February 2, 2024

January Jobs - Wow... just wow.

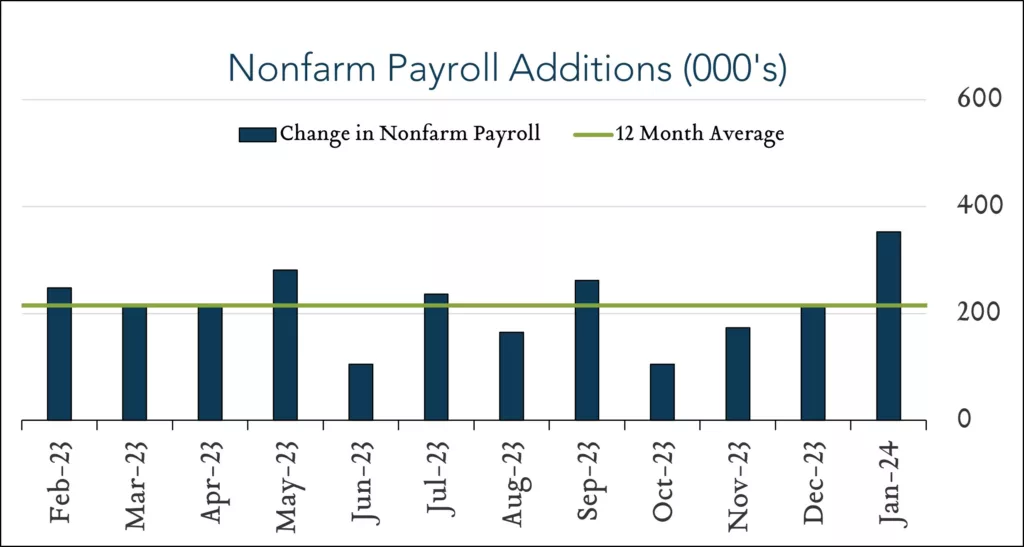

Surging job gains and higher wages great for economy and consumers, but likely extend rate cut timing. The U.S. labor market added the most jobs since last January’s blowout exceeding all estimates while the prior two months were revised significantly higher. Meanwhile, wage growth accelerated meaningfully year-over-year and month-over-month. Fed projections provided in December indicated expectations for three rate cuts in 2024 and yesterday’s update indicated a March rate cut was highly unlikely. Today’s report seems to support the Fed’s patience which stands in contrast to market expectations. Entering 2024, markets were pricing in six cuts for the year. Following this morning’s jobs report, investors pared expectations down to five. Overall, the report highlights a labor market that has been instrumental in powering consumer spending and economic growth, but continued above trend hiring and wage growth could challenge Fed efforts to reduce inflation.

- 353K jobs added in January – Above all estimates; December revised significantly higher. The U.S. labor market added 353K jobs in January, up from +333K (revised up from +216K previously reported) in December. Forecasts ranged from +120K to +300K with a median of +185K. Hiring was more pronounced in professional and business services (+74K), health care (+70K), and retail trade (+45K), while manufacturing, government and information trended higher as well. The leisure & hospitality industry was little changed compared to December.

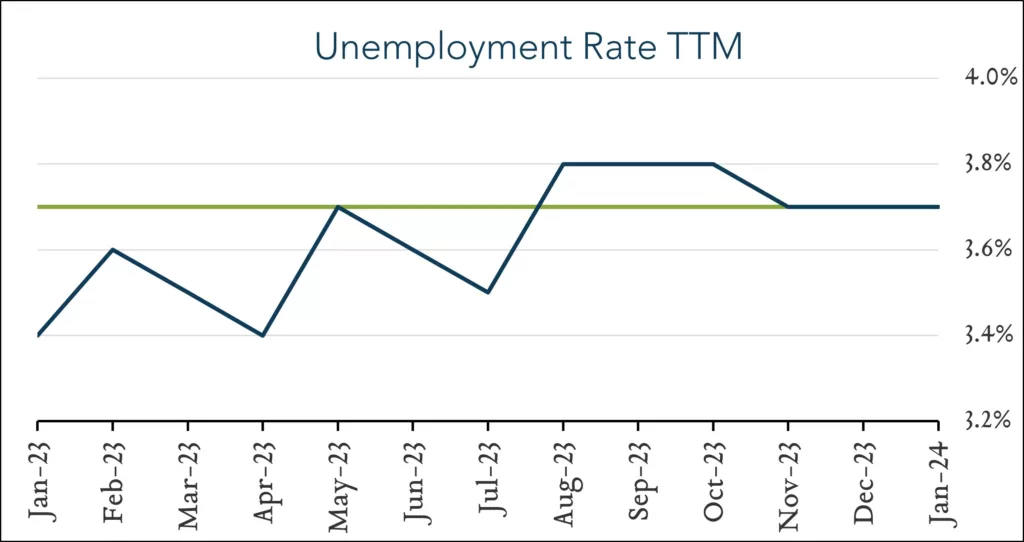

- 3.7% unemployment – unchanged. The U.S. unemployment rate was unchanged at 3.7% in January. Forecasts ranged from 3.6% to 3.9% with a median of 3.8%. This marks the 24th consecutive month below 4% as unemployment has ranged from 3.5% to 4.0% since the end of 2021. The labor force participation rate was unchanged at 62.5%. Year-over-year, wage growth increased 4.5% compared to +4.3% in December and expectations of 4.1%. Month-over-month, wages increased 0.6% compared to +0.4% in December and above expectations of +0.3%.