February 14, 2023

January Inflation - Above Forecast, Shelter Yet to Turn

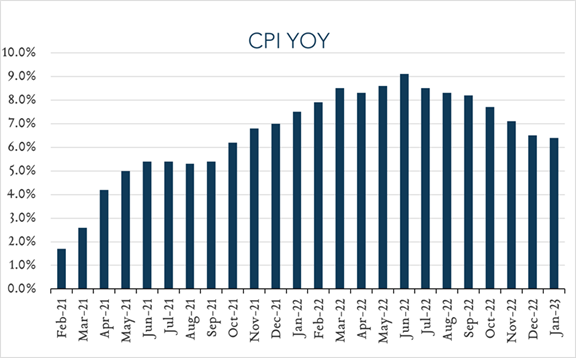

January inflation data showed price increases slowing for the seventh straight month, though not to the degree analysts had anticipated. The outcome, combined with January’s blowout jobs report, underscores the durability of the economy and accompanying inflationary pressures despite aggressive policy moves from the Fed. Shelter costs, which represent nearly one third of CPI, were by far the largest contributor to the overall increase. Importantly, because of the way shelter costs are incorporated into CPI, there is a significant lag between real-time price changes and their impact on CPI. Based on the decelerating home prices we observe today, we would expect shelter inflation to drop below 3% by year-end (from nearly 8% today).

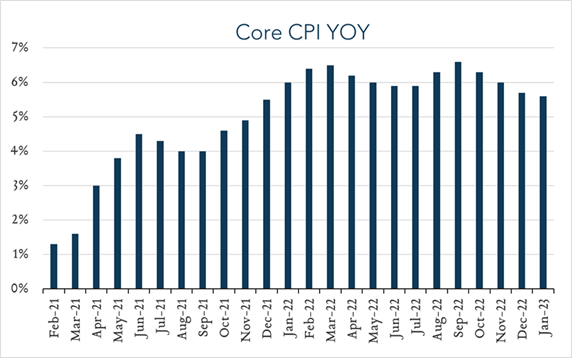

- Consumer prices (CPI) increased 6.4% year-over-year. In January, the consumer price index (CPI) increased 6.4%, decelerating only slightly from 6.5% in December. Expectations ranged from 5.8% to 6.7% with a median of 6.2%. Food and energy were key contributors to the increase. Meanwhile, shelter costs, which represent nearly one third of the consumer price index and tend to increase with a lag, increased 7.9%. Used cars and trucks was the only category to post a year-over-year decline, down 11.6%. Core CPI (excludes food and energy) increased 5.6% year-over-year (compared to expectations of +5.5%).

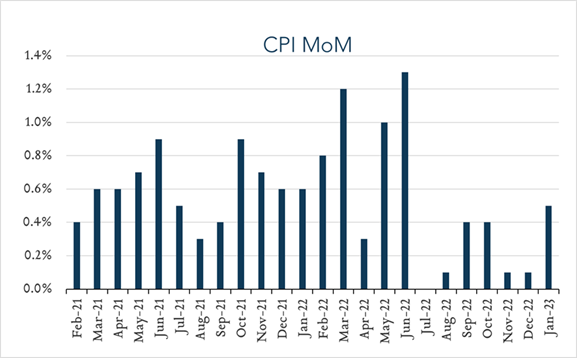

- Consumer prices (CPI) increased 0.5% month-over-month. In January, consumer prices rose 0.5% compared to December. Expectations ranged from +0.3% to +0.6% with a median of +0.5%. Shelter costs increased 0.7% for the month. Used car and truck prices fell another 1.9% in the month. Core CPI (excludes food and energy) increased 0.4% compared to December, in line with expectations.