November 13, 2024

October Inflation - In Line Report Supports December Cut

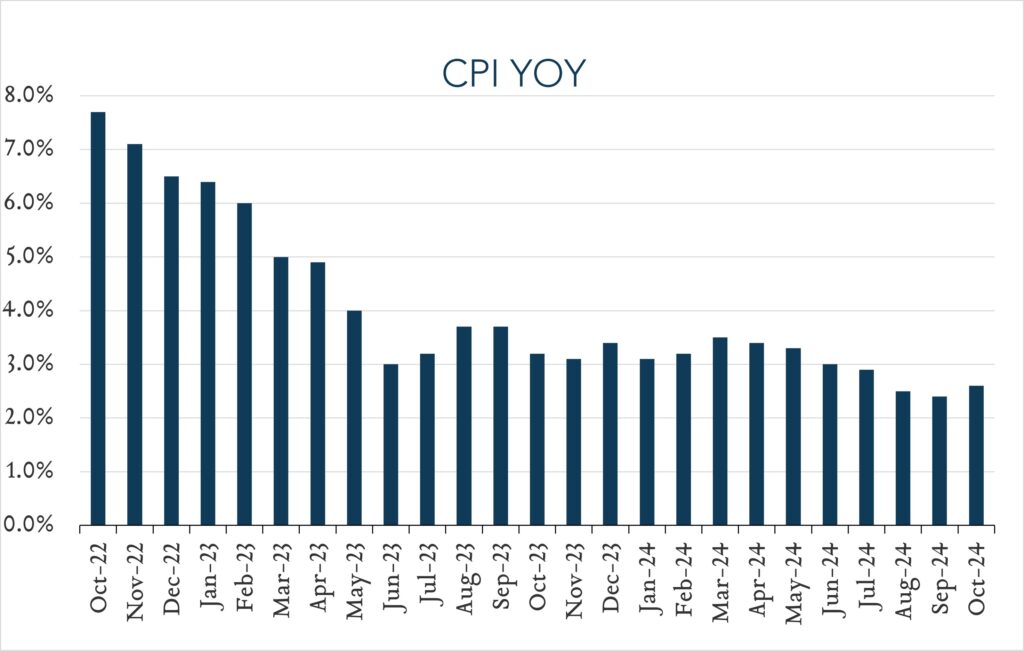

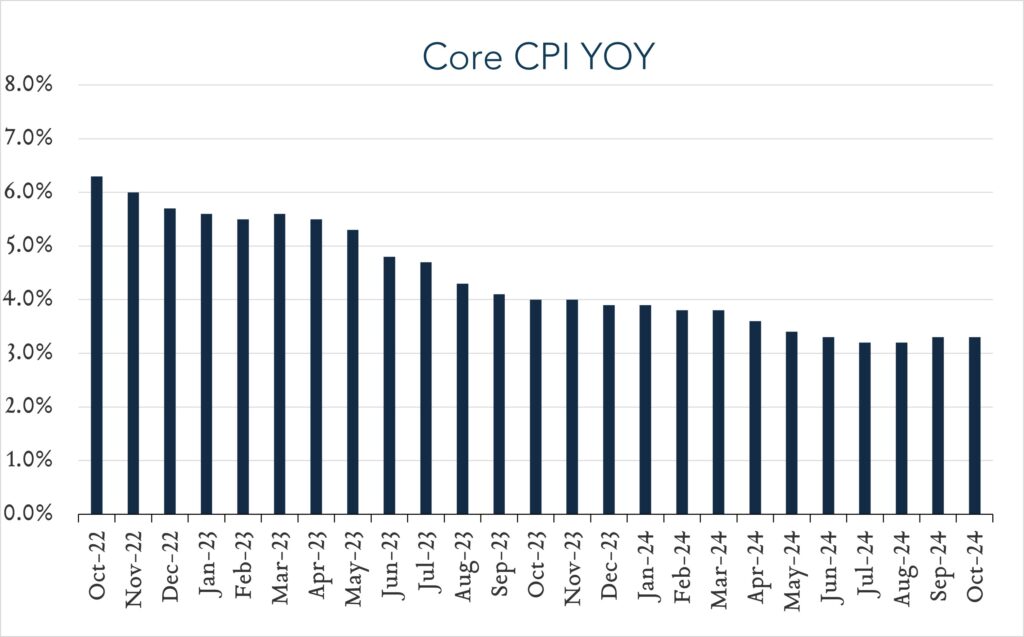

In October, consumer prices as measured by CPI, rose 2.6% compared to a year ago, up from 2.4% in September, but in line with expectations. Core CPI (excludes volatile food and energy prices) rose 3.3%, unchanged from September and in line with expectations. These readings are arguably less useful in the eyes of the market which will price for expected (and actual) policy choices of the new administration. Still, the outcome of the December Fed meeting will depend on the data in hand at the time and policymakers’ evaluation of it. The Fed cut rates 0.50% cut in September and 0.25% in November. Prior to today’s report, investors were pricing in near even odds of a pause or another 0.25% cut in December. However, with inflation steady as she goes, investors increased bets on a 0.25% cut next month.

- Consumer prices (CPI) increased 2.6% year-over-year. In October, the consumer price index (CPI) increased 2.6%, up from 2.4% in September and in line with expectations. Transportation services (+8.2%) and shelter (+4.9%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-3.4%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +4.9% year-over-year, shelter inflation was unchanged month over month, down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.3% year-over-year, unchanged from September and in line with expectations.

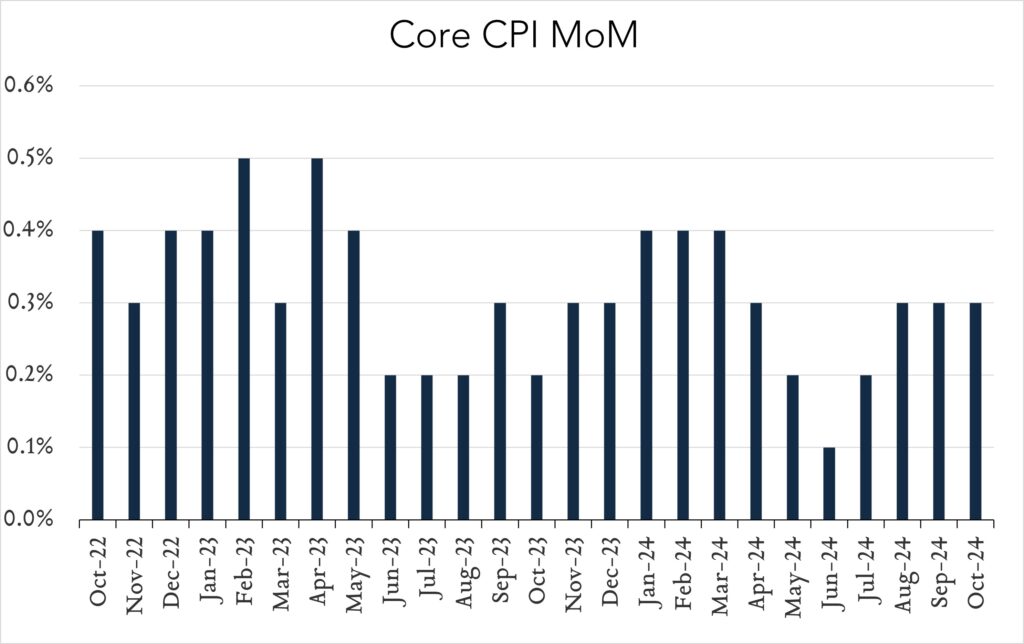

- Consumer prices (CPI) increased 0.2% month-over-month. In October, consumer prices rose 0.2% compared to September. Expectations ranged from +0.1% to +0.3% with a median of +0.2%. Shelter costs increased 0.4% (up from +0.2% in September). Core CPI (excludes food and energy) increased 0.3% month-over-month, unchanged from September and in line with expectations.