December 12, 2023

November Inflation - Down YoY; Up MoM

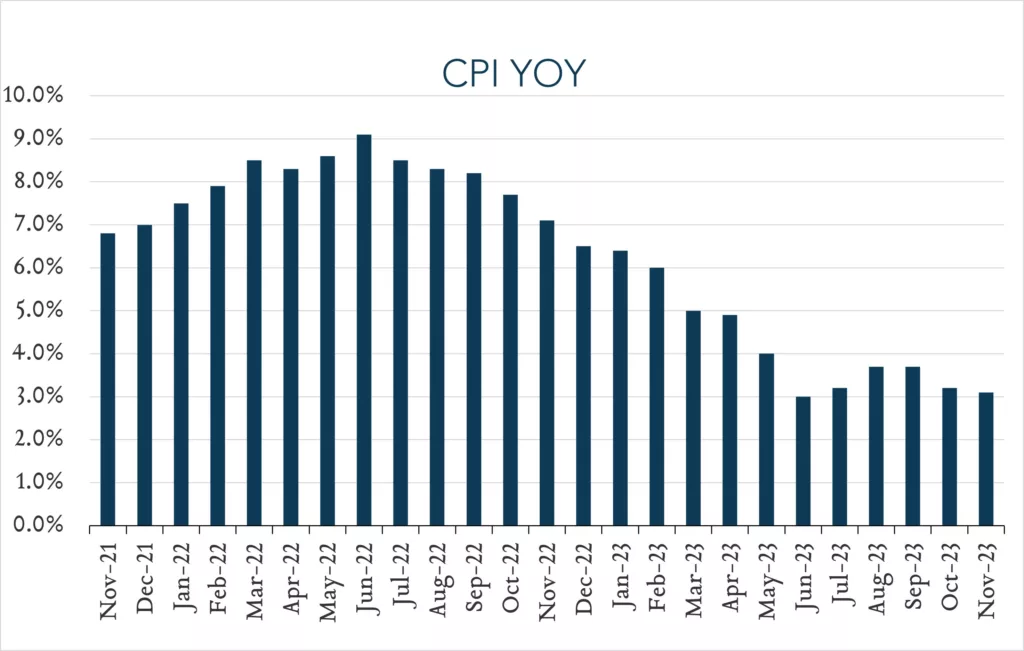

Year-over-year, inflation decelerated modestly to 3.1% from 3.2% in October. Month-over-month, inflation ticked up to 0.1% from 0.0% in October. While inflation has declined substantially from a 40-year high of 9.1% reached last year today’s report highlights the choppy nature of bringing inflation back down to the Fed’s 2.0% target as a still-strong labor market continues to drive consumer spending and the broader economy. Policymakers begin their December meeting today and are expected to hold interest rates steady tomorrow afternoon. The main focus will be on Chair Powell’s commentary which may offer insights into the year ahead. Overall, we expect Powell to reiterate a need for a more sustainable pullback in inflation before easing policy.

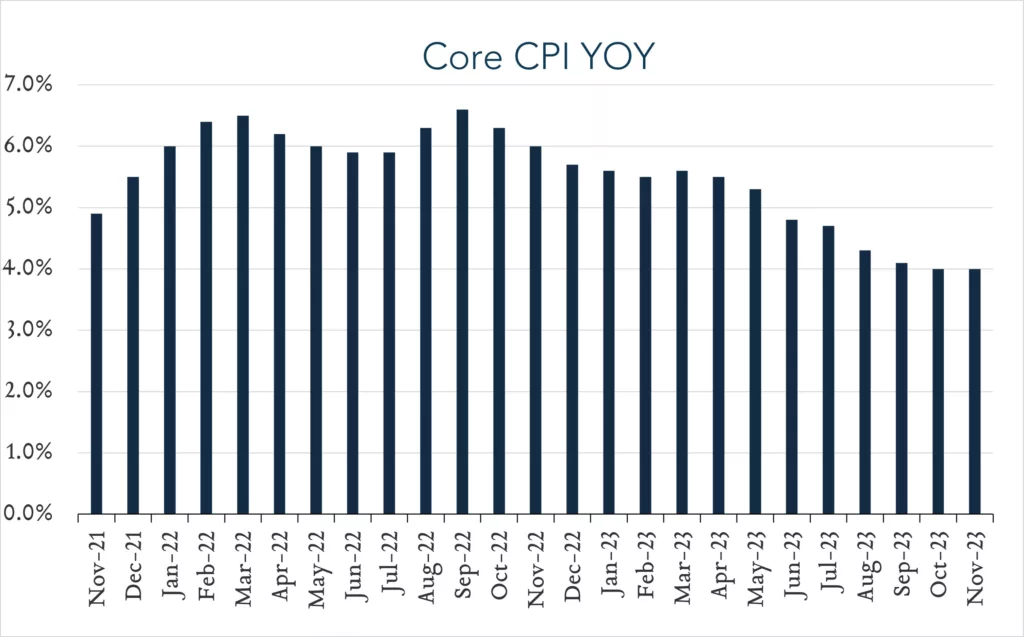

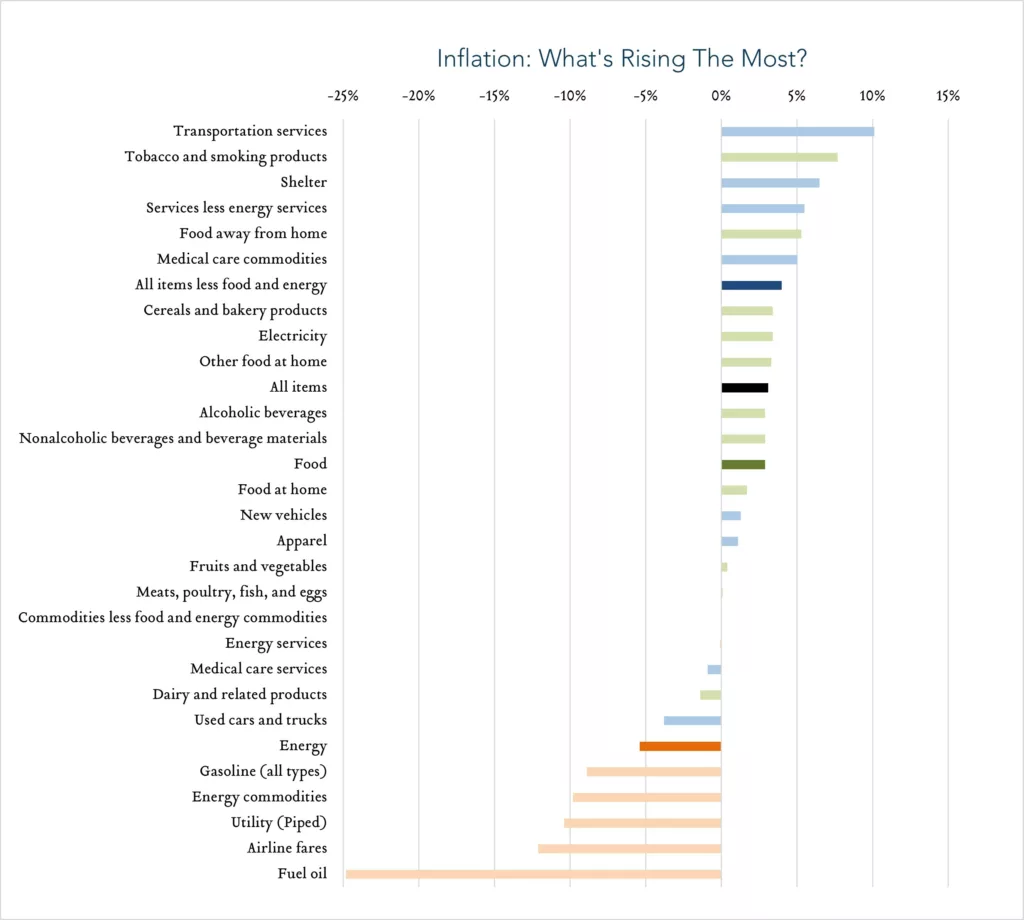

- Consumer prices (CPI) increased 3.1% year-over-year. In November, the consumer price index (CPI) increased 3.1%, decelerating from 3.2% in October and in line with expectations. Transportation services (+10.1%) and shelter costs (+6.5%) were key contributors to the overall increase, more than offsetting declines in energy (-5.4%) and used vehicles (-3.8%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +6.5% year-over-year, shelter costs decelerated from +6.7% in October and a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 4.0% year-over-year, unchanged from October and in line with expectations.

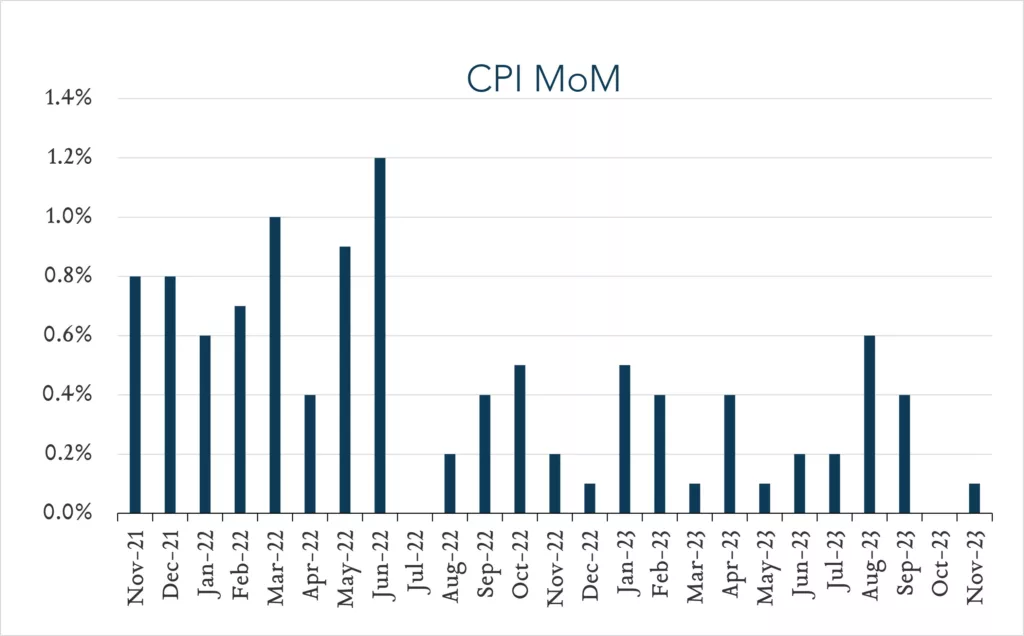

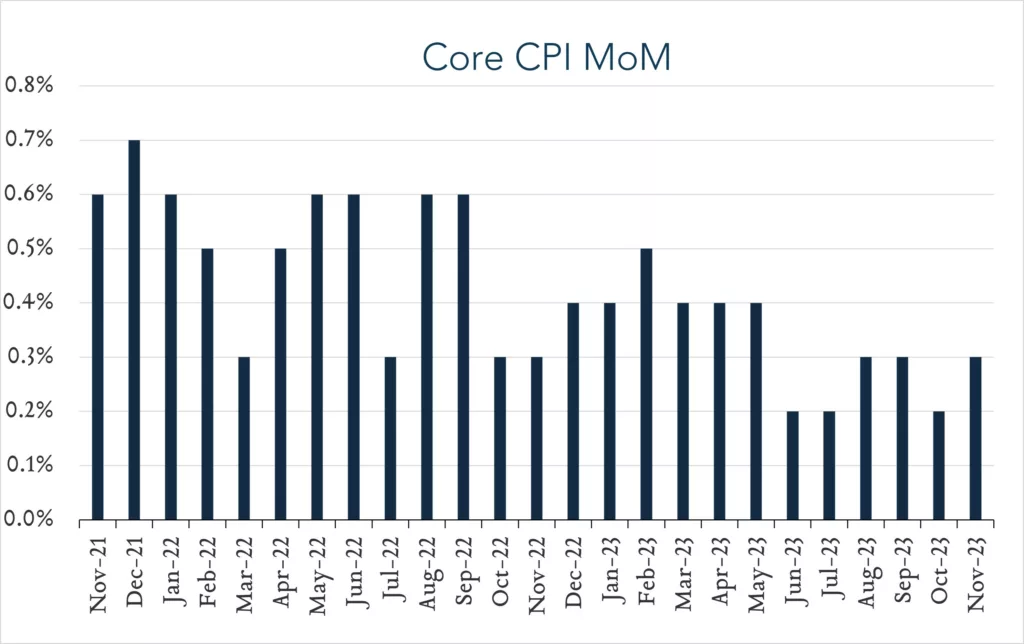

Consumer prices (CPI) increased 0.1% month-over-month. In November, consumer price levels increased 0.1% compared to October. Expectations ranged from -0.1% to +0.2% with a median of +0.0%. Energy prices declined 2.3%, and shelter costs, which represent nearly one-third of the index, increased 0.4% for the month. Core CPI (excludes food and energy) increased 0.3% month-over-month, down from +0.2% in October and in line with expectations.