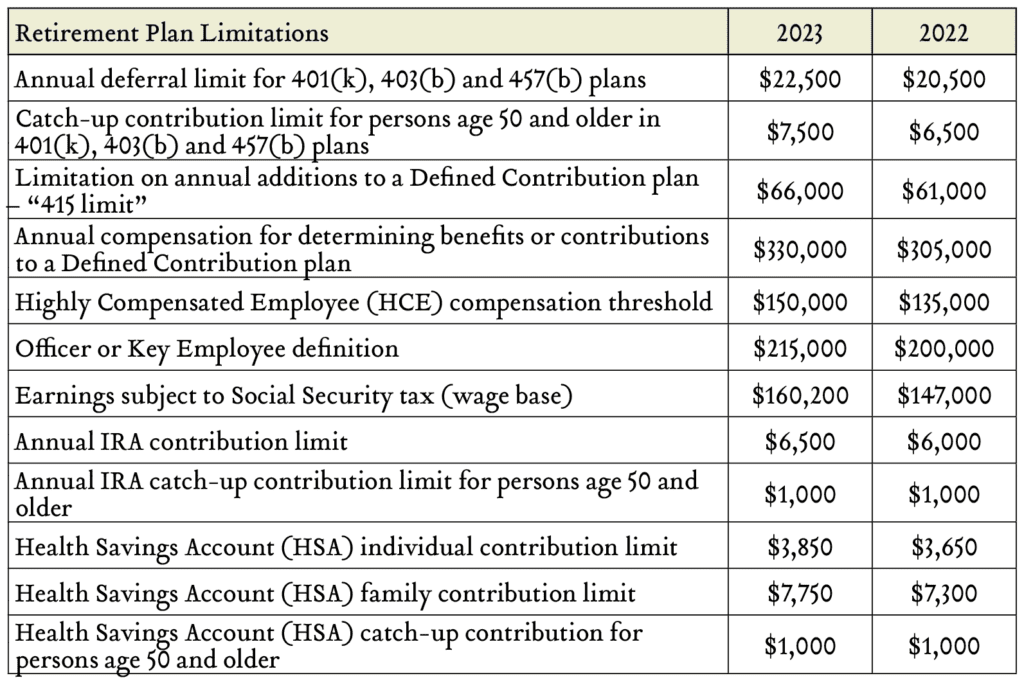

On the following page is a table highlighting some common retirement plan and other benefit limitations.

The Saver’s Tax Credit for low- to moderate-income workers will reflect adjustments as well. The Saver’s Credit is a tax break that is available to many people with modest incomes, offering a way for savers to make their money work harder for them. The credit is between 10-50% of the individual’s eligible contribution up to $2,000. The annual income limit to receive the credit for 2023 is $36,500 for single filers; $54,750 for head of household; and $73,000 for married couples filing jointly.

Should you have any questions regarding the various limitations that apply to retirement plans, including some that are not included in the above table, please contact our retirement plan services team.