November 15, 2024

October Retail Sales - Strong Print Ahead of Holiday Season

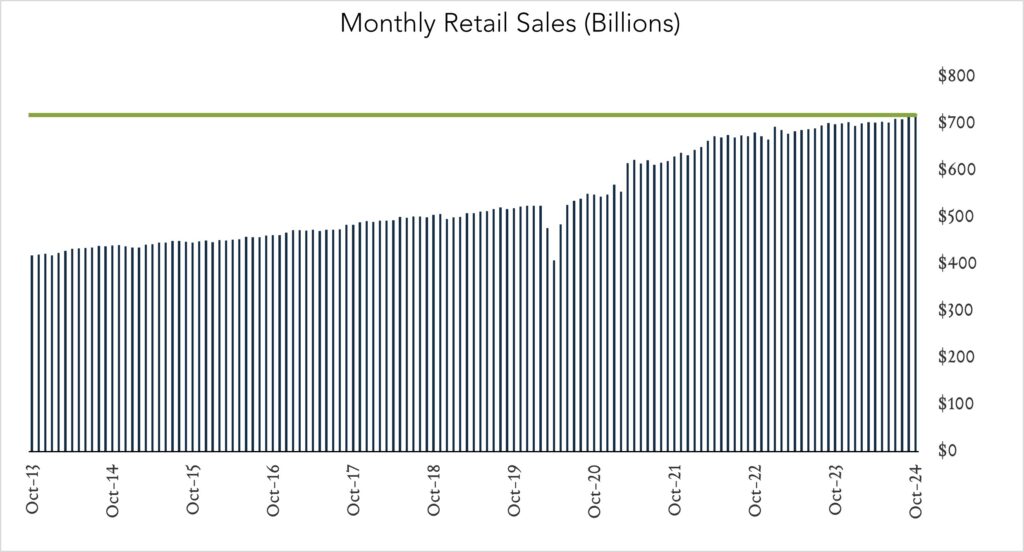

U.S. retail sales rose more than expected in October and September figures were revised higher suggesting consumers are entering the start of holiday season with strong momentum. Retail spending, unadjusted for inflation, rose 0.4% topping expectations for 0.3%. September growth was upwardly revised to +0.8% from +0.4% originally reported. Today’s report indicates yet-resilient household demand even as hiring and wage growth have shown some signs of moderating. As it stands, investors are pricing near-even odds on whether Fed policymakers will pause or cut another 0.25% in December.

- Real (inflation adjusted) retail sales advanced 0.2% year-over-year. In October, retail sales grew 2.8% nominally netting growth of 0.2% after adjusting for 2.6% inflation. Higher spending at online retailers (+7.0%) and restaurants (+4.3%) was partially offset by lower spending at gas stations (-7.1%). Eight of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales expanded 0.2% month-over-month. In October, nominal retail sales levels increased 0.4% compared to September (consensus +0.3%) netting 0.2% growth after adjusting for 0.2% inflation. Higher spending on motor vehicles (+1.6%) and restaurant dining (+0.7%) contributed to strength. Five of thirteen categories increased in real terms.