April 15, 2023

March Retail Sales - Losing Momentum

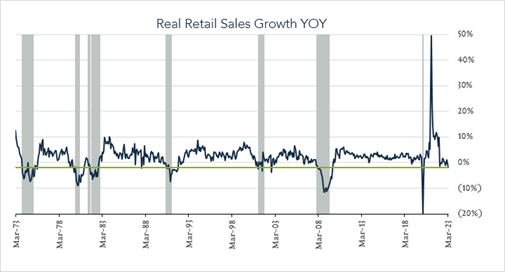

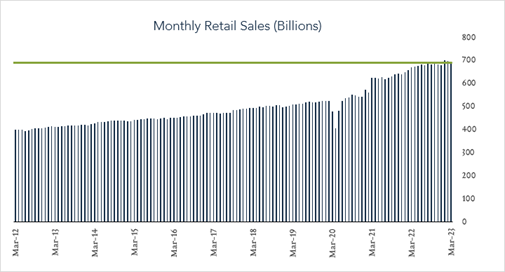

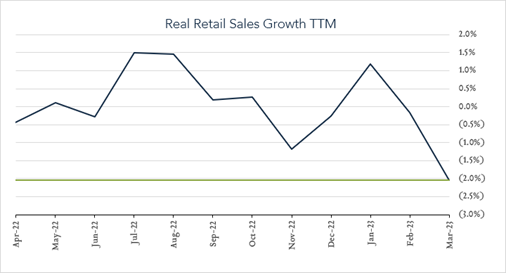

U.S. retail sales fell for a second straight month in March, an indication that household spending is waning amid inflation and increased borrowing costs. In real terms, retail spending declined 1.1% month over month and 2.1% year over year. Monthly data helps to highlight current trends, however we focus more closely on year-over-year results as a recession indicator. Real (inflation adjusted) declines in retail spending can indicate increased recession risk as the consumer represents the lion’s share of the U.S. economy. In the context of our key recession indicators, (unemployment, retail spending, yield curve) we have characterized retail spending as a “yellow light” since it originally triggered back in March 2022. Over the last year, we have seen real year-over-year declines six times averaging -0.6%. Today’s result (-2.1% YoY) is the largest real decline since May 2020 adding evidence that momentum is slowing in household spending and the broader economy as inflation persists and monetary policy continue to tighten.

- Real (inflation adjusted) retail sales down 2.1% year-over-year. In March, retail sales grew 2.9% nominally and declined 2.1% after adjusting for 5.0% inflation – this is the largest real decline since May 2020 during the onset of the pandemic. Higher spending on restaurants (+13.0%) and non-store retailers (+12.3%) was partially offset by lower spending at gas stations (-14.2%) and electronics/appliance stores (-10.3%). Nine out of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales down 1.1% month-over-month. In March, retail sales levels fell 1.0% compared to February (consensus -0.5%) netting -1.1% in real terms. Eight of thirteen categories declined last month, offset partially by growth at nonstore retailers (+1.9%), and health & personal care stores (+0.3%).