April 12, 2023

March Inflation - Brisk, But Better Than Expected

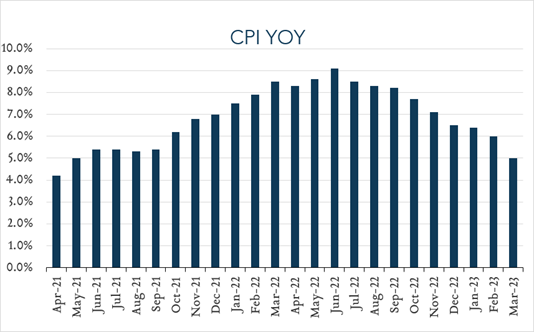

March inflation data showed overall annualized price increases slowing for a ninth straight month to 5.0% compared to expectations for 5.1%. Month over month, prices rose just 0.1% compared to expectations for a 0.2% increase. The policy-making environment remains challenging. While policymakers are watching closely for any sign that banking turmoil is placing undue stress on the economy, continued elevated inflation levels and a still strong labor market likely underpin one additional rate increase at the FOMC meeting in May before a potential pause.

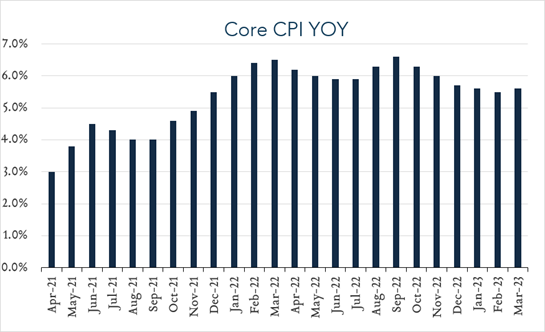

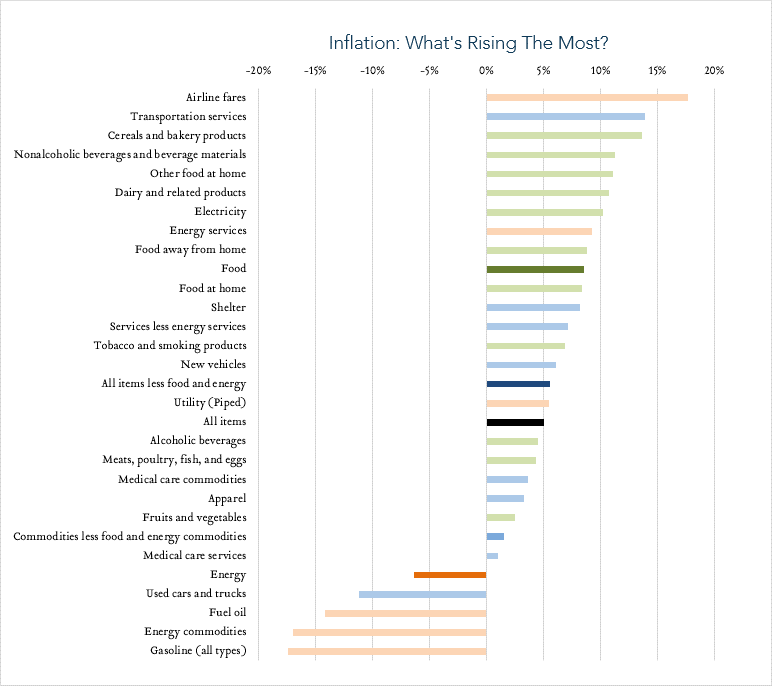

- Consumer prices (CPI) increased 5.0% year-over-year. In March, the consumer price index (CPI) increased 5.0%, decelerating from 6.0% in February. Expectations ranged from 4.9% to 5.4% with a median of 5.1%. The sharp deceleration from February reflects comparison to March 2022, when energy prices spiked immediately after Russia’s invasion of Ukraine. Transportation services (+13.9%), Food (+8.5%), and shelter (+8.2%) were key contributors to the overall increase, more than offsetting declines in used vehicles (-11.2%) and energy (-6.4%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. Core CPI (excludes food and energy) increased 5.6% year-over-year, in line with expectations.

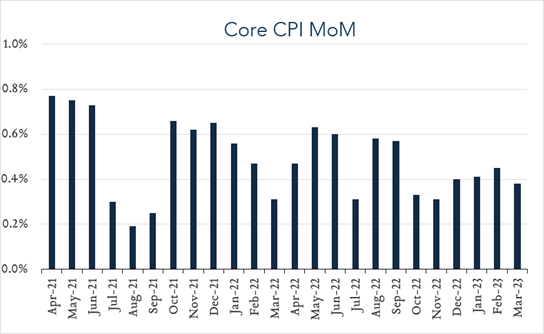

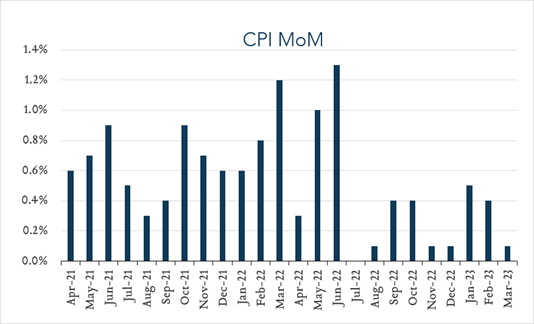

- Consumer prices (CPI) increased 0.1% month-over-month. In March, consumer prices rose 0.1% compared to February. Expectations ranged from +0.1% to +0.4% with a median of +0.2%. Shelter costs increased 0.7% for the month – by far the largest contributor to the overall increase, and more than offsetting a 3.5% decline in energy prices. Core CPI (excludes food and energy) increased 0.4% compared to February, in line with expectations.