July 15, 2025

June CPI - Underlying Inflation Up Less Than Expected

In May, consumer prices as measured by CPI, rose 2.7% compared to a year ago, up from 2.4% in May and above expectations for +2.6%. Core CPI (excludes volatile food and energy prices) rose 2.9%, in line with forecasts, but up from 2.8% in May. Investors are likely to focus on a core month over month reading of +0.2% that came in below expectations for a fifth time in a row as some companies have been able to shield customer from price increases by building inventory ahead of tariffs and/or absorbing part of the higher costs. The weaker-than-expected reading could support additional calls for the Federal Reserve to lower rates later this month, though the committee is widely expected to hold rates steady again.

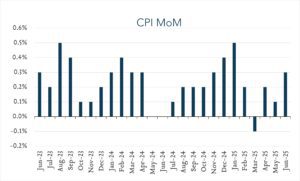

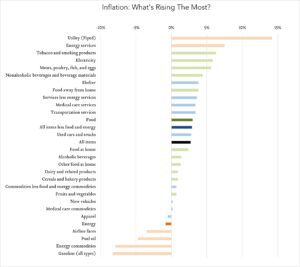

- Consumer prices (CPI) increased 2.7% year-over-year. In June, the consumer price index (CPI) increased 2.7% – higher than expectations for 2.6% and up from 2.4% in May. The cost of shelter (+3.8%) and food (+3.0%) were key contributors to the overall increase, more than offsetting declines in gasoline (-8.3%). Shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag, continued on a path of deceleration. At +3.8% year-over-year, shelter inflation decelerated modestly from May 2025 and is down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 2.9% year-over-year, up from 2.8% in May and in line with expectations.

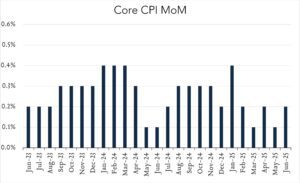

- Consumer prices (CPI) rose 0.3% month-over-month. In June, consumer prices rose 0.3% month-over-month up from 0.1% in May and in line with expectations. Core CPI (excludes food and energy) increased 0.2% month-over-month, up from 0.1% in May and below expectations for +0.3%.