November 7, 2022

Primer on the European Natural Gas Crisis

Russia and Ukraine are significant producers of crude oil and natural gas commodities essential to the energy industry. The Russian invasion of Ukraine has caused significant disruptions in these energy sources, particularly for Europe. With winter around the corner, now is an appropriate time to provide a primer on the situation. This article will focus on the outlook for natural gas in Europe by providing background, a timeline of events, a summary of responses, and potential market and economic implications going forward.

Background

Focusing on sources of energy is not typical for most US consumers. We flip the light switch, or set the thermostat, and the light or heat comes on. So, here are some relevant facts that will help readers understand Europe’s dilemma.

- Crude oil is a global commodity. It is relatively easy to transport, including over land by trucks.

- This means most global purchasers of crude oil pay roughly the same amount, whether they are located in Europe or North America or elsewhere.

- Replacing disrupted crude oil supply is achievable through crude oil tankers.

- The primary use of oil is for transportation (i.e. gasoline).

- Natural gas is more of a regional commodity. Over land transportation is typically done by pipeline. This means that regional prices can diverge significantly.

- Technological advances have made transporting liquified natural gas (LNG) more economical.

- It is now possible, but is more difficult and expensive, to replace disrupted natural gas supply in many parts of the world through importing & regasification.

- The primary uses of natural gas are to generate electricity and for heat.

- Europe is a significant importer of energy. In 2020, 58% of EU energy consumption was imported.

- Before the invasion, Russia and Ukraine were significant suppliers of crude oil and natural gas to Europe. Russia supplied 28% of imported crude oil and 45% of imported natural gas to Europe.

- Although the Eurozone has a common currency and the European Union has free movement of goods and people within member states, each government is responsible for its own energy policy.

- There are significant differences between European countries in terms of their reliance on energy from Russia, and their access to alternative sources of energy.

Timeline

- This is a highly dynamic and complex situation. This article is being written on October 21 and by the time you read it, circumstances may have changed. Let’s review the timeline of the evolving European natural gas crisis.

- February 21, Putin signs decrees recognizing independence of territories in Donetsk & Luhansk.

- February 22, German Chancellor suspends certification of the Nord Stream 2 gas pipeline from Russia.

- February 24, Russia invades Ukraine.

- February 26, the US, EU, UK, Canada, France, Germany & Italy take joint action to remove some Russian banks from the SWIFT messaging system and impose other sanctions.

- March 8, US bans import of Russian oil, LNG, and coal.

- Rest of March, G7 countries apply escalating sanctions on Russia & Russian oligarchs.

- March 31, Putin signs a decree forcing gas payments to be made in rubles.

- April 27, Russian energy company Gazprom cuts off natural gas exports to Poland and Bulgaria over their refusal to pay in rubles.

- May 21, Gazprom cuts off natural gas exports to Finland for failing to pay in rubles.

- July 27, Russian natural gas exports through Nord Stream 1 are reduced to 20% of capacity.

- September 2, G7 ministers agree on a price cap for Russian crude oil and petroleum products.

- September 2, Russia suspends natural gas shipments to Europe through the Nord Stream 1 pipeline.

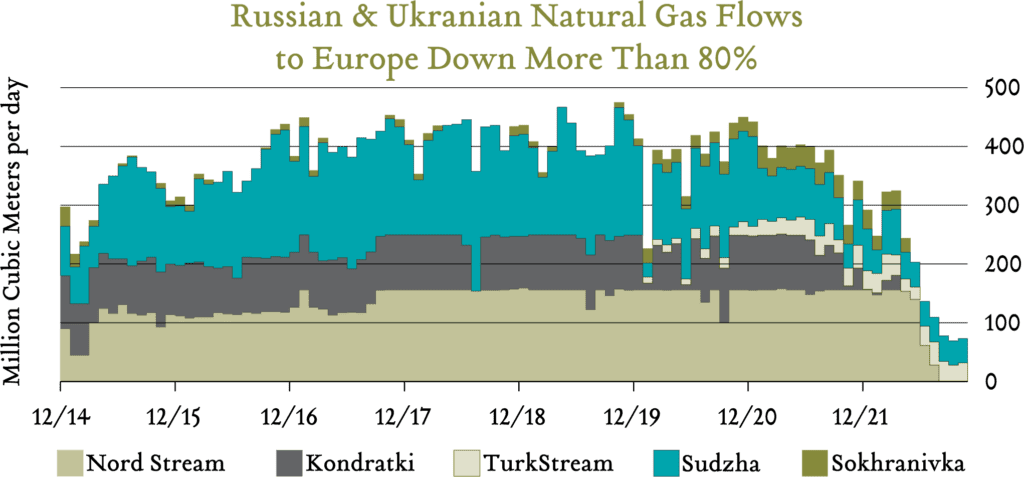

- September 26, explosions damage the Nord Stream 1 pipeline under the Baltic Sea, effectively halting Russian natural gas exports to Europe, except some limited supply through Ukraine.

Summary of Responses

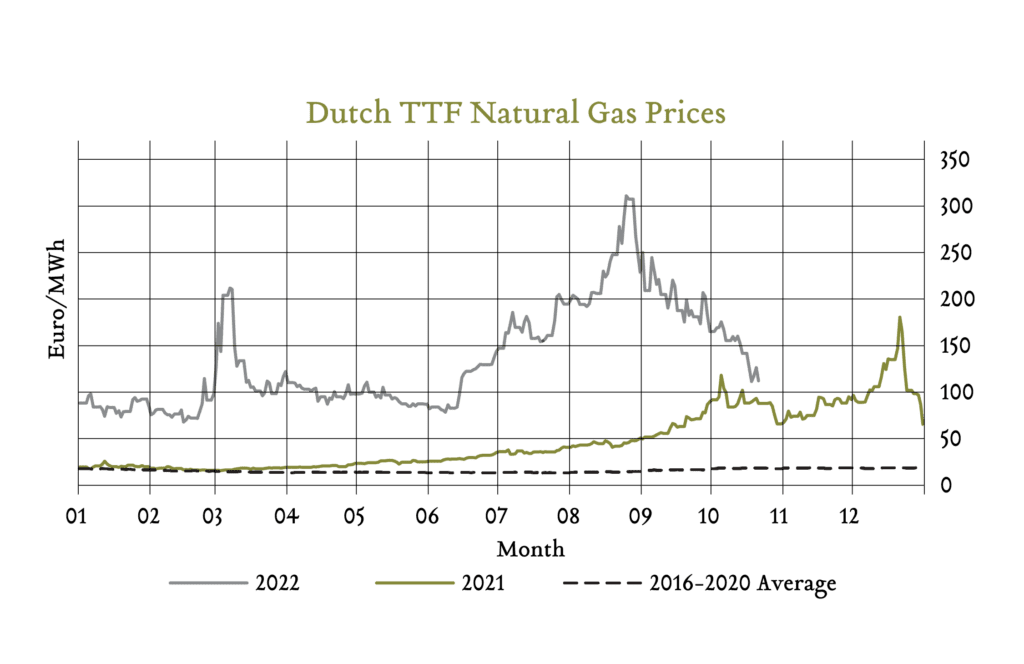

The loss of a major energy supplier has caused dramatic price spikes in natural gas in Europe. In August, as Russia cut its exports through Nord Stream 1 to near zero, benchmark natural gas prices hit more than 20 times their 2016–2020 average. Imagine paying 20 times your typical monthly heating bill and you can appreciate the scale of the shock hitting Europe.

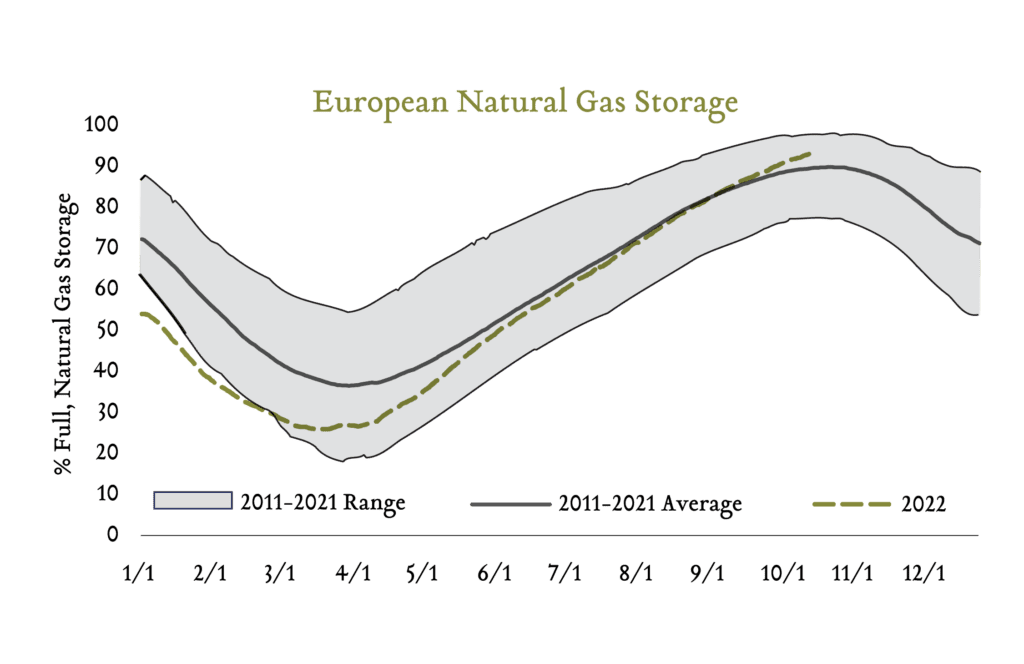

Prices remain extremely elevated, 6.5 times the historical average, but have eased recently due to the first major response from affected European countries: building natural gas storage to survive the winter months. They’ve done this by importing more energy from Norway, and from LNG markets like the United States and Africa.

As of this writing, these efforts have been relatively successful. Natural gas storage sits at around 93% of capacity, above the average of 89% for this time of year. At these levels of storage, Europe may be able to handle an average winter heating season without resorting to blackouts or energy rationing. If the winter is colder-than-average in Europe, or in regions that compete with Europe for LNG imports, maintaining adequate supply could become a multi-year problem.

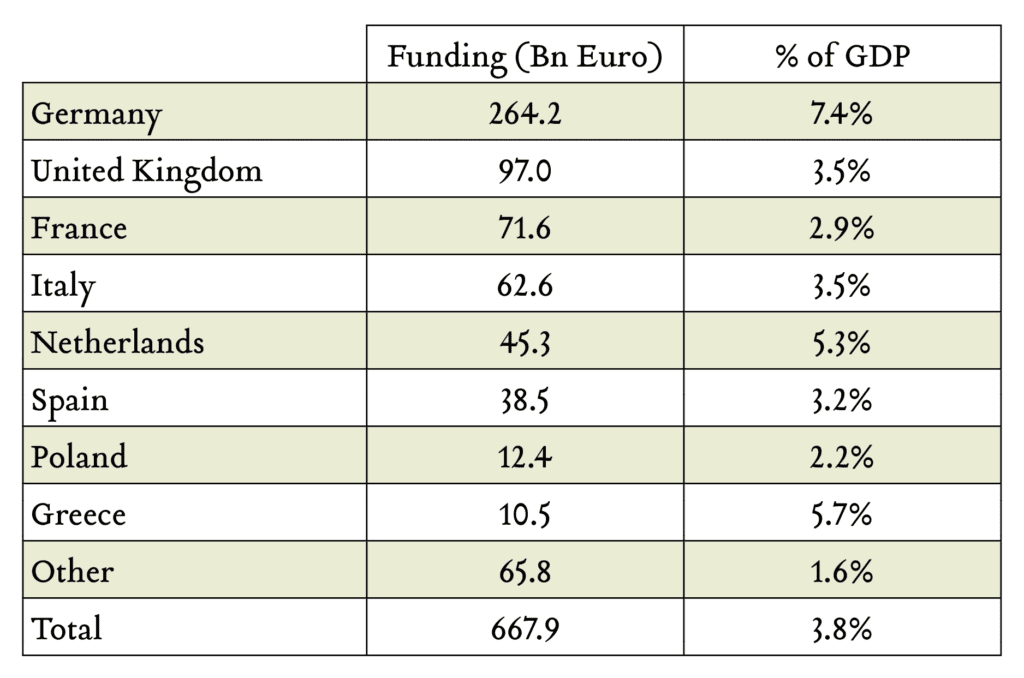

In addition to building up storage, affected governments have enacted fiscal support to blunt the impact of higher energy prices on businesses and consumers. For example, on September 29, Germany announced a 200 billion euro plan to subsidize gas costs, allowing consumers to pay 0.12 euros per kilowatt hour for the first 80% of the amount of energy they used in 2021. Across Europe, around 670 billion euros in fiscal support have been allocated to protect citizens and businesses from higher energy prices.

Finally, governments have also stepped in with subsidies, and in some cases, nationalization of businesses involved in the production of energy. Germany, for example, nationalized Uniper, buying it from Finland’s Fortum, at a cost of around 29 billion euros. Uniper is an electric utility company and had previously been a large importer of Russian natural gas. The estimated value of credit lines, loans and bailouts total another 180 billion euros. Combined, this support is nearly equal to the amount of borrowing undertaken by the EU to navigate the COVID-19 pandemic.

Potential Economic and Market Implications

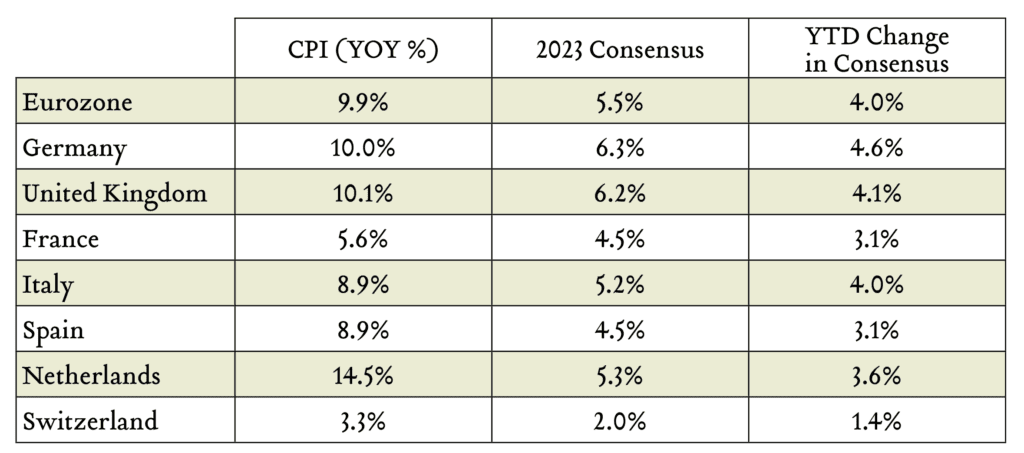

The first and most direct impact of this energy shock has been to inflation. Several European countries are now dealing with double-digit inflation, and accelerating expectations for inflation next year.

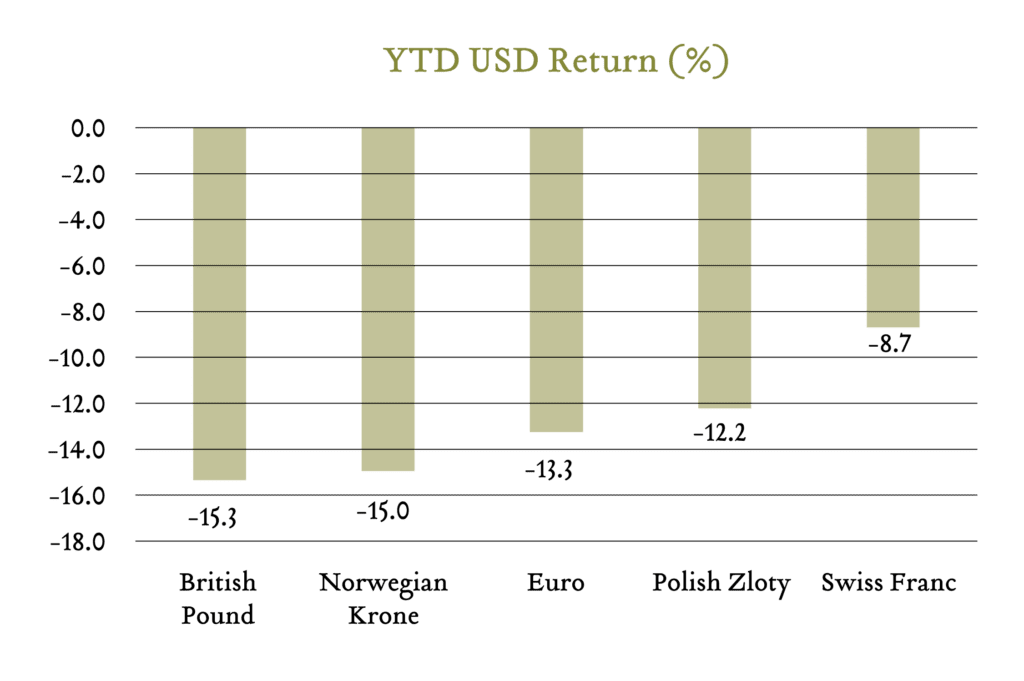

The second major impact, arguably, has been in the currency markets. The need for additional deficit spending has contributed to a depreciation of many European currencies against the US Dollar.

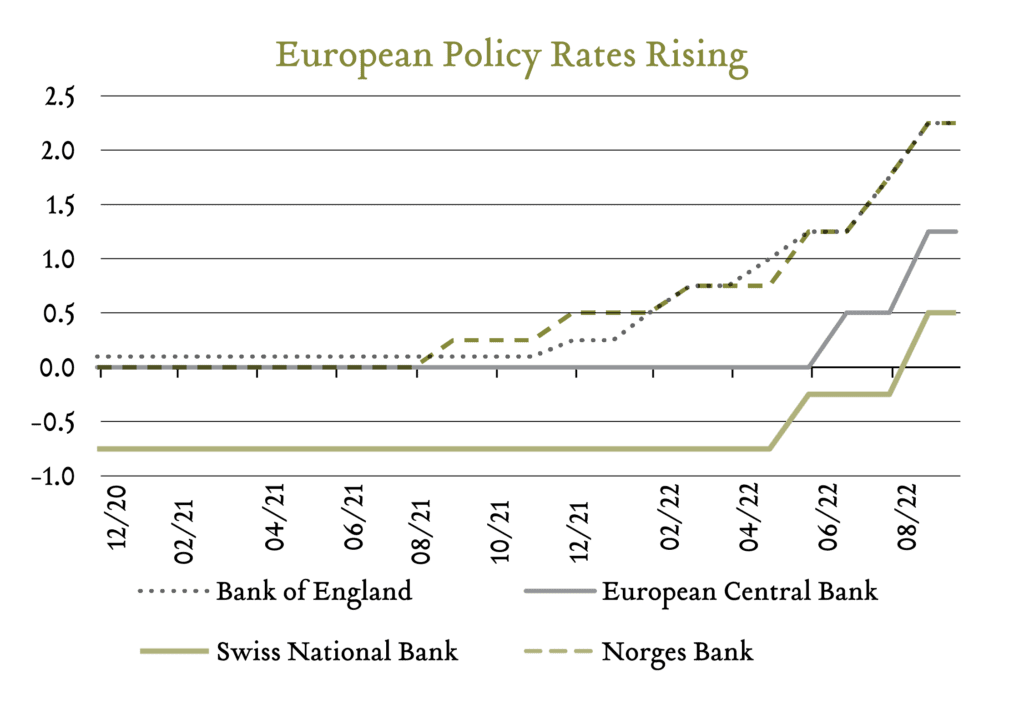

Following these high levels of inflation, central banks in Europe have been moving to more restrictive monetary policy stances.

The combination of higher interest rates and higher energy costs is likely to push some European economies into recession, if they are not already there.

The final impact worth mentioning is on the prices of natural gas in other regions. LNG export markets will be key to resupplying Europe. Any disruptions to the export market could leave European governments facing difficult choices around blackouts and energy rationing. This new source of global demand will keep natural gas prices elevated in countries like the United States as well, where natural gas prices hit 10-year highs in May and August this year. It will likely be a multi-year project to rebalance the energy markets to cope with the absence of Russian supply.

Conclusion

The Russian invasion of Ukraine continues to impact the economic and investment landscape. Europe is navigating a natural gas crisis that has disrupted their economies and required significant fiscal support. The region is entering the colder winter months with strong levels of storage and a mild winter could leave them in a positive position in 2023. However, the energy markets remain a key source of risk and are likely to remain volatile in the short-term. We will continue to monitor the situation and provide updates as warranted. Thank you for the opportunity to serve on your behalf.