November 3, 2023

October Jobs - Cooling but Not Freezing

Cooling, not Freezing. After an unexpected surge in September, U.S. hiring cooled by more than expected in October and the unemployment rate inched slightly higher. The U.S. labor market added 150K jobs, the unemployment rate increased to 3.9%, and wages grew slightly less than expected. Of note: the UAW strike accounted for a 33K decline in manufacturing jobs in October. This is a bit of a goldilocks report for the Fed as today’s report highlights a gradually normalizing labor market amid tempering demand for workers. Earlier this week, the Fed held interest rates steady for a second straight meeting and Chair Powell hinted that we may have reached the end of the current hiking cycle. Additional data points due to be released prior to the next Fed meeting in December will determine the path ahead for policymakers.

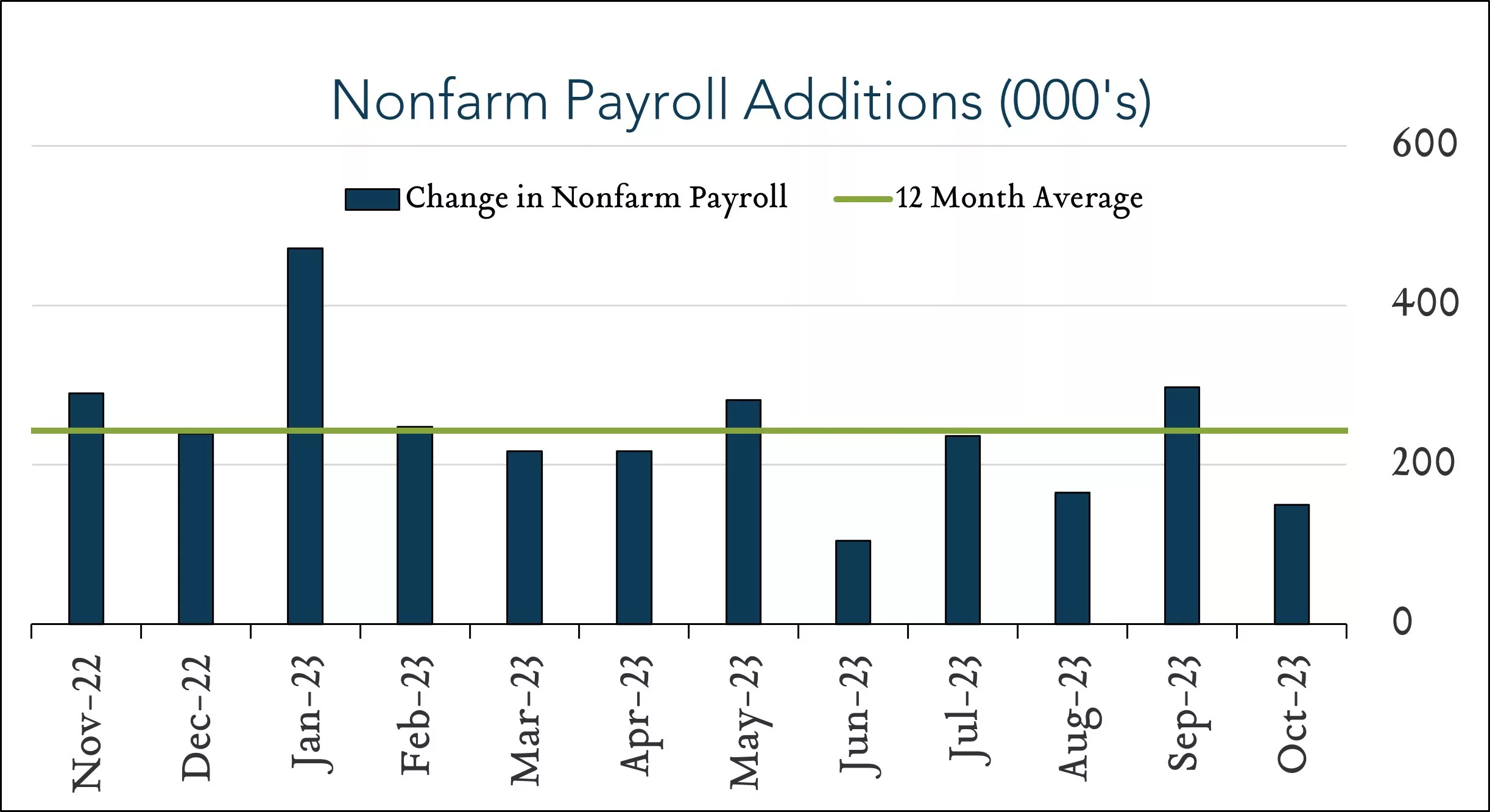

- 150K jobs added in October – Lower than expected. The U.S. labor market added 150K jobs in October, down from +297K (revised lower from 336K originally reported) in September. Forecasts ranged from +20K to +235K with a median of +180K. U.S. employment has grown by an average of 240K per month in 2023, moderating from an average of 400K per month in 2022. Hiring was more pronounced in health care (+58K), government (+51K), and construction (+23K). Employment in manufacturing declined by 35K in October, including a decline of 33K tied to the UAW strike. Other major industries added jobs or were little changed for the month.

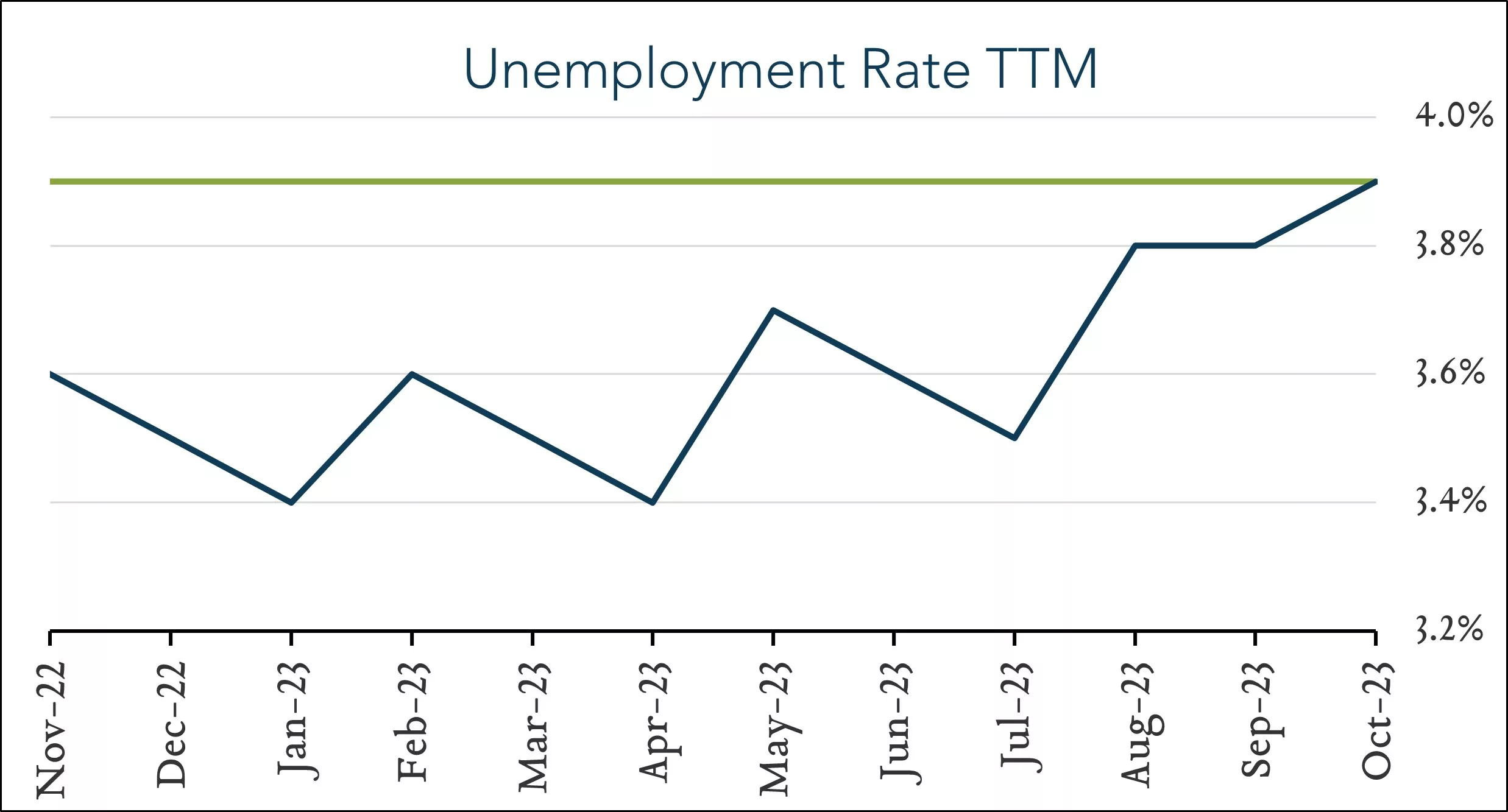

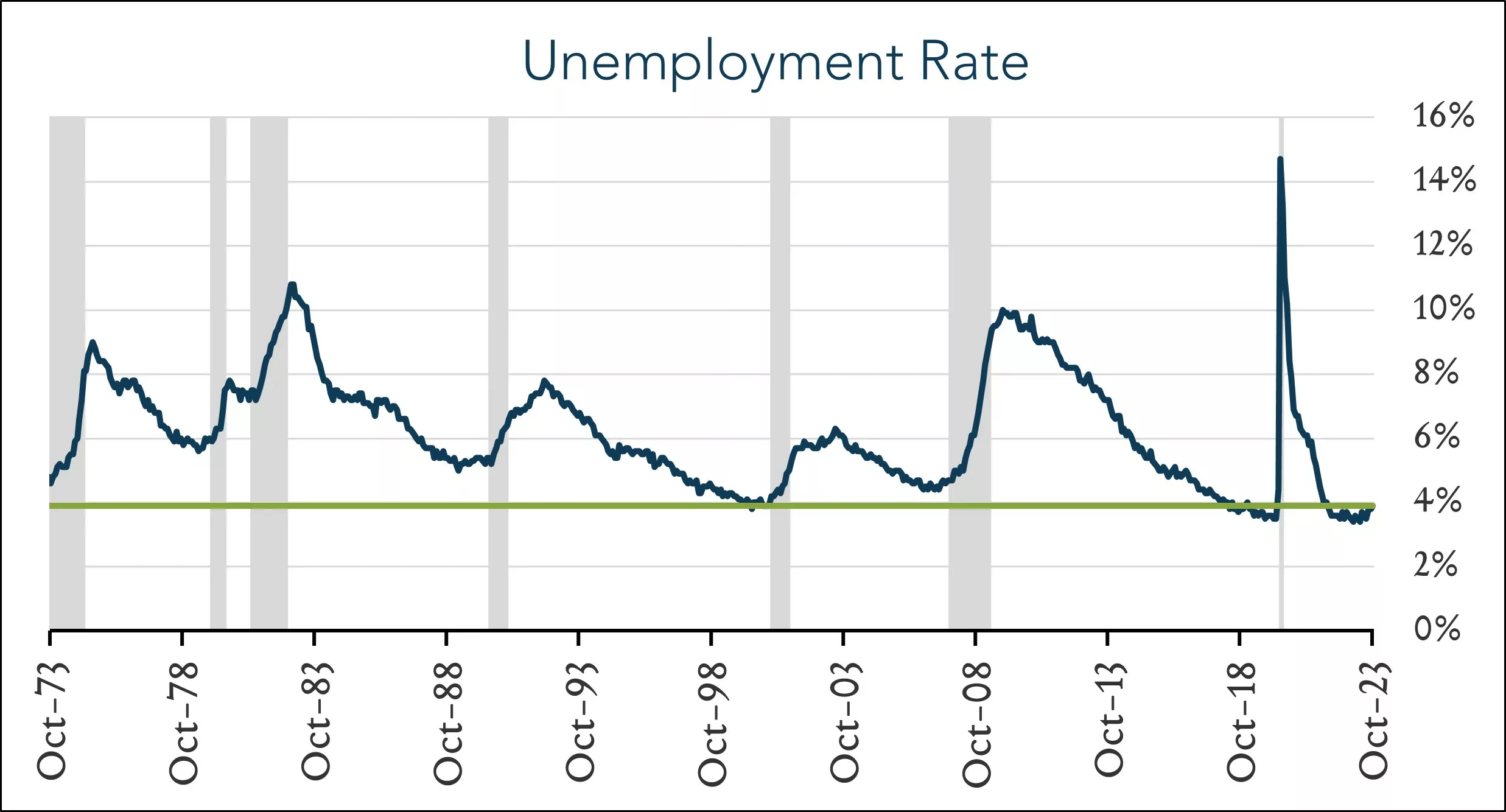

- 3.9% unemployment – remains historically low. The U.S. unemployment rate ticked up 0.1% from the prior month to 3.9%. Forecasts ranged from 3.7% to 3.9% with a median of 3.8%. Unemployment has ranged from 3.5% to 4.0% since the end of 2021. The labor force participation rate inched 0.1% lower to 62.7%, still lagging the pre-pandemic level of 63.3%. Wage growth was marginally slower with average hourly earnings up 4.1% over the last year (compared to 4.3% in September) and 0.2% month-over-month (down from 0.3% in September and below expectations of +0.3%).