October 9, 2023

Unlocking Financial Clarity: Monte Carlo Analysis and Its Role in Decision Making

Financial decisions are an integral part of our lives, shaping our present and future. Among these choices, few are as critical as those related to saving, spending and investing. How we allocate our resources in early adult life can significantly impact our financial security in later years, including the assets we leave behind at death. To navigate this complex terrain and make informed choices, Monte Carlo analysis can be a powerful tool. In this article, we’ll explore how Monte Carlo analysis can illuminate the long-term consequences of early-life purchases and aid in making complex financial decisions.

Understanding Monte Carlo Analysis

Before diving into its application, let’s grasp the essence of Monte Carlo analysis. Named after the Monte Carlo Casino in Monaco, this method employs randomness to solve complex problems. In the world of finance, Monte Carlo simulations involve creating a thousand possible future scenarios to assess the likelihood of different outcomes. It allows us to consider numerous variables and uncertainties simultaneously, making it a valuable tool for predicting financial outcomes over time.

How Monte Carlo Analysis Works

Monte Carlo analysis relies on a combination of historical data and probabilistic modeling to generate a wide range of possible future scenarios. Here’s a simplified overview of how it works:

- INPUT PARAMETERS: You provide input parameters, such as your current financial situation, income, expenses, and goals. This data forms the basis for the simulation.

- PROBABILISTIC MODELING: The simulation then incorporates historical data and probabilistic models for various factors like market returns, inflation, and interest rates. These models introduce randomness into the analysis, accounting for the uncertainties inherent in financial markets.

- SCENARIO GENERATION: The Monte Carlo method runs a thousand simulations, each representing a possible future scenario. These scenarios consider different combinations of factors and how they might evolve over time.

- OUTCOME ASSESSMENT: After running the simulations, the analysis provides a range of possible outcomes for your financial situation. This includes scenarios where your assets grow significantly, scenarios with moderate growth, and scenarios where unexpected challenges arise.

- decision making: Armed with this array of potential outcomes, you can make informed financial decisions. Monte Carlo analysis helps you assess the probability of achieving specific goals, such as retiring comfortably, sending your children to college, or leaving a substantial legacy.

How Monte Carlo Analysis Guides Complex Financial Decisions

- RISK ASSESSMENT: One of the primary benefits of Monte Carlo analysis is its ability to assess risk. By examining a wide range of potential outcomes, it helps you understand the likelihood of success or failure for various financial decisions. This risk assessment is especially valuable when making complex choices involving substantial investments or commitments.

- OPTIMAL ALLOCATION: Monte Carlo analysis can assist in determining the optimal allocation of resources. Whether you’re deciding between paying off debt, investing in the stock market, or saving for retirement, the simulations can show you the potential impact of each choice on your long-term financial well-being.

- GOAL PLANNING: Planning for major life events, such as retirement or funding your children’s education, can be daunting. Monte Carlo simulations provide a clear picture of whether your current financial trajectory aligns with your goals. If not, you can adjust your strategy accordingly to increase your chances of success.

- LEGACY PLANNING: For many individuals, leaving a financial legacy for their heirs is a priority. Monte Carlo analysis can help you understand how different financial decisions impact the assets you’ll be able to pass on to your loved ones, ensuring your wealth continues to benefit future generations.

The Impact of Early-Life Purchases

Early adulthood is often marked by significant financial milestones, such as purchasing a home, starting a family, or investing in higher education. These decisions can have far-reaching consequences on your financial health throughout your life. To understand the full extent of their impact, Monte Carlo analysis can be instrumental.

In the following scenario, we will explore the decisions and potential consequences of starting a family. John and Jane Doe are married in their mid-thirties with about $250,000 in liquid assets saved. Jane has received a big promotion and their combined income now totals approximately $225,000 annually with retirement planned at age 65. John and Jane currently rent their home, paying $2,000 per month. Living expenses total $90,000 in addition to liabilities and rent. Income and expenses are indexed for inflation.

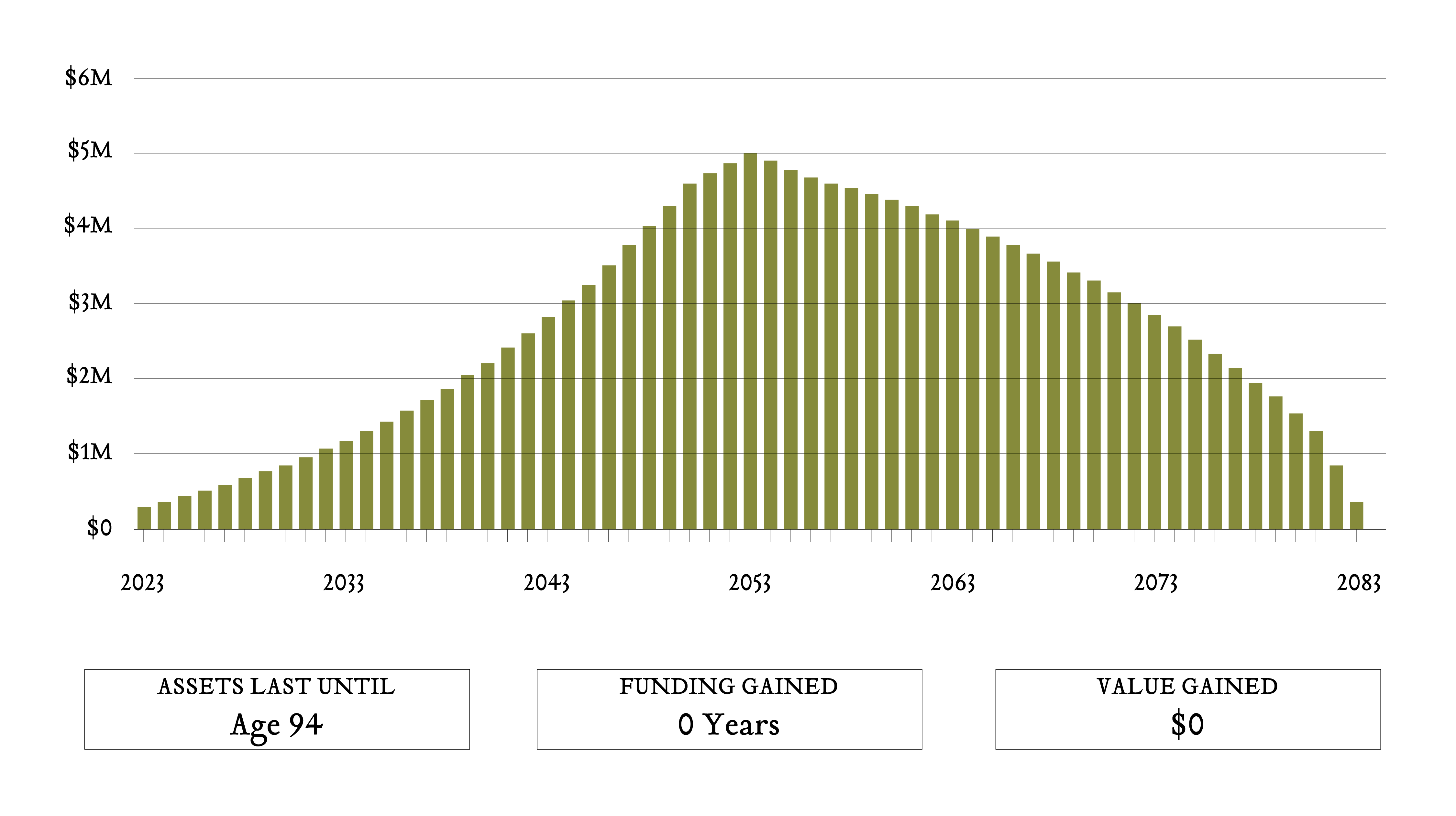

- FAMILY PLANNING: Starting a family is a life-changing decision with substantial financial implications. Monte Carlo analysis can model the impact of raising children on your financial stability, helping you plan for childcare costs, education, and the potential need for life insurance. The impact of 18 years of childcare expenses to the tune of $15,000 per year is depicted below.

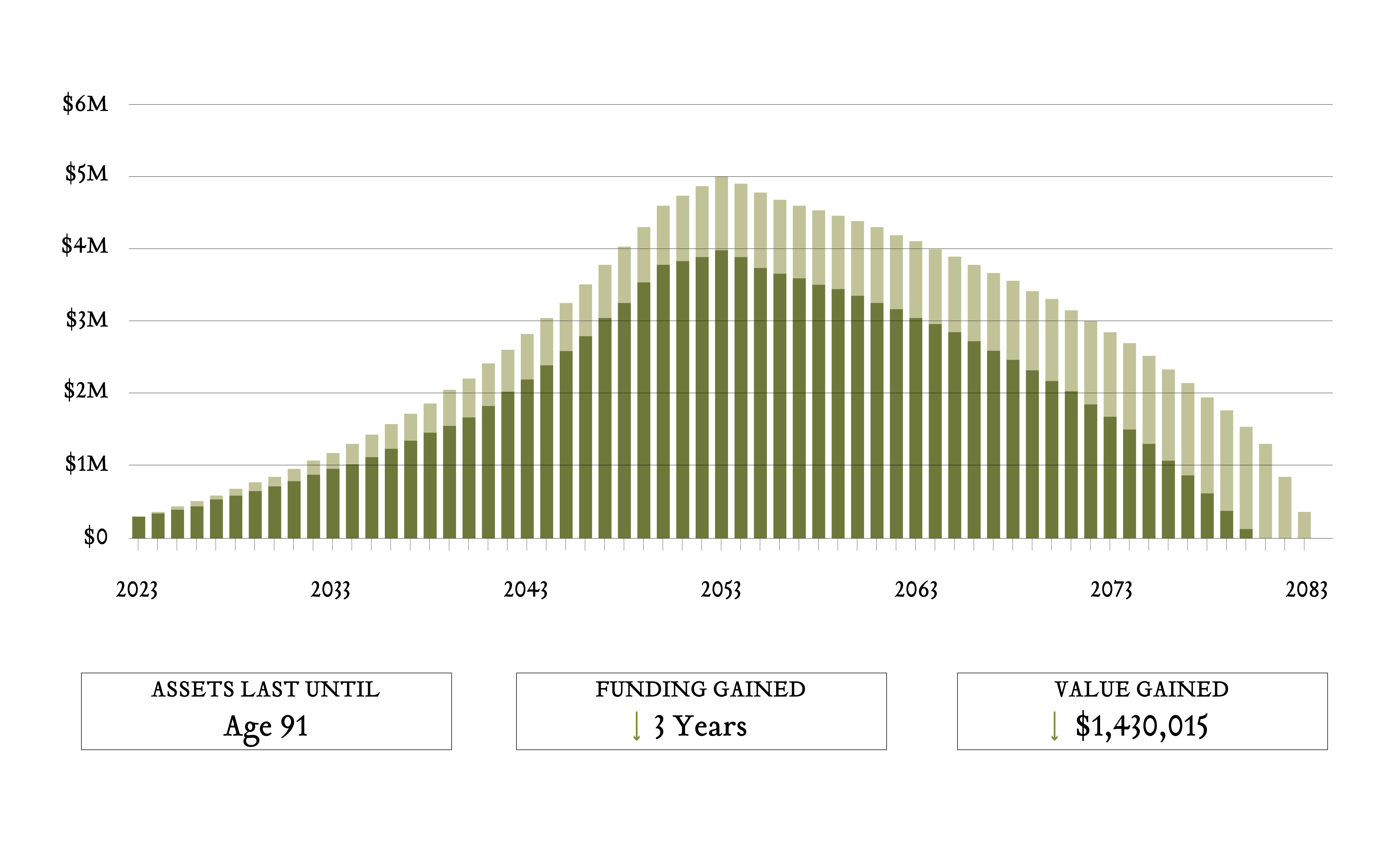

- EDUCATION: Funding higher education can be a gateway to higher earning potential for your children, but it also incurs significant costs, including tuition, living expenses, and student loans. Monte Carlo simulations can help you assess the impact of higher education costs on your own retirement and help build an appropriate strategy considering 529 contributions, education trusts, direct payments and potentially loan repayment terms. Shown below is the impact of four years of college expenses at $25,000 per year in addition to the initial childcare expense. Education expenses start in 2042.

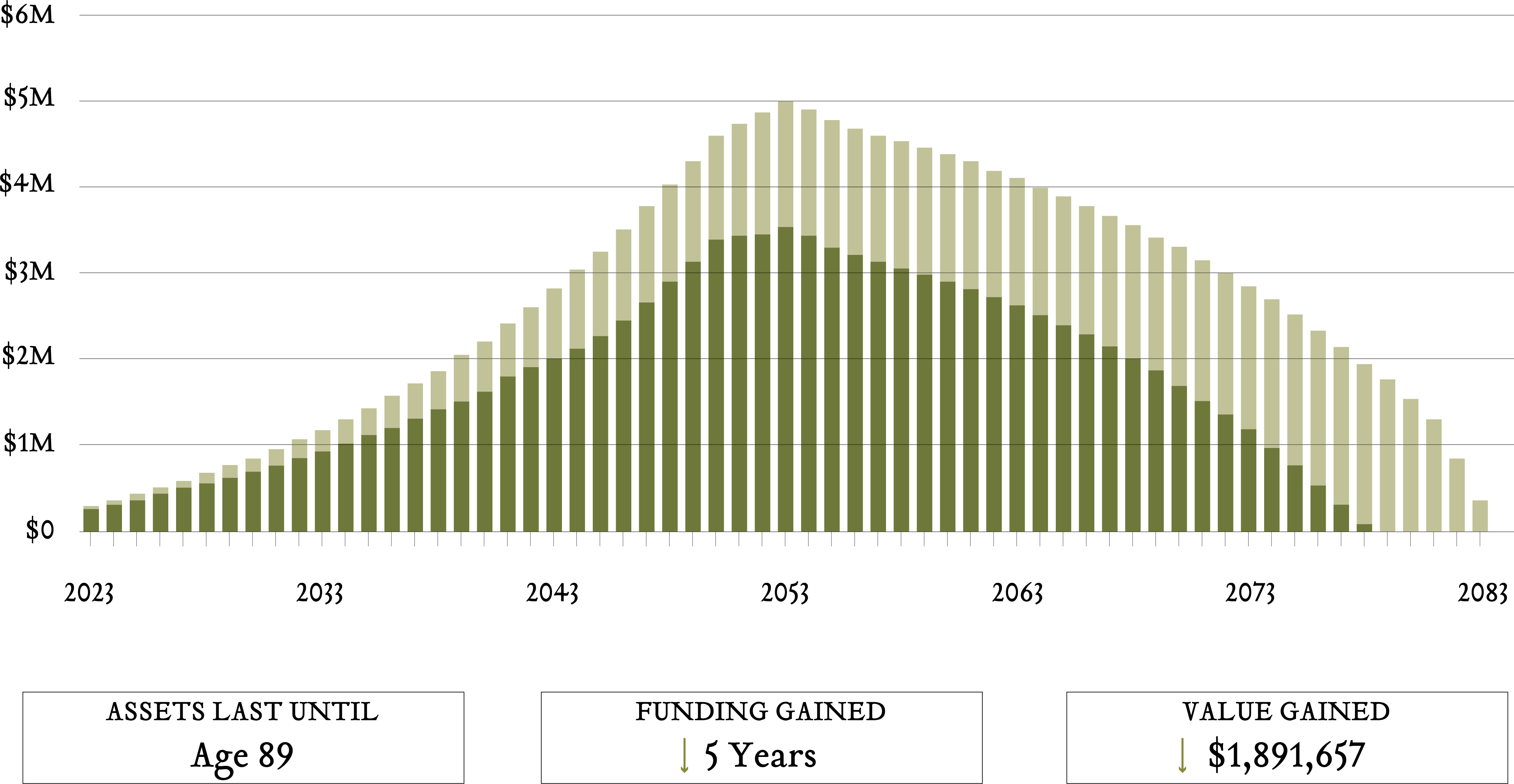

- HOMEOWNERSHIP: Buying a house is a hallmark of adulthood for many. However, it comes with substantial upfront costs, ongoing expenses, and long-term mortgage commitments. Monte Carlo analysis can project how various housing decisions might affect your future wealth. By considering factors like interest rates, property values, and unexpected repairs, you can make informed choices about when and where to invest in real estate. Notice the impact of a $450,000 home purchase in 2024, with a $50,000 down payment and 7% interest rate over 30 years, versus continuing to rent throughout their life. Previous changes are included.

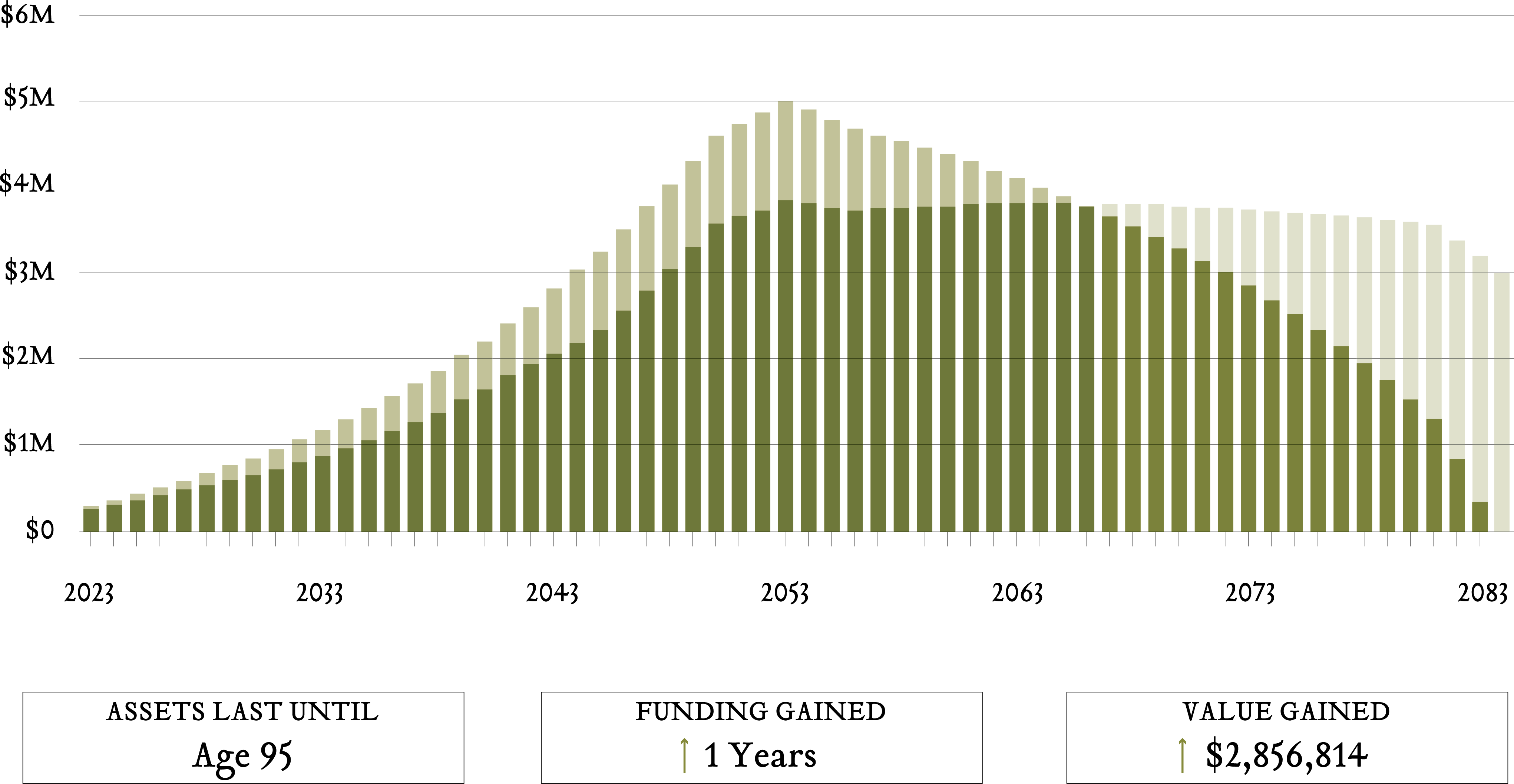

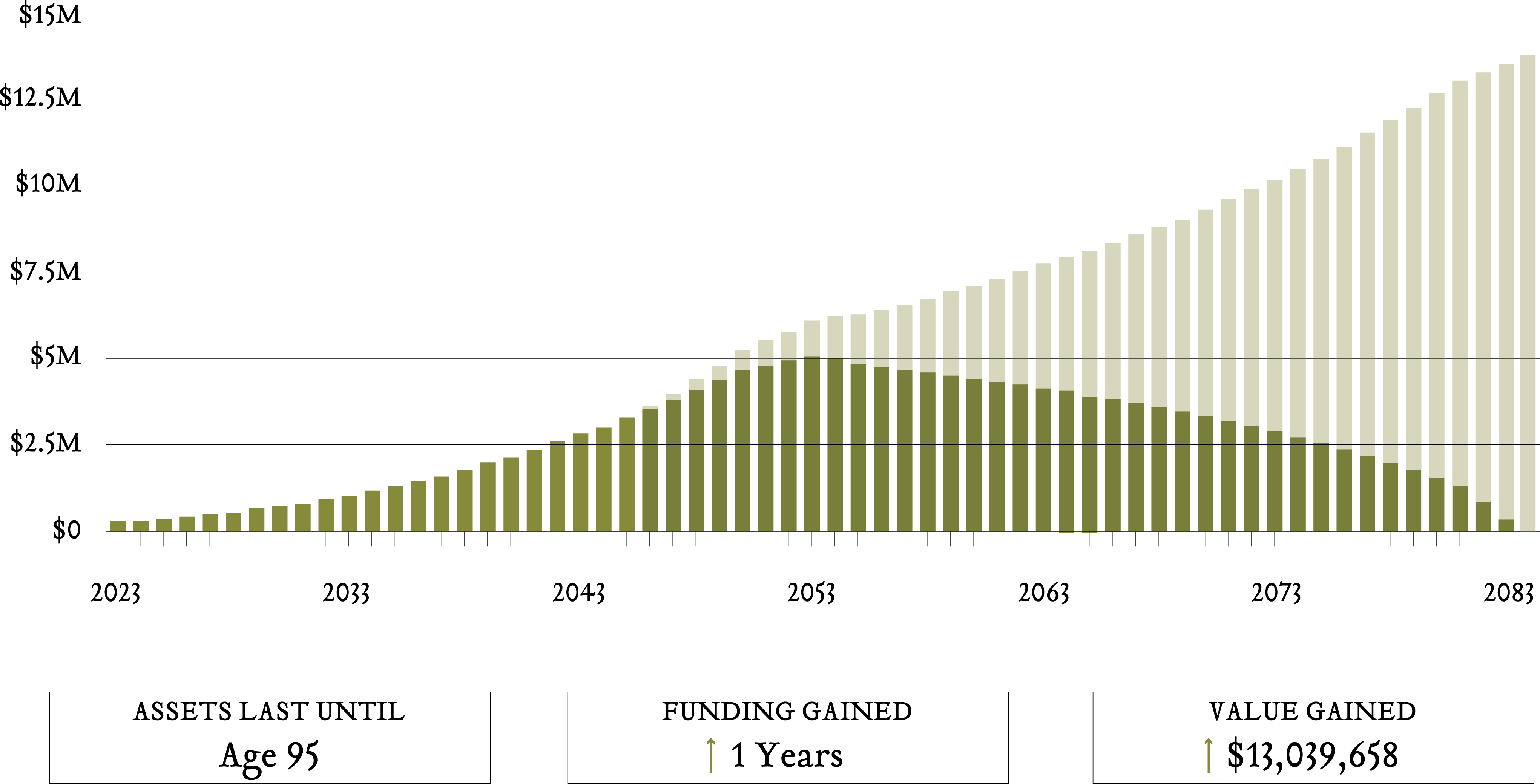

- INVESTMENT CHOICES: Deciding how to allocate your savings and investments in your early years is crucial. Monte Carlo simulations can analyze different investment strategies, risk tolerance levels, and expected returns to determine the optimal path to achieving your financial goals. John and Jane are conservatively invested in a “30% Equity/70% Fixed Income” portfolio despite their long investment time horizon. After a discussion with their client centric team, the Does have decided to reallocate to a “70% Equity/30% Fixed Income” portfolio. Previous changes are included.

Conclusion

In the ever-changing landscape of personal finance, understanding the long-term consequences of early-life purchases and complex financial decisions is paramount. Monte Carlo analysis serves as a powerful tool to shed light on the potential outcomes of various choices, enabling individuals to make informed decisions that align with their goals and values. By leveraging this sophisticated method, you can navigate the intricate web of financial choices with confidence, securing your financial future and leaving a lasting legacy for generations to come. What scenario can we analyze for you?