April 15, 2024

March Retail Sales - Strong Print Supports Delayed Rate Cut Expectations

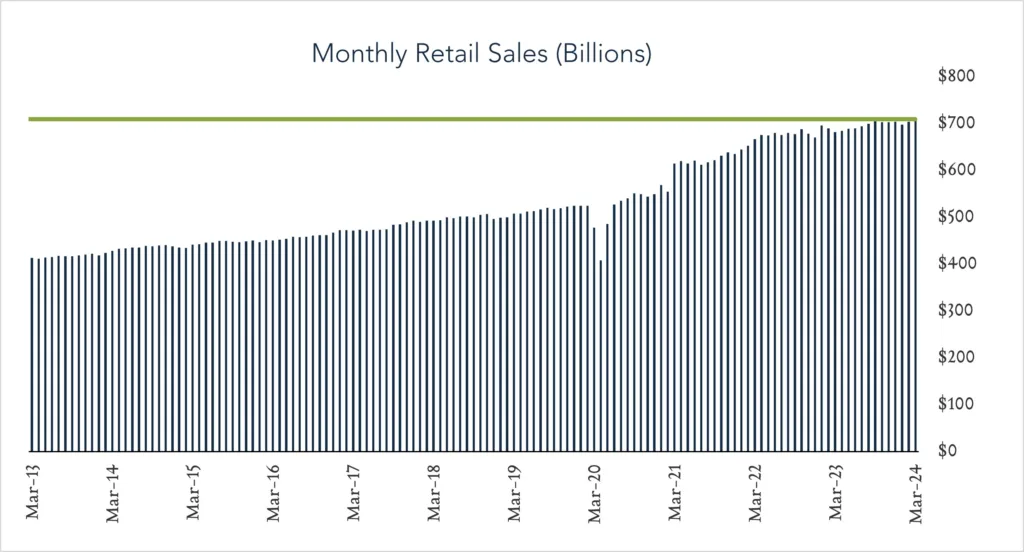

U.S. retail sales rose by more than forecast in March and February results were revised upward, highlighting yet-resilient consumer demand exiting the first quarter. A month ago, consumer spending appeared to be waning against a backdrop of higher prices and more limited access to credit. However, today’s report seems to suggest plenty of momentum with support from a strong labor market (and in spite of restrictive monetary policy). Recent data points, including stronger than expected indications from the labor market and inflation reports, have changed the narrative on Fed rate cut expectations with investors now pricing in just one to two 0.25% cuts in 2024 – down from six expected when the year began. As long as the labor market remains strong enough to support consumer demand, there’s a risk that above-target inflation could become entrenched. Overall, this dynamic supports a “higher for longer” posture from policymakers.

- Real (inflation adjusted) retail sales grew 0.5% year-over-year. In March, retail sales grew 4.0% nominally netting real growth of 0.5% after adjusting for 3.5% inflation. Healthy spending at online retailers (+11.3%) and on restaurant dining (+6.5%) was partially offset by lower spending on building materials (-0.6%) and gasoline (-0.7%). Four out of thirteen categories showed growth in real terms.

- Real (inflation adjusted) retail sales grew 0.3% month-over-month. In March, nominal retail sales levels grew 0.7% compared to February (consensus +0.4%) netting 0.3% growth in real terms. Increased spending at online retailers (+2.7%) and gas stations (+2.1%) was partially offset by lower spending on motor vehicles. Five out of thirteen categories showed growth in real terms.