November 10, 2022

October Inflation - Cooled More Than Forecast

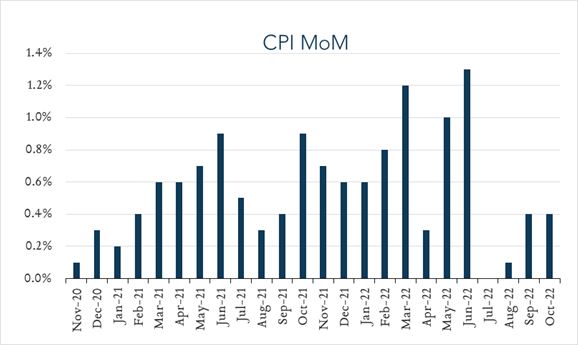

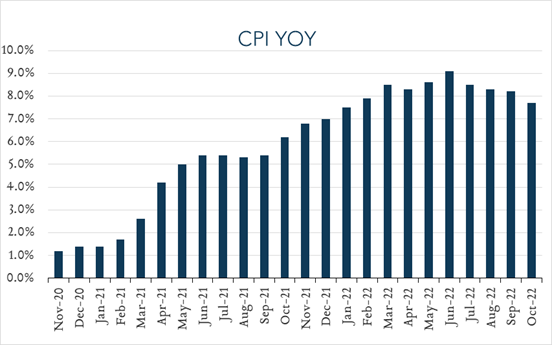

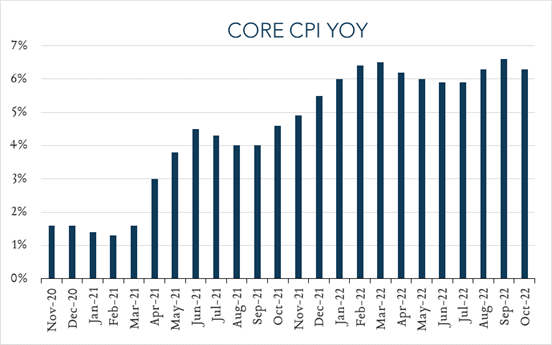

October inflation data surprised positively this morning offering hope that decades high price increases are easing and perhaps giving Fed policymakers some breathing room in the months ahead. The Consumer Price Index rose 7.7% from the same period a year ago compared to expectations of +7.9%. In addition to beating expectations, October CPI was the lowest print this year, and marked deceleration from +8.2% in September and a peak of +9.1% in June. Core CPI rose 6.3% decelerating from a peak of +6.6% in September.

- Consumer prices (CPI) increased 7.7% year-over-year. In October, the consumer price index (CPI) increased 7.7%, decelerating from 8.2% in September. Expectations ranged from 7.8% to 8.1% with a median of 7.9%, so today’s outcome came in below all forecasts. Food (+11%) and energy (+18%) remained the largest contributors to the overall increase. Core CPI (excludes food and energy) increased 6.3% year-over-year (vs. expectations of +6.5%), and decelerated from 6.6% (40-year high water mark) in September.

- Consumer prices (CPI) increased 0.4% month-over-month. In October, consumer prices increased 0.4% compared to September. Expectations ranged from +0.5% to +0.8% with a median of +0.6%. Shelter costs, which represent nearly one third of the consumer price index and tend to increase with a lag, increased 0.8% for the month, up from +0.7% in August and September. Core CPI (excludes food and energy) increased 0.3% compared to September – well below expectations of +0.5%.