November 16, 2022

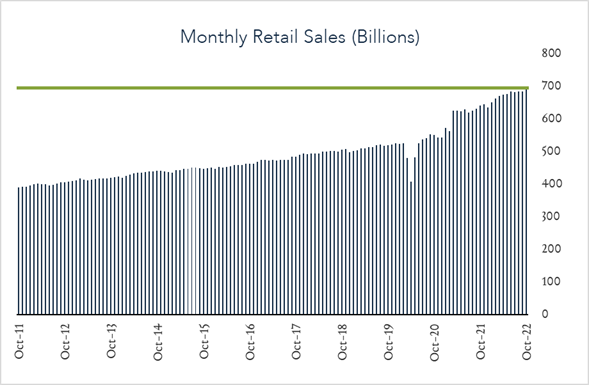

October Retail Sales - Stronger than Expected

U.S. retail sales posted the largest month over month increase since February and real growth of 0.6% year-over-year indicating that demand for goods is broadly holding up despite decades high inflation and a deteriorating economic outlook. While real year-over-year growth in retail sales tends to be an indication of economic health, consumer resilience may complicate the argument for decelerating interest rate hikes heading into 2023 in light of favorable inflation data released earlier this month.

- Real (inflation adjusted) retail sales increased 0.6% year-over-year. In October, retail sales grew 8.3% compared to a year ago netting +0.6% real growth after adjusting for 7.7% inflation. Higher spending on gasoline compared to a year ago (+18%) accounted for a large portion of the nominal increase though real gains were also evident in restaurants (+14%) and non-store retailers (+12%). On the flip side, spending on electronics and appliances declined more than 12%, while department store spending fell 1%.

- Real (inflation adjusted ) retail sales rose 0.9% month-over-month. In October, retail sales levels increased by 1.3% compared to September (consensus +1.0%) netting +0.9% growth after adjusting for Nine of thirteen categories rose last month, including solid results at auto dealers (+1.5%) restaurants (+1.6%) and grocery stores (+1.4%). Sales at gasoline stations increased 4.1% largely due to higher prices at the pump.