July 7, 2023

2023 Mid-Year Update

After a challenging 2022, investors should be pleased with the market experience in the first half of 2023. In stark contrast to a period when both stocks and bonds moved lower together, financial markets have largely been in recovery mode over the last six months.

Several positive themes have bolstered markets including a strong labor market, resilient consumer, favorable corporate earnings, moderating inflation, and signs that the Federal Reserve is nearing the end of the fastest tightening cycle in the last 30 years. In addition, removal of two significant tail risks, namely the debt ceiling crisis and regional bank turmoil, has offered relief. Looking ahead to the second half of the year, monetary policy remains in focus, and investors continue to grapple with the prospect of a US recession.

A Healthy Start

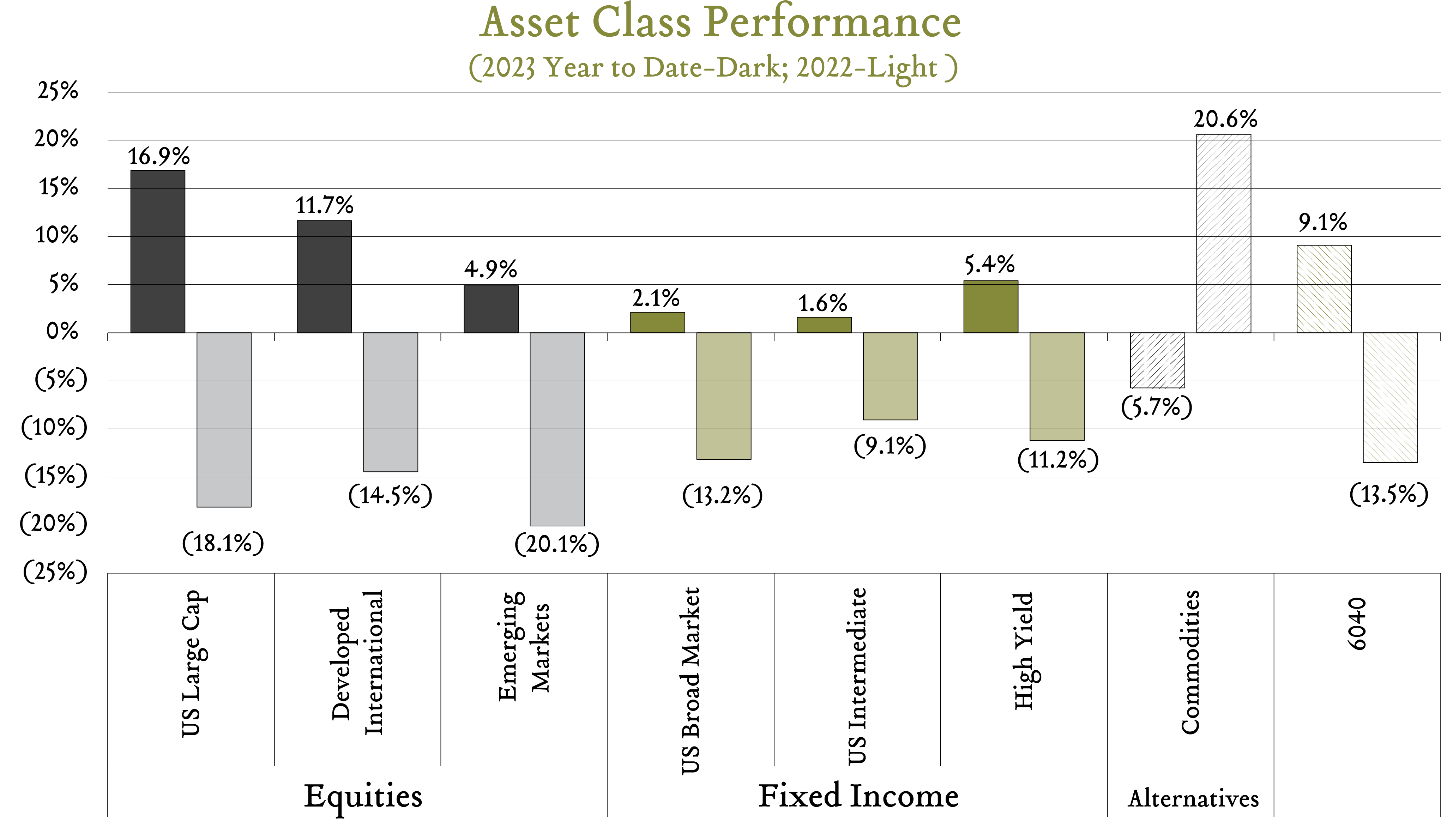

Year-to-date, global equities are up more than 14%. Domestic large caps are up more than 16%, while developed international and emerging market stocks are up 12% and 5%, respectively. Fixed income categories are up 2% to 5% while the 10-year Treasury bond rate stands at 3.84% compared to 3.87% starting the year. Commodities, a bright spot in 2022, have fallen nearly 6% in 2023. Even a balanced portfolio composed of 60% stocks and 40% bonds is up more than 9% in the first six months of the year.

Tail Risks Abate

It can be easy to forget the intensity of the debt ceiling crisis as well as the regional bank turmoil now that the former has been resolved and the latter appears more muted. We identified the possibility of a US default as a tail risk at our year-in-review seminar in January. The expected outcome was always that policymakers would come to an agreement and avoid the worst case scenario, however the brinksmanship extended longer than anyone would have hoped given the stakes. Ultimately, the debt ceiling resolution, which suspended the debt ceiling until January 2025 in exchange for modest limits on future federal spending, was a favorable outcome from the perspective of investors. In contrast, we did not foresee the risk of bank failures that arose in the first half of the year. Over two months, four regional banks failed. While others may still be at risk, concerns over contagion into the largest US banks have faded.

Refocusing on Fundamentals

With some of the more exogenous concerns removed from the spotlight, our gaze returns to evaluating the implications of monetary policy choices and fundamentals of the economy. After increasing interest rates at ten consecutive meetings, the FOMC took a pause in June to allow more time to assess incoming economic data. The policymaking environment remains challenging and officials are trying to strike a delicate balance stabilizing inflation without completely dislocating the labor market.

May inflation data showed overall annualized price increases slowing for an eleventh straight month to 4.0% – down from a June 2022 peak of 9.1% to the lowest level in more than two years. Meanwhile, the May jobs report was encouraging. US employers added 339K jobs in May after an upwardly revised +294K in April, while the unemployment rate jumped 0.3% to 3.7% and average hourly earnings growth decelerated to 0.3% month-over-month, from 0.5% in April.

There is clear evidence that tighter policy is already affecting the most interest rate sensitive sectors of the economy like housing, but officials believe it will take time for the full impact to be felt through the broader economy and to bring inflation back to the committee’s 2% target. With this in mind, Fed projections for the 2023 year-end rate now stand at 5.50%-5.75%, implying two more increases, with four 0.25% cuts expected in 2024.

Recession-Proof?

When it comes to predicting the next recession, the question is not “if,” but “when” it will happen. Recessions are a very normal part of the economic cycle, typically occurring every 4-5 years on average. Economists currently predict a 65% likelihood that we will enter a recession in the next twelve months – one of the highest readings outside of an actual recession. Interestingly, the same economists were making the same prediction six months ago. So far so good.

In the coming quarters, economists are forecasting zero growth in Q3 and a 0.5% decline in Q4 (QoQ SAAR). Forecasts for growth in Q3 have been improving, while Q4 forecasts have been deteriorating. We joke around the office that the next recession is always six months away. Economists continue to expect declining growth, they just continue to expect it further out in the future. The official definition of a recession is not consecutive quarters of negative GDP growth, but rather “a significant, widespread, and prolonged downturn in economic activity,” so even if these forecasts materialize, the slowdown may not be considered an official recession unless it is accompanied by a deteriorating labor market and other widespread evidence of a downturn in the economy.

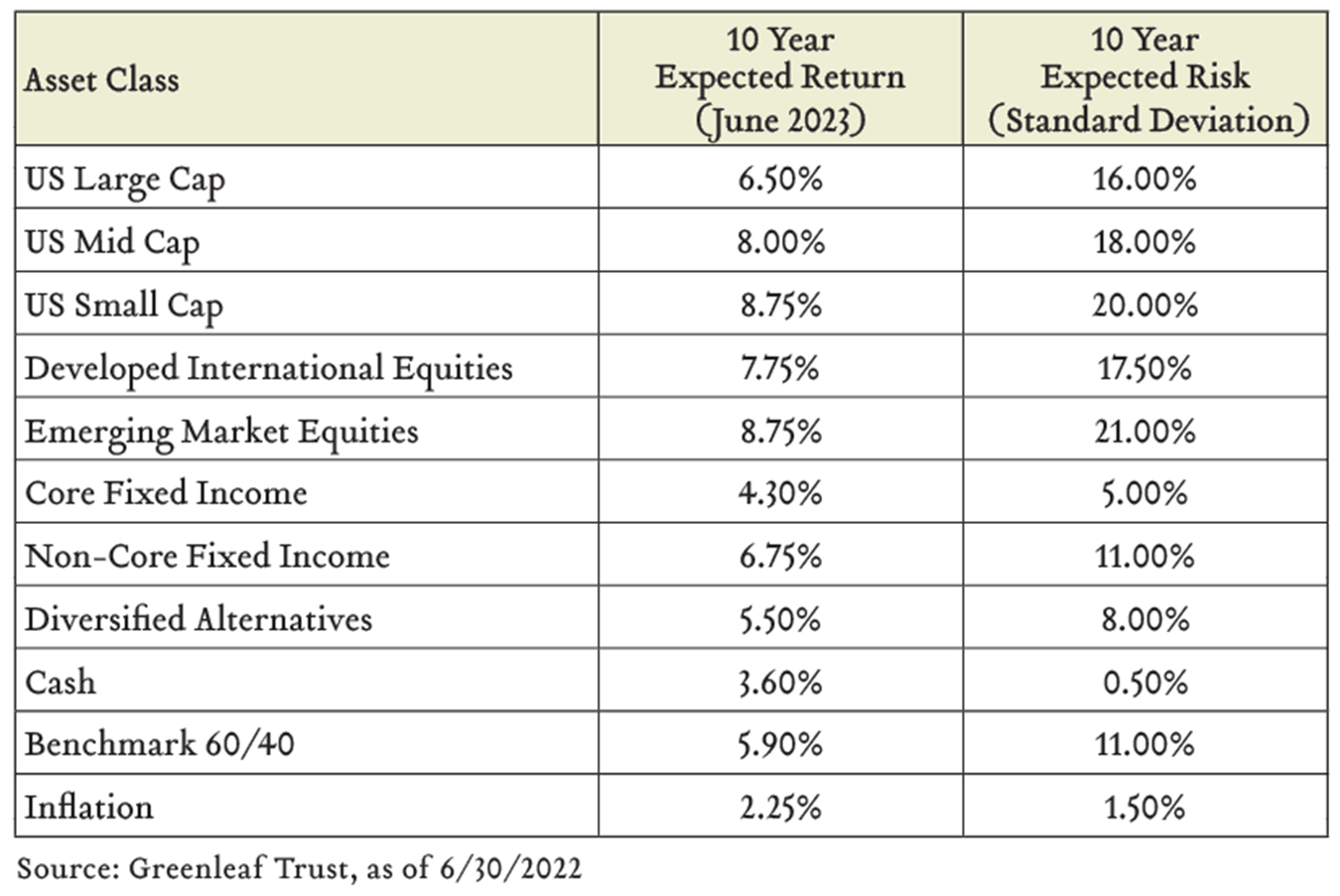

Looking Forward – Capital Market Assumptions

As for the market experience going forward, we share our updated capital market assumptions below. These forecasts represent our expectations for average annualized returns for each asset class over the next ten years. Over the next decade, there will be years where returns exceed our expectations and years where returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

We continue to recommend most of our clients hold a full weight to global equities in accordance with their individualized risk profile and we remain marginally more constructive on international equities. Concurrently, in this relatively uncertain environment, we are utilizing diversifying strategies (alternative assets) that can access return drivers uncorrelated with traditional stock and bond markets.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. On behalf of the entire team, thank you for allowing us to serve on your behalf and good luck in the second half of the year.