July 16, 2024

June Retail Sales - Solid End to 2Q

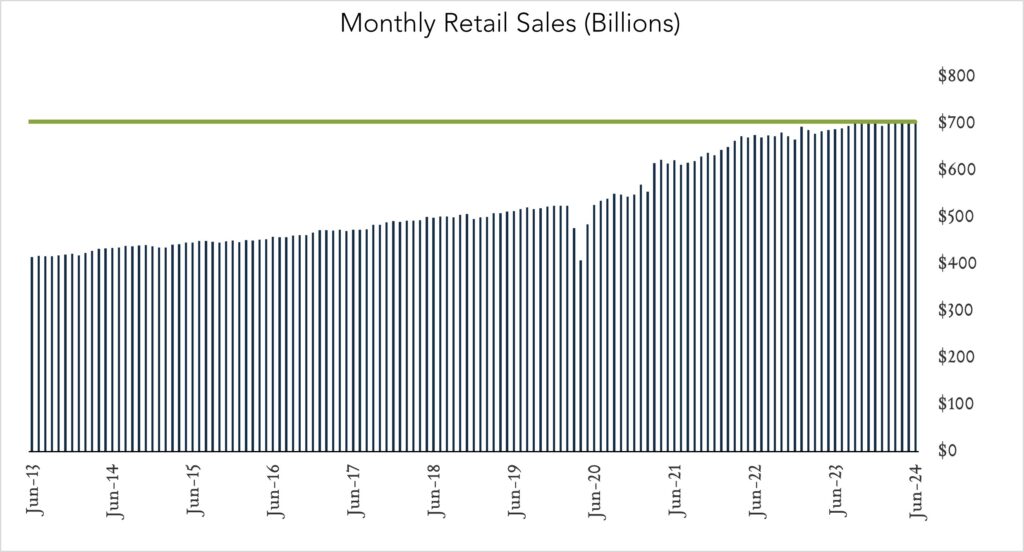

U.S. retail spending was unchanged in June and May figures were revised favorably suggesting resilient consumer spending exiting the second quarter even in spite of a cyberattack on auto dealerships which drove a 2% slide in vehicle receipts. Today’s report contradicts a recent trend pointing to gradual erosion of consumer strength, suggesting the economy’s main driver is holding up better than expected as inflation recedes and Fed policymakers consider rate cuts.

- Real (inflation adjusted) retail sales declined 0.7% year-over-year. In June, retail sales grew 2.3% nominally netting a decline of 0.7% after adjusting for 3.0% inflation. Higher spending at online retailers (+8.9%) and on restaurant dining (+4.4%) was partially offset by lower spending on motor vehicles (-2.2%) and building supplies (-0.9%). Nine of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales grew 0.1% month-over-month. In June, nominal retail sales levels were unchanged compared to May (consensus -0.3%) netting a 0.1% increase in real terms (consumer prices fell 0.1% MoM). Higher spending at online retailers (+1.9%) and building materials (+1.4%) was offset by lower spending on motor vehicles (-2.0%) and gas stations (-3.0%). Only two of thirteen categories declined in real terms.