April 10, 2024

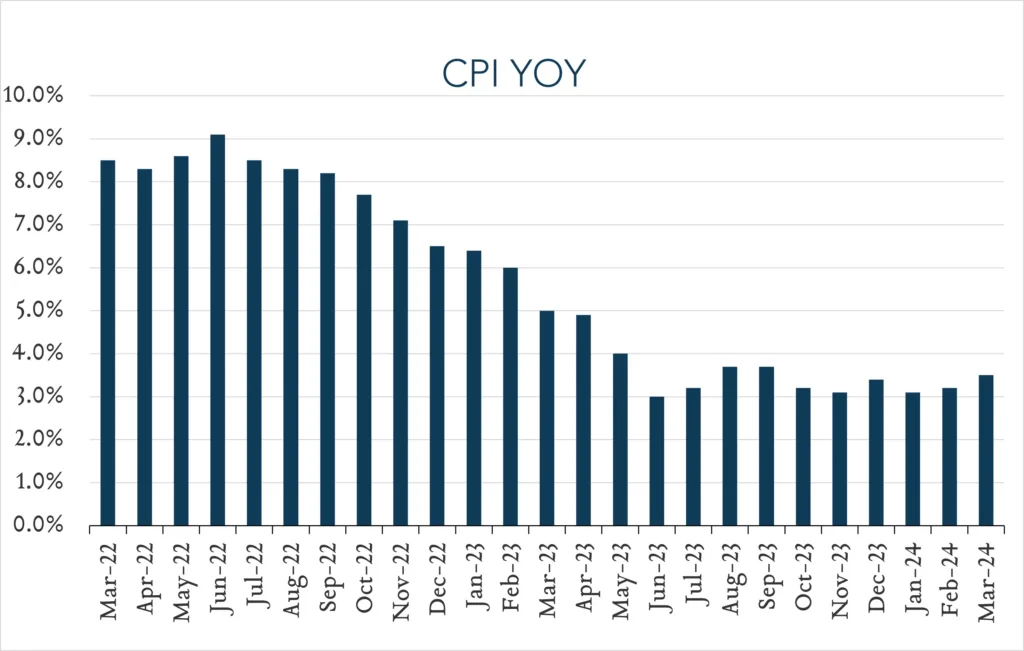

March Inflation - Hot Print Likely Eliminates June Cut

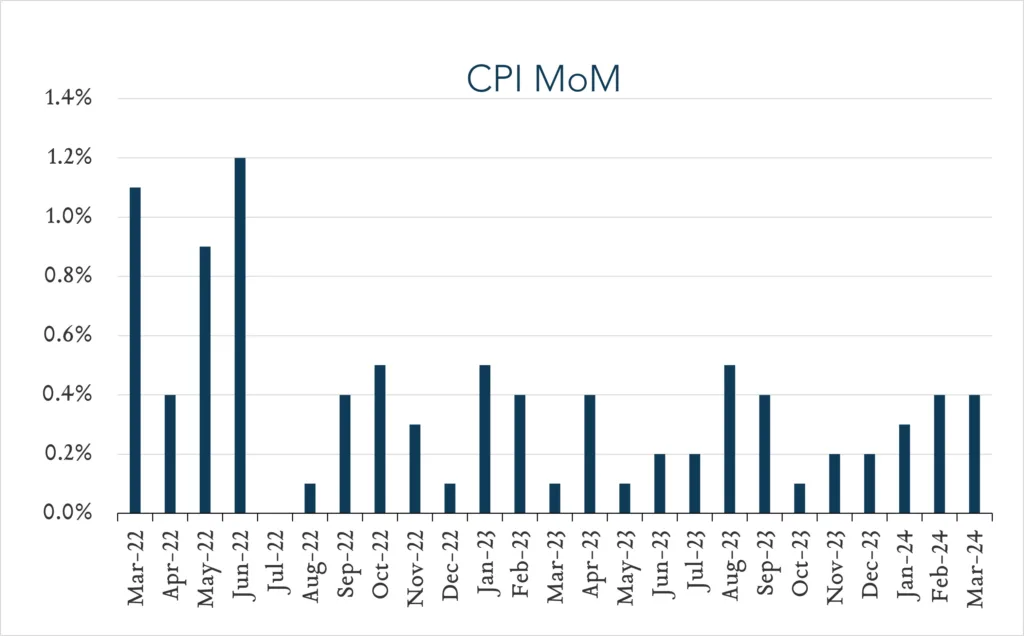

Year-over-year, inflation rose 3.5% in March, up 0.3% compared to February and 0.1% ahead of expectations. Month-over-month, prices increased +0.4%, unchanged from February, but above expectations of +0.3%. Today’s report marked the third time in as many months that price increases came in hotter than expected suggesting that progress on taming inflation may be stalling out. Unchanged since July 2023, Fed policy rates remain at a two-decade high, but a robust labor market continues to support strong demand for goods and services. In March, policymakers communicated expectations for three 0.25% rate cuts in 2024. At the time, investors were aligned in their expectations, which subsequently trended down to just two to three cuts with a 50% probability of the first cut happening in June. Following this morning’s report, investors adjusted expectations further with markets now pricing in just one to two cuts this year and only a 20% probability of a cut in June.

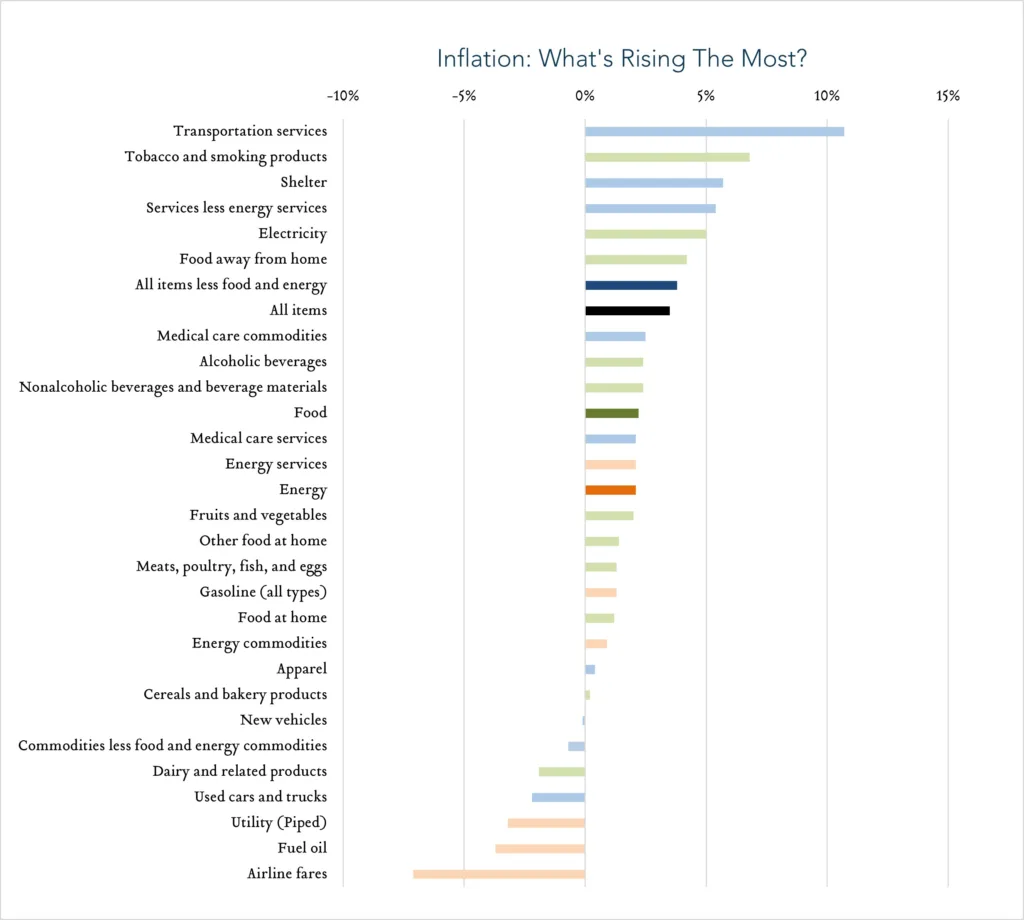

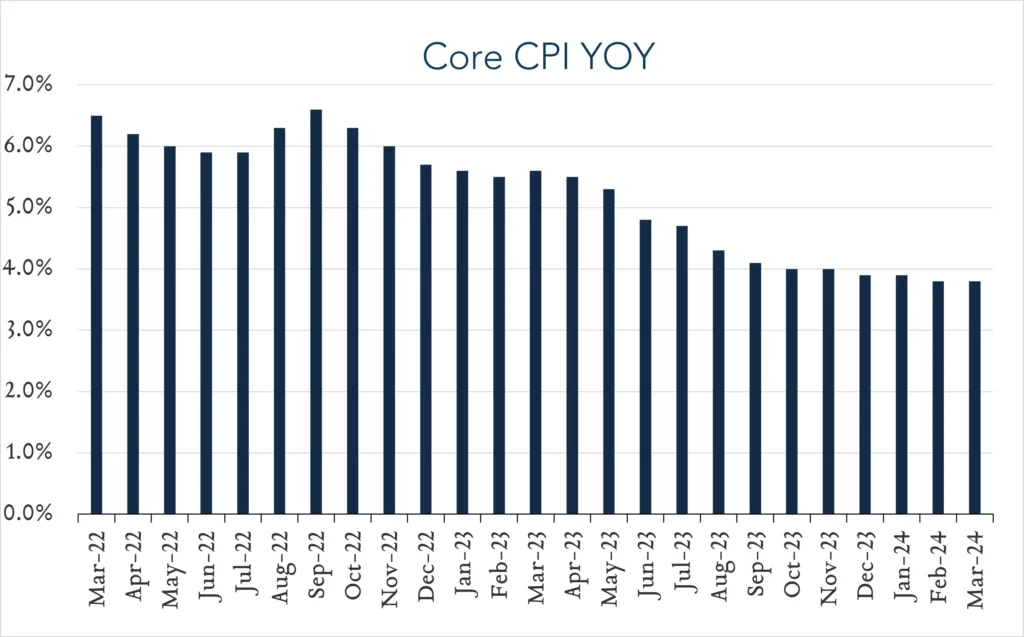

- Consumer prices (CPI) increased 3.5% year-over-year. In March, the consumer price index (CPI) increased 3.5%, up from 3.2% in February and 0.1% ahead of expectations. Transportation services (+10.7%) shelter (+5.7%), and energy costs (+4.2%) were key contributors to the overall increase, more than offsetting slower growth in food costs (+2.2%) and a decline for used vehicles (-2.2%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.7% year-over-year, shelter costs were unchanged from February, but down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.8% year-over-year, consistent with February.

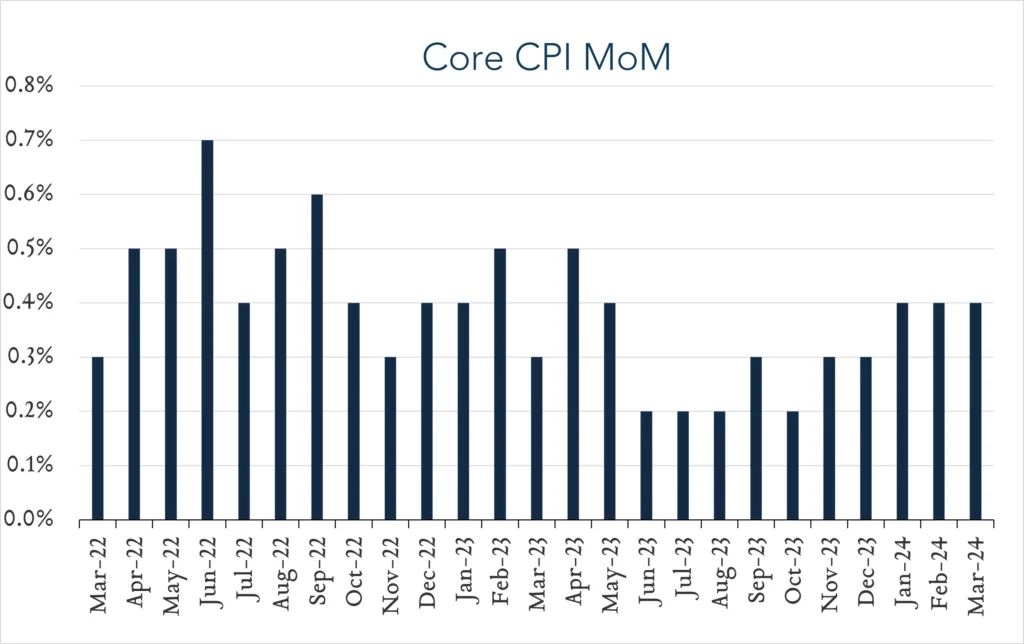

- Consumer prices (CPI) increased 0.4% month-over-month. In March, consumer prices increased 0.4%, unchanged from February. Expectations ranged from +0.2% to +0.5% with a median of +0.3%. Shelter costs increased 0.4% for the month while energy prices rose 1.1%. Core CPI (excludes food and energy) also increased 0.4% month-over-month, consistent with February and above expectations of +0.3%.