October 17, 2023

September Retail Sales - Stronger Than Forecast

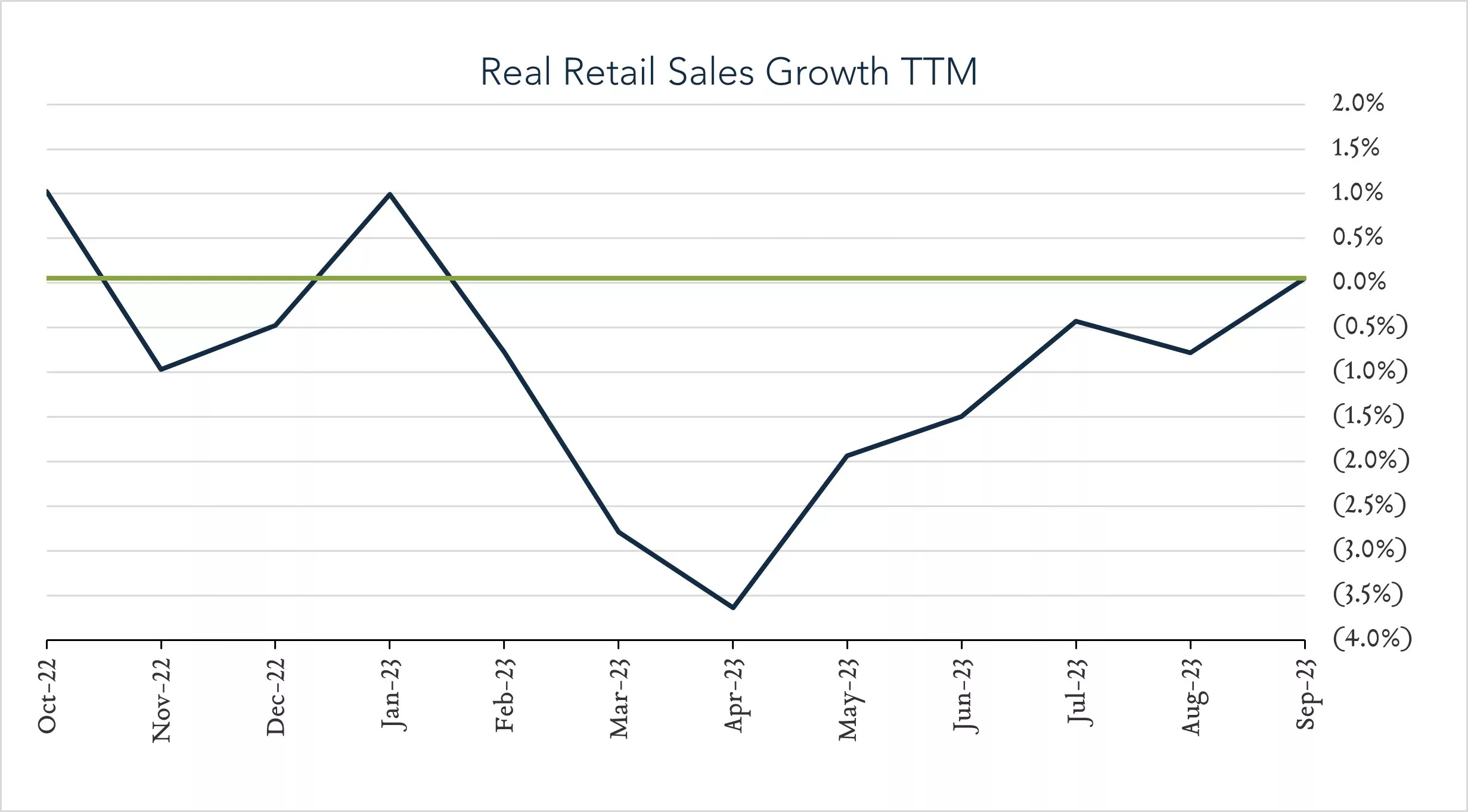

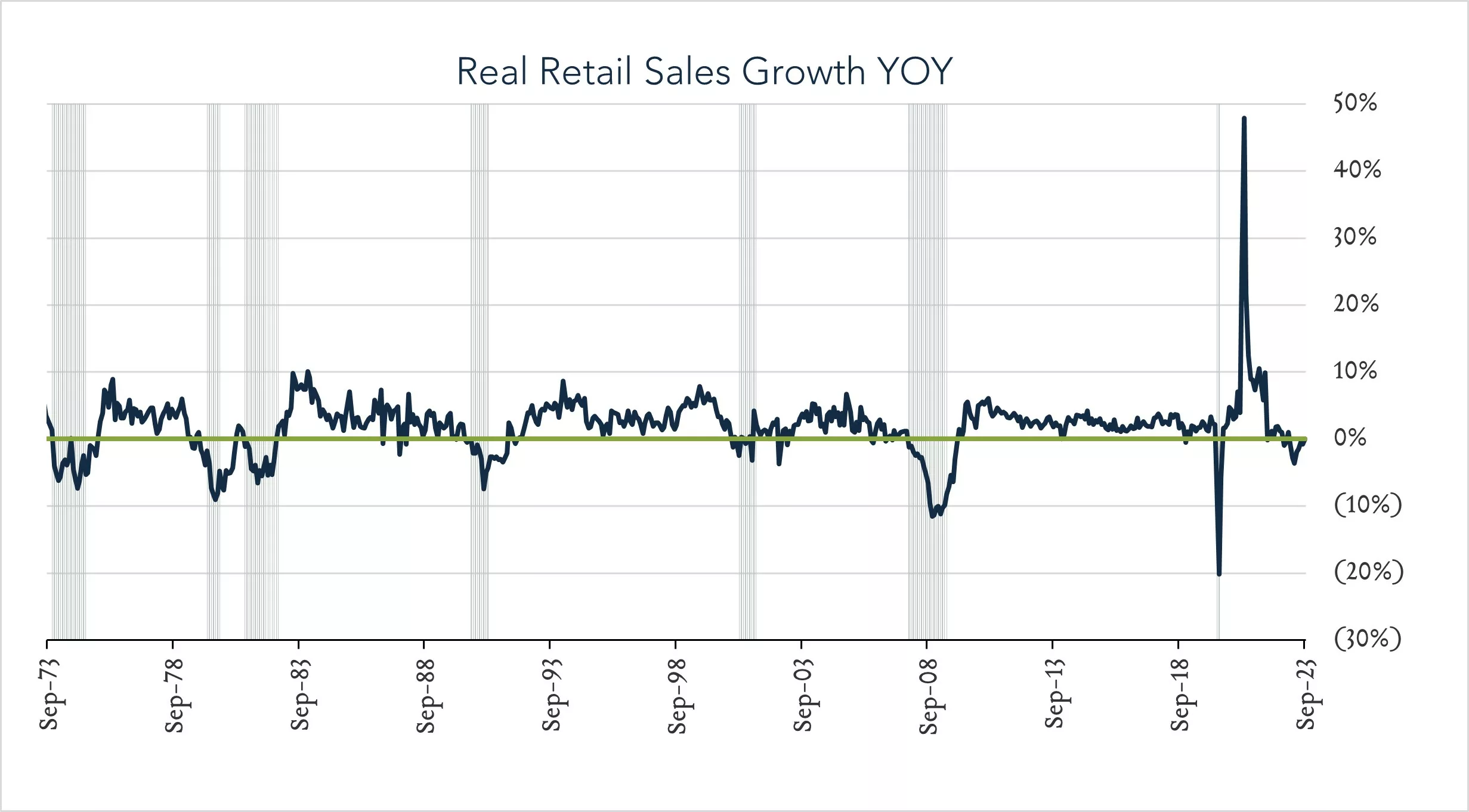

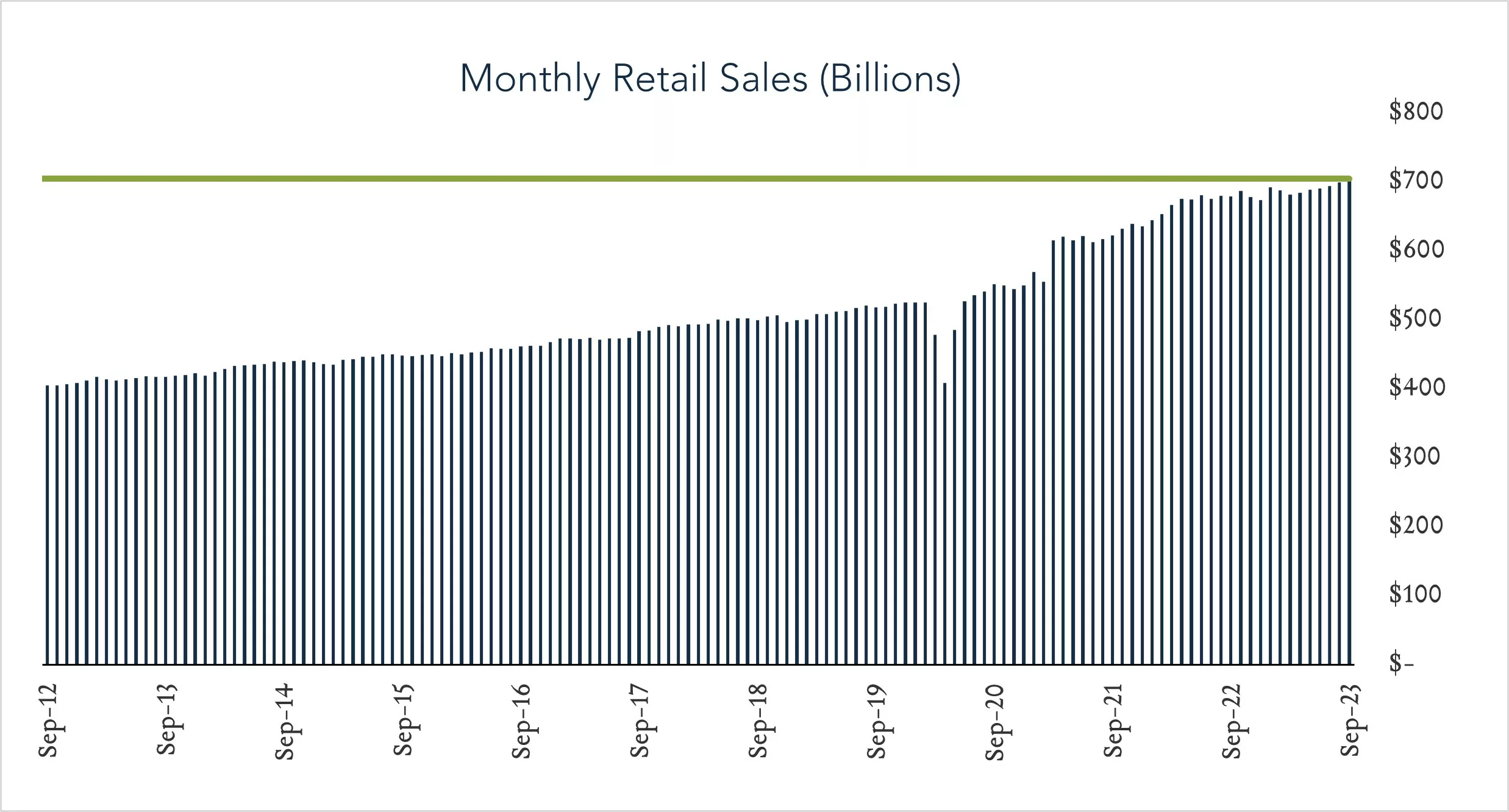

U.S. retail sales came in better than expected in September underscoring the resiliency of consumer demand exiting the third quarter. In real terms, retail spending increased 0.3% compared to August and 0.1% year-over-year. The advance showcases an American consumer that continues to spend money in spite of a recent energy-driven increase in inflation. While wage growth has started to decelerate, the labor market remains relatively strong overall. October data, due out in mid-November could include a dampening effect from resumption of student loan repayments, which would not have been captured in September numbers. All that said, continued strength in consumer demand, stubborn inflation, and a robust labor market could nudge policymakers toward implementing an additional rate increase prior to year-end.

- Real (inflation adjusted) retail sales up 0.1% year-over-year. In September, retail sales grew 3.8% nominally netting a 0.1% real increase after adjusting for 3.7% inflation. Higher spending at restaurants (+9.2%), online retailers (+8.4%), and health and personal care stores (+8.3%), was partially offset by lower spending on furniture (-5.9%), building materials (-4.0%), and gas stations (-3.5%). Only four out of thirteen categories showed growth in real terms.

- Real (inflation adjusted) retail sales increased 0.3% month-over-month. In September, nominal retail sales levels increased 0.7% compared to August (consensus +0.3%) netting 0.3% growth in real terms. Increased spending at brick & mortar retailers (+3.0%), online retailers (+1.1%), and on motor vehicles (+1.0%) was partially offset by lower spending on clothing and electronics. Five out of thirteen categories showed growth in real terms.