March 14, 2024

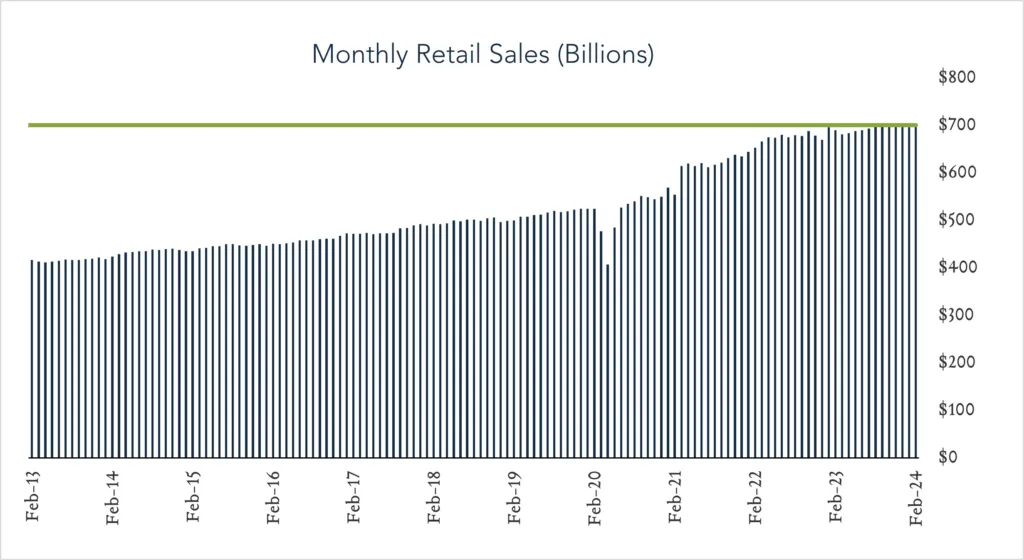

February Retail Sales - Below Forecasts

On the heels of a robust holiday shopping season, U.S. retail sales decelerated sharply in January and missed forecasts in February, underscoring concerns over how household spending will hold up this year. Supported by a strong labor market, consumers have played a key role driving continued economic growth and keeping the U.S. out of a recession over the past year. At Tuesday’s research meeting we highlighted a labor market that was “cooling from a very hot starting point” with some indications of softness on the margins. Year-to-date spending data seems to suggest that consumers are proceeding with caution as higher prices continue to pinch household budgets and credit access becomes more limited. While labor market resilience and stubborn inflation likely support expectations that the Fed will keep rates unchanged for a fifth straight meeting next week, we see increasing justification for easing monetary policy in coming months.

- Real (inflation adjusted) retail sales declined 1.7% year-over-year. In February, retail sales grew 1.5% nominally netting a 1.7% decline after adjusting for 3.2% inflation. Healthy spending at online retailers (+6.4%) and on restaurant dining (+6.3%) was partially offset by lower spending on building materials (-6.1%) and gasoline (-4.5%). Only two out of thirteen categories showed growth in real terms.

- Real (inflation adjusted) retail sales grew 0.2% month-over-month. In February, nominal retail sales levels grew 0.6% compared to January (consensus +0.8%) netting 0.2% growth in real terms. Increased spending on building materials (+2.2%), motor vehicles (+1.6%), and gasoline (+0.9%), was partially offset by slower growth in online retail spending (-0.1%) and restaurant dining (+0.4%). Five out of thirteen categories showed growth in real terms.