July 7, 2023

Health Savings Account: The Triple Crown Advantage

The Kentucky Derby is an iconic event that kicks off the Triple Crown series between May and early June of each year. One of the most difficult and sought after accomplishments in horse racing, the grueling schedule requires thoroughbred three-year-old horses to compete in the Kentucky Derby in May, the Preakness two weeks later, followed by the Belmont Stakes in three weeks. While many have tried to accomplish this infamous task, only 13 horses over the course of time have achieved the Triple Crown.

I am not a horse trainer, nor a jockey, therefore, I do not pretend to understand how difficult it be to obtain this achievement. However, being of a financial planning mind and embracing strategies to help our clients grow and accumulate their wealth, the best comparison I can make to the Triple Crown is the triple tax benefit of a health savings account (HSA). While this may not be the Secretariat of the 1970s that smashed racing records, it does carry the reputation of being one of the greatest wealth building vehicles permitted within today’s tax code.

Triple Tax Advantage

The health savings account was first introduced in December 2003 as part of the Medicare Prescription Drug, Improvement and Modernization Act. Provisions of the act provided consumers of high deductible health insurance plans the ability to set aside pre-tax dollars with three primary advantages:

Tax Deductible: Health savings account contributions are tax deductible, regardless of the individual’s income level or whether (or not) the individual takes the standard deduction or itemizes his/her income tax deductions. Additionally, when contributing to a health savings account, funding the account should be completed through payroll deduction whenever possible. The contributions are counted as pre-tax amounts that not only are excluded from taxable income but will potentially avoid payroll taxes as well.

Tax Deferred: Contributions in the health savings account grow income tax deferred.

Tax-free withdrawals, when used for Qualified Medical Expenses: Health savings account distributions are not subject to income tax when used for qualified medical expenses. The definition of qualified medical expense is relatively broad, and the list of opportunities vary from some insurance premiums to long-term care outlays, with no shortage of potential qualified medical expenses. If the health savings account owner is over the age of 65, withdrawals for non-medical reasons are permitted on a penalty-free basis, but the withdrawals are subject to income tax.

2023 Health Savings Account Contribution Limits

For an individual who is under the age of 55 years, the maximum contribution is $3,850, and if over that age, the maximum contribution to a health savings account is $4,850. Contributions to a health savings account for a family are $7,750, and if over age 55, the contribution limit increases to $9,750. A family covered by a “family” high deductible health plan, which covers both spouses, is still limited to a maximum aggregate amount of $7,750, i.e., the spouses cannot ‘double’ the contribution(s) to $15,500 for both. The spouses can, however, allocate a catch-up contribution to each of their respective health savings accounts, if over age 55, if the aggregate amount does not exceed the annual contribution limit of $9,750 ($7,750 contribution + $1,000 catch-up Spouse A health savings account + $1,000 catch-up Spouse B health savings account).

Long-Term Compounding Impact

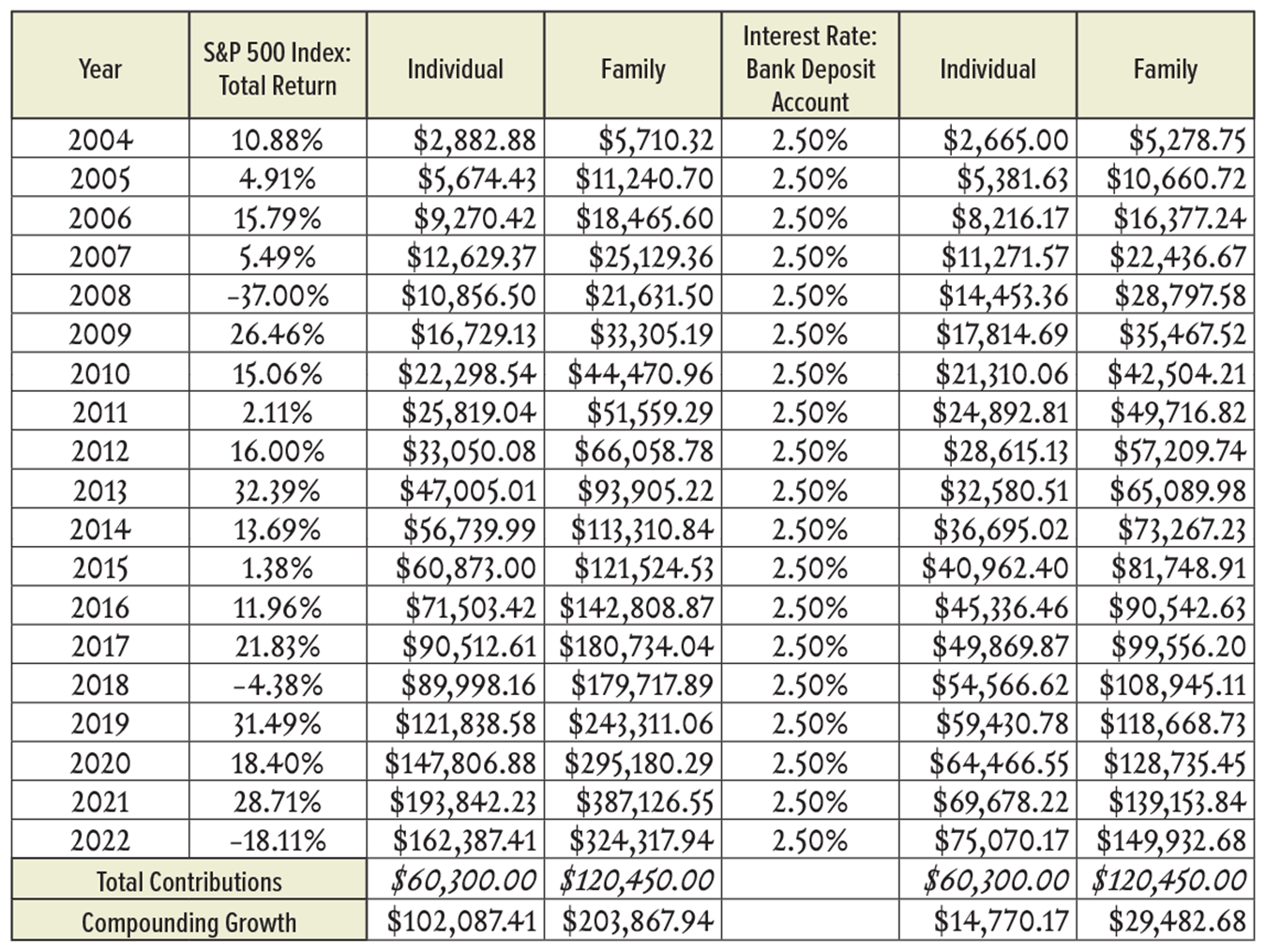

A majority of health savings account owners use their account to pay for medical expenses at the point of service, and therefore, match their investment strategy to utilize highly liquid, savings account type of investment for their contributions. This strategy makes sense if there are no other means of providing payment for qualified medical expenses, but if there are, the account owner is missing out on long-term, tax-deferred growth. For example, instead of investing in a typical bank savings account or money market fund limiting the potential return, let’s say the account owner invested in an S&P 500 index fund. The table above shows the impact of compounding investing power, demonstrating the opportunity set presented through investing in the market compared to that of a bank savings account.

The data indicates that a single person who saved the maximum amount annually and invested their health savings account dollars into the S&P 500 index fund (start of year), would have amassed a balance of $162,387 by year-end 2022, with over $100,000~ attributed to compounding growth. Similarly, a family contributor who saved the maximum amount annually, invested in the S&P 500 index fund, would have achieved a balance of more than $320,000 of which ~$200,000 is directly from compounding growth. It’s important to note that all growth, dividends and interest were sheltered from taxation over the course of 18-plus years. All clients’ financial situations are not the same, nor are the cash flow sources to support qualified medical expenses. But if the opportunity is available to invest health savings account contributions into the market versus a bank deposit account, knowing we invest for the long-term, the compounding over the course of time significantly outperforms.

When deciding which long-term retirement buckets should be filled first, health savings accounts should be near the top of the list. The triple-tax benefits of pre-tax contributions, tax-deferred growth, and potentially tax-free withdrawals, multiplied with the historical compounding of equity markets, make this almost as clear cut of a winner as Secretariat’s historical Triple Crown. If you would like to learn more about how a health savings account may fit into your overall wealth management plan, please don’t hesitate to contact a member of your Greenleaf Trust client centric team.