February 15, 2023

January Retail Sales - Stronger Than Expected; Fed on High Alert

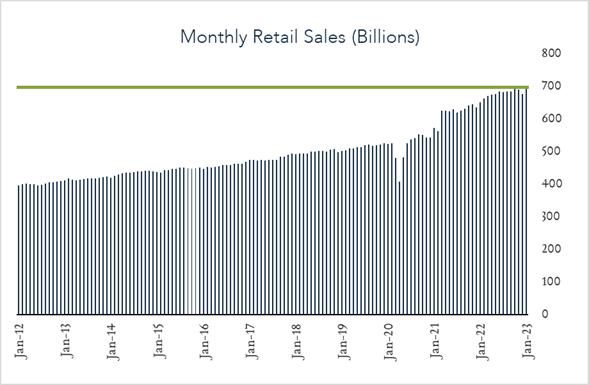

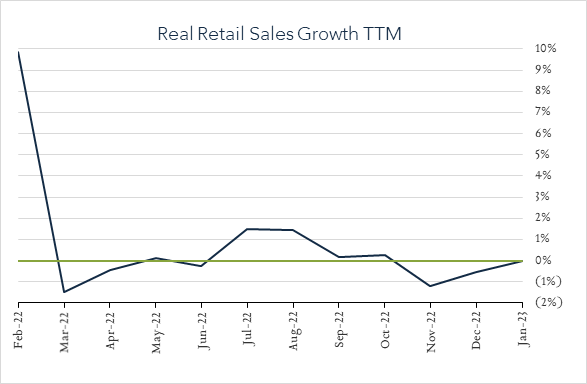

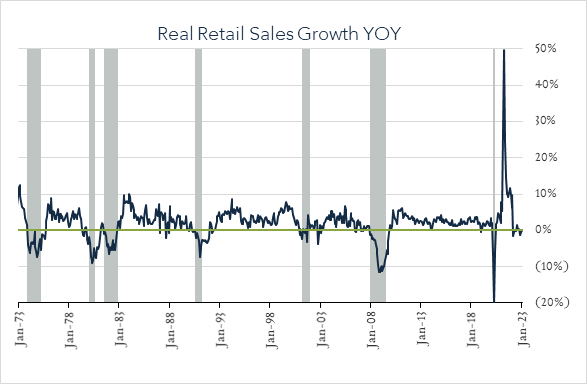

U.S. retail sales rose in January by the most in nearly two years, signaling robust consumer demand which, combined with yesterday’s stronger-than-expected inflation report and labor market resiliency, could mean the Fed will need to raise interest rates more than originally expected. Retail spending rose more than forecast in January (+3.0% MoM vs. +2.0% expected). Year-over-year, retail spending was unchanged after adjusting for inflation.

- Real (inflation adjusted) retail sales unchanged year-over-year. In January, retail sales grew 6.4% – in line with inflation. Higher spending on restaurants (+25.2%), sporting goods (+6.9%) and other brick and mortar retailers (+6.7%) accounted for a large portion of the nominal increase though all other categories (ten of thirteen) posted declines after adjusting for inflation.

- Real (inflation adjusted ) retail sales grew 2.5% month-over-month. In January, retail sales levels increased 3.0% compared to December (consensus +2.0%) netting +2.5% in real terms. All thirteen categories rose last month, led by restaurants (+7.2%) motor vehicles (+5.9%), and furniture (+4.4%). Spending at gas stations was unchanged.