December 8, 2023

November Jobs - Stronger Than Expected

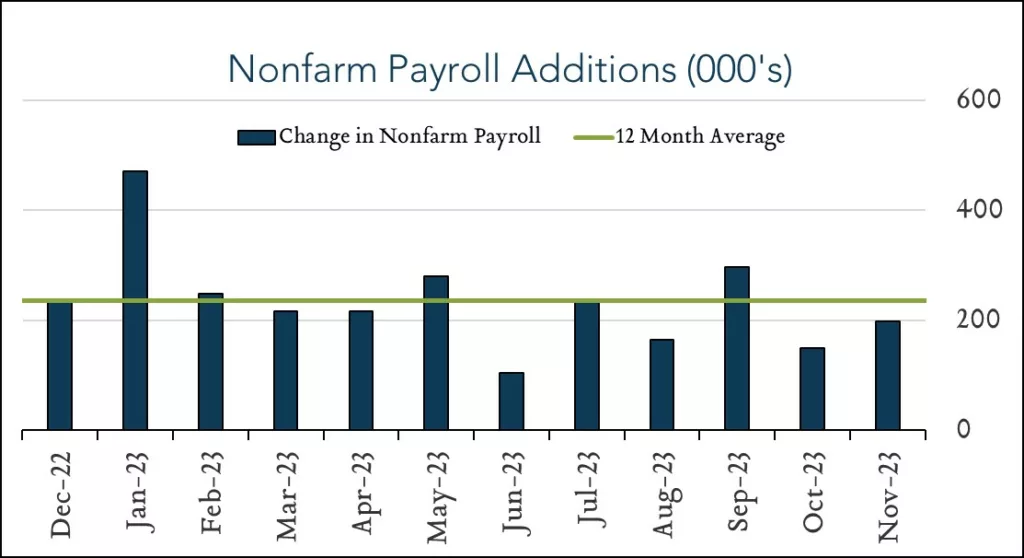

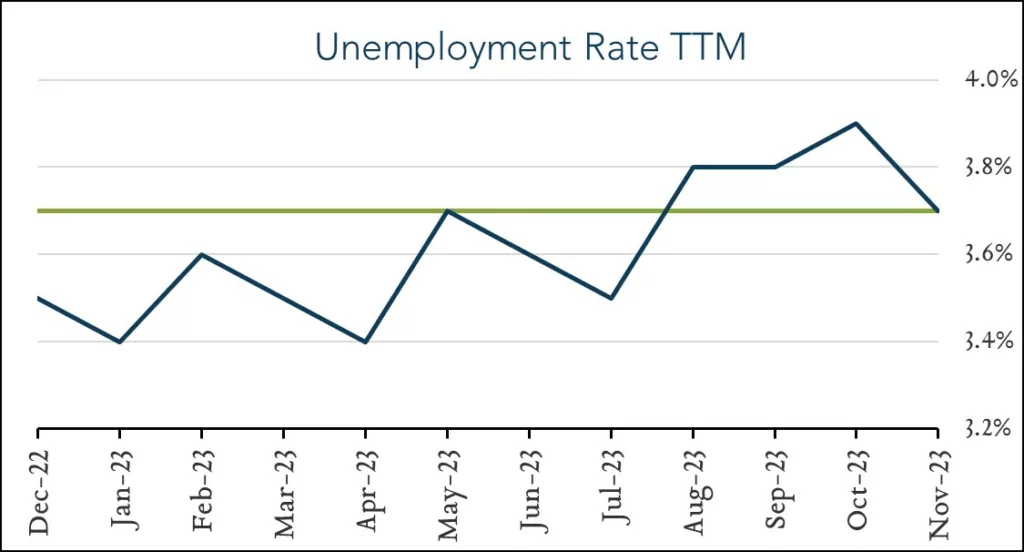

Broad-based strength. U.S. employers added more jobs than expected and the unemployment rate unexpectedly fell in November, underscoring the Federal Reserve’s intent to keep interest rates higher for longer. The labor market added 199K jobs, the unemployment rate fell to 3.7% and wage growth accelerated slightly compared to October. Recently easing labor market dynamics have underpinned investor expectations for looser policy in 2024. However, November’s unexpected strength tilts the balance in favor of the Fed’s higher for longer mantra, while a sustained pickup could tilt officials toward another rate increase before all is said and done.

- 199K jobs added in November – slightly higher than expected. The U.S. labor market added 199K jobs in November, up from +150K in October. Forecasts ranged from +45K to +275K with a median of +185K. U.S. employment has grown by an average of 235K per month in 2023, moderating from an average of 400K per month in 2022. Hiring was more pronounced in health care (+77K), government (+49K), and leisure & hospitality (+40K). Employment in manufacturing rose by 28K in November reflecting an increase of 30K as striking UAW members returned to work.

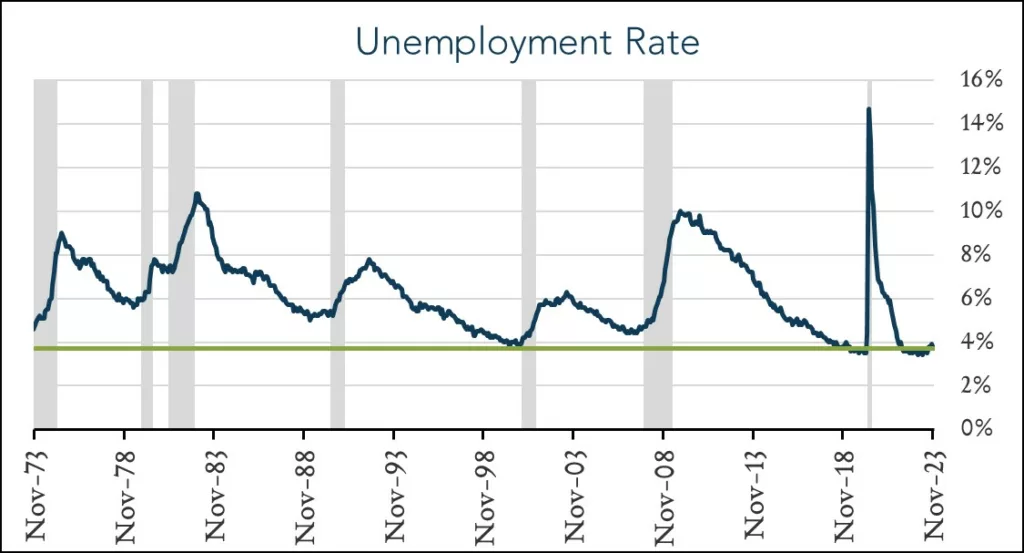

- 3.7% unemployment – unexpectedly lower. The U.S. unemployment rate ticked down to 3.7% in November from 3.9% in October. Forecasts ranged from 3.8% to 4.0% with a median of 3.9%. Unemployment has ranged from 3.5% to 4.0% since the end of 2021. The labor force participation rate inched up 0.1% to 62.8% – matching the post-pandemic high, but still lagging the pre-Covid level of 63.3%. Year-over-year, wage growth was marginally slower with average hourly earnings up 4.0% over the last year (compared to 4.1% in October). Month-over-month, wage growth accelerated slightly to 0.4% (up from 0.2% in October and above expectations of +0.3%).