September 1, 2023

August Jobs - Resilience and Moderation

Hiring up and wage growth down. U.S. hiring accelerated in August and wage growth cooled – opposing signals from today’s report. The U.S. labor market added 187K jobs, the unemployment rate rose 0.3% to 3.8%, and wage moderated. A resilient labor market has been key to ongoing economic expansion in 2023. While job openings and wage growth have moderated over the last several months, hiring and incomes are still firm enough to support consumer spending. This is the last jobs report before the next Fed meeting later this month. Policymakers are still expected to hold rates steady in September, but Chair Powell recently commented that the committee is prepared to keep interest rates high and potentially increase them further should inflation prove sticky.

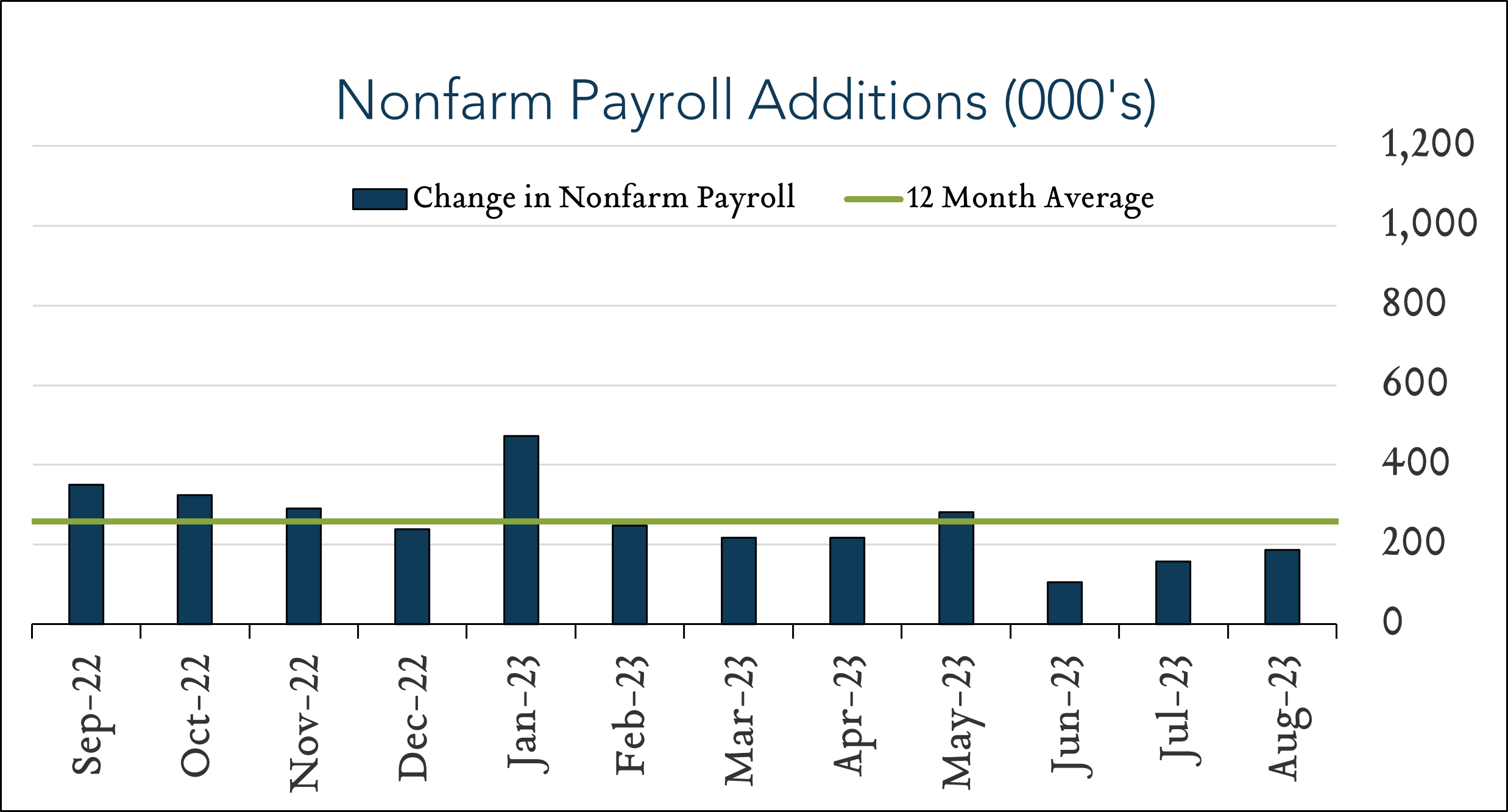

- 187K jobs added in August – Slightly better than expected. The U.S. labor market added 187K jobs in August, up from +157K (revised down from 187K originally reported) in July and +105K (revised down from +209K originally reported) in June. Forecasts ranged from +120K to +230K with a median of +170K. U.S. employment has grown by an average of 235K per month in 2023, moderating from an average of 400K per month in 2022. Notable job gains were observed in health care (+71K), leisure and hospitality (+40K), social assistance (+26K), and construction (+22K). Transportation and warehousing lost 34K jobs in August.

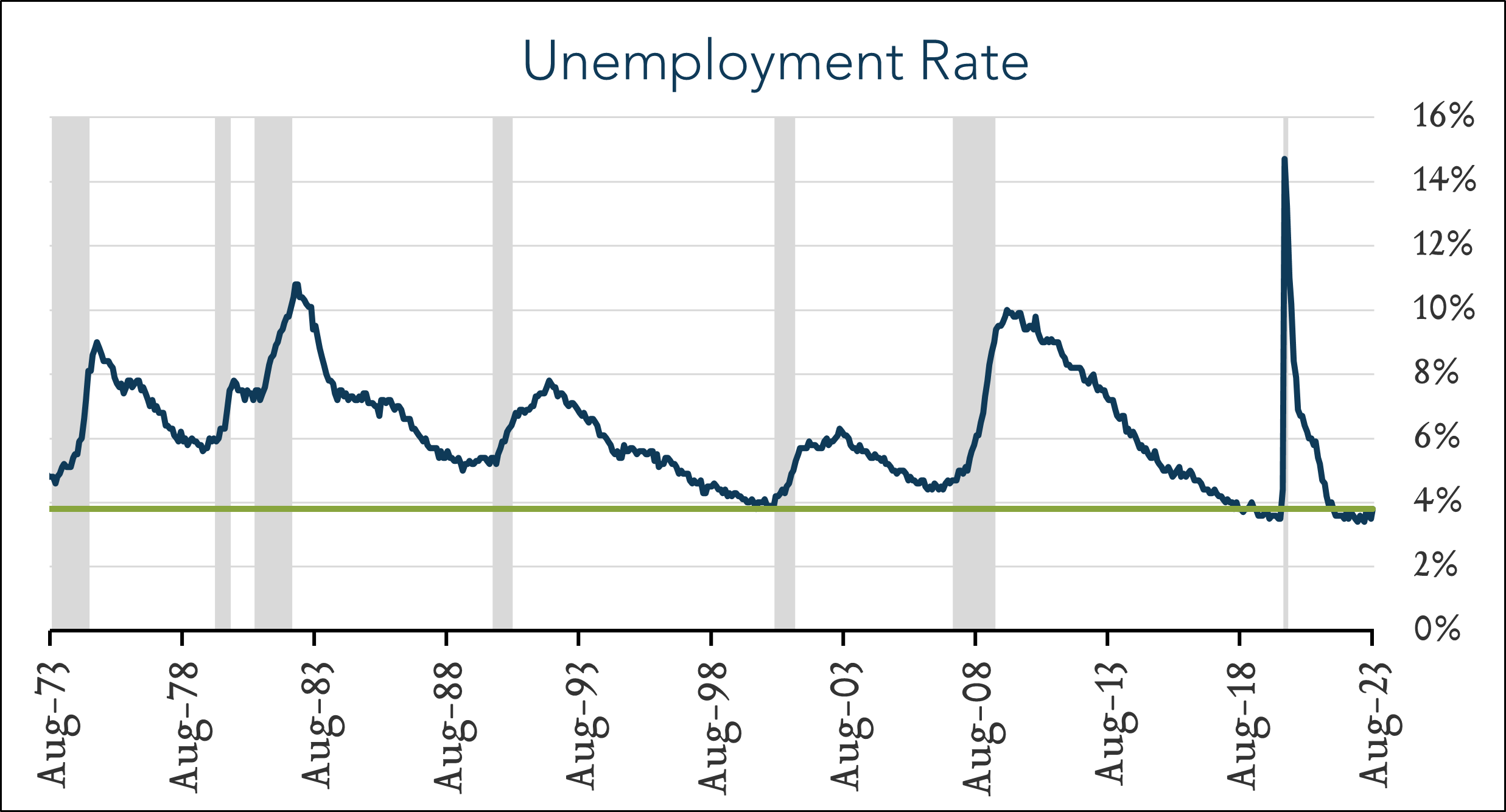

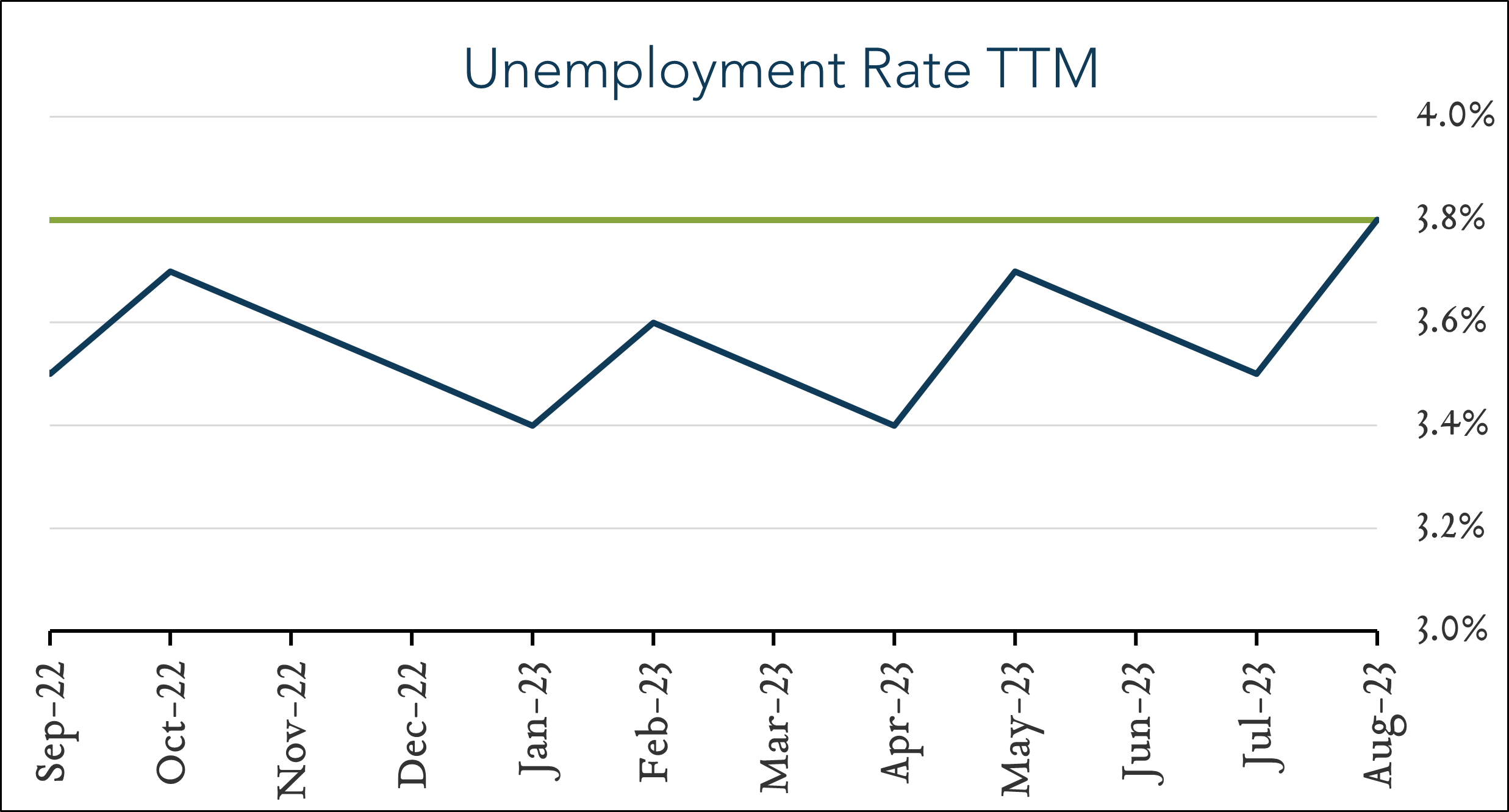

- 3.8% unemployment – remains historically low. The U.S. unemployment rate ticked up to 3.8% from 3.5% a month ago, partially owing to a higher labor force participation rate. Forecasts ranged from 3.5% to 3.6% with a median of 3.5%. Unemployment has ranged from 3.5% to 4.0% since the end of 2021. The labor force participation rate rose 0.2% to 62.8%, above expectations for 62.6% and closing in on the pre-pandemic level of 63.3%. Wage growth decelerated with average hourly earnings up 4.3% over the last year (down from 4.4% in July) and 0.2% month-over-month (down from +0.4% in July and below expectations of +0.3%).