October 6, 2023

September Jobs - Hiring Surges, Tough Print For the Fed

Double-Edged Sword. U.S. hiring unexpectedly surged in September by the most since January, highlighting continuing resiliency of the labor market and bolstering the case for another Fed rate hike. The U.S. labor market added 336K jobs, the unemployment rate was unchanged at 3.8%, and wages grew slightly less than expected. A resilient labor market has been key to ongoing economic expansion in 2023. The surprising strength of the job market suggests companies remain confident in their growth prospects heading into 2024 and while job openings and wage growth have moderated compared to 2022, hiring and incomes are still firm enough to support consumer spending. On the flip side, continued strength of the labor market threatens to keep upward pressure on inflation, which increases the likelihood of another Fed rate increase by year end.

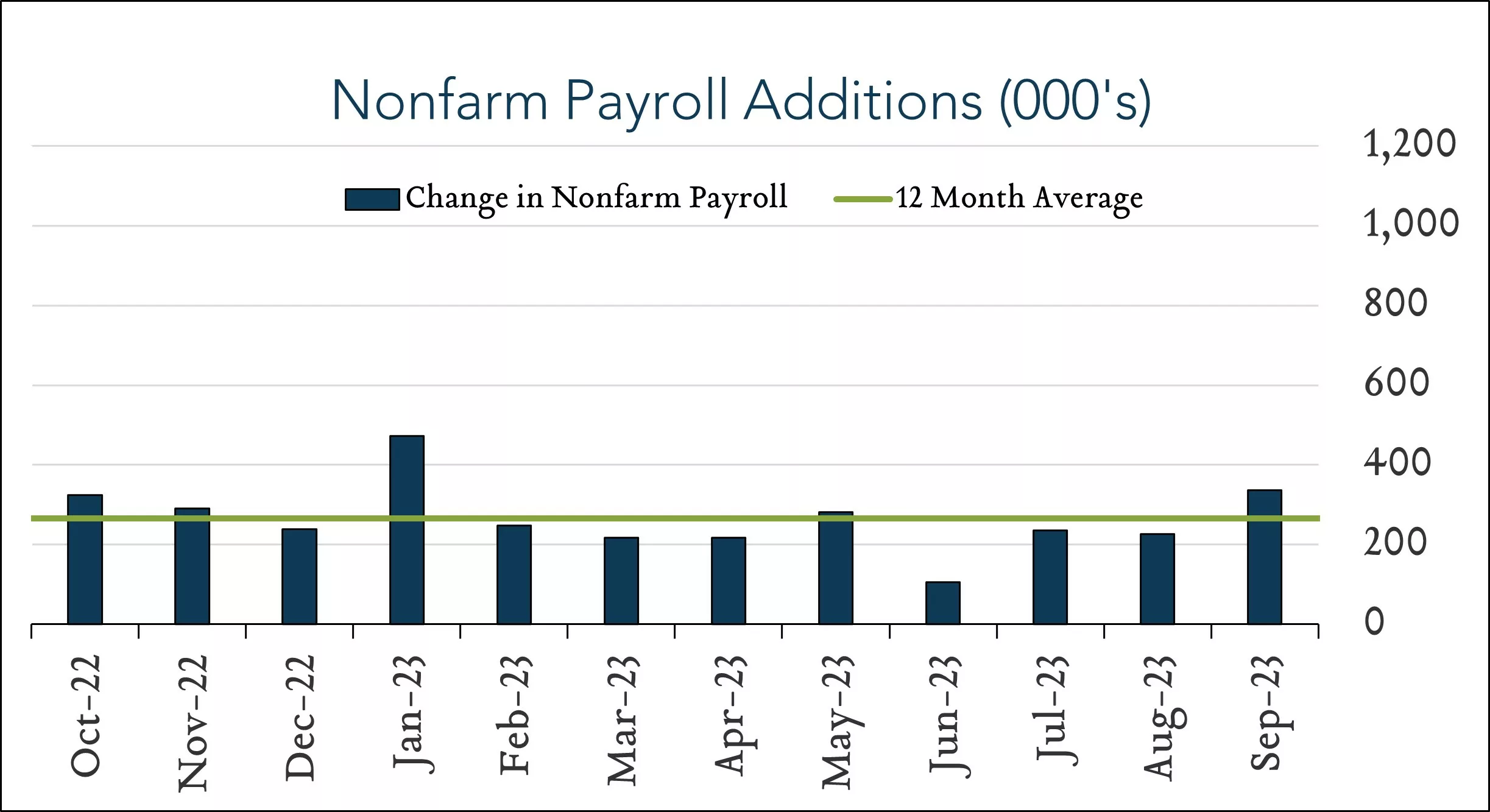

- 336K jobs added in September – Almost doubling expectations. The U.S. labor market added 336K jobs in September, up from +227K (revised up from 187K originally reported) in August and +157K in July. Forecasts ranged from +90K to +250K with a median of +170K. U.S. employment has grown by an average of 260K per month in 2023, moderating from an average of 400K per month in 2022, but still stronger than policymakers would like. Hiring was relatively broad-based with notable gains in leisure and hospitality (+96K), government (+73K), and health care (+41K). Other major industries added jobs or were little changed for the month.

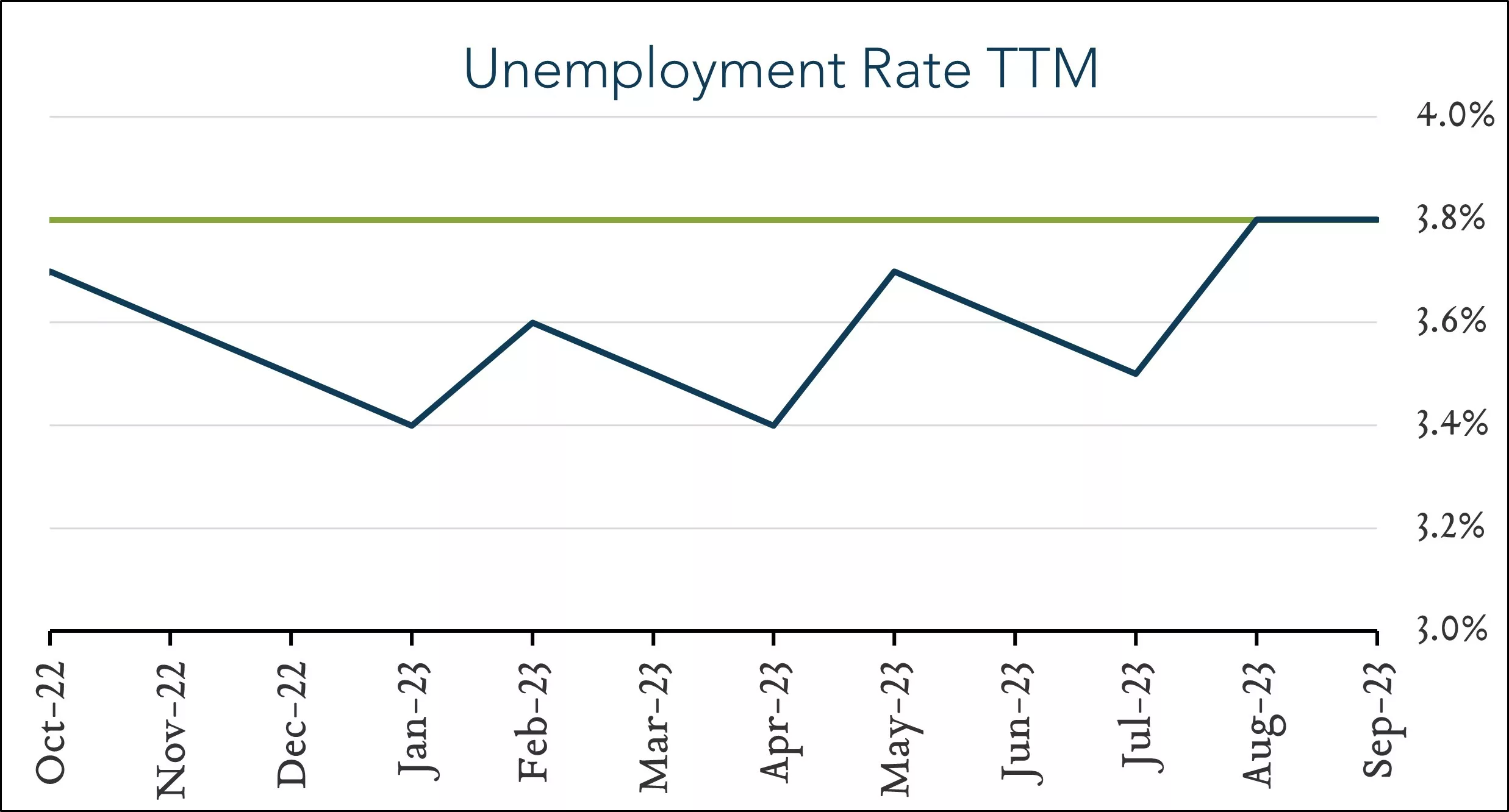

- 3.8% unemployment – remains historically low. The U.S. unemployment rate was unchanged from the prior month at 3.8%. Forecasts ranged from 3.6% to 3.9% with a median of 3.7%. Unemployment has ranged from 3.5% to 4.0% since the end of 2021. The labor force participation rate rose was unchanged and in line with expectations at 62.8%, still lagging the pre-pandemic level of 63.3%. Wage growth was marginally slower with average hourly earnings up 4.2% over the last year (compared to 4.3% in August) and 0.2% month-over-month (in line with August and below expectations of +0.3%).