August 2, 2024

July Jobs Report Fuels Risk-Off Trade

The July jobs report is fueling a risk-off trade with stocks set to open 1.5-2.5% lower and the 10 year treasury yield falling 10-15 bps.

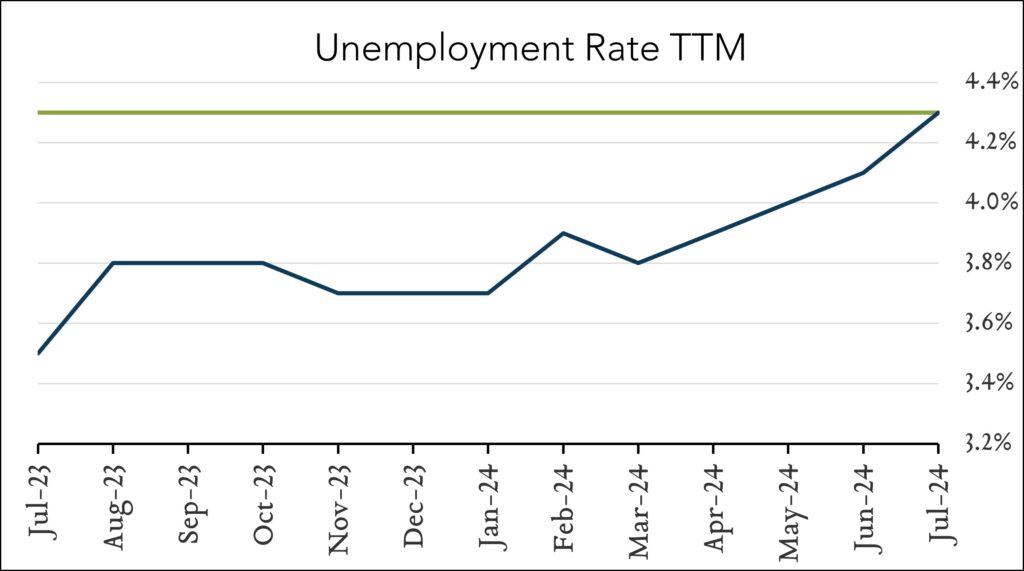

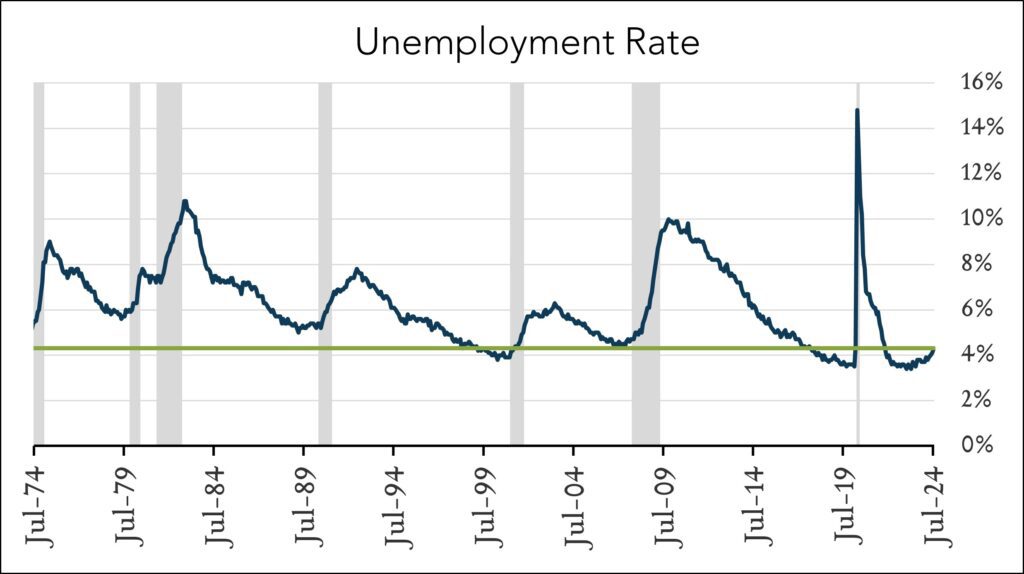

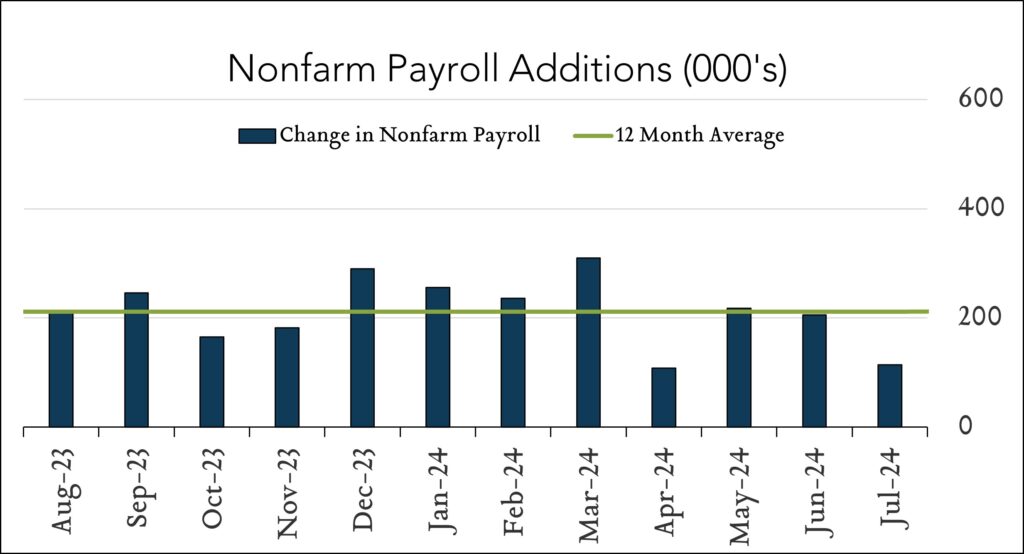

Job gains miss; unemployment rises, traders question if we’re moving from a ‘balanced’ labor market to a ‘weak’ one. Hiring and wage growth continued to decelerate in July and the unemployment rate ticked up to 4.3%. The labor market added 114k jobs in July compared to 179k (revised) in June and 216k (revised) in May. The consensus forecast was for 175k additions. The unemployment rate ticked up by 0.2% to 4.3%. Today’s report calls into question whether slowing in the labor market is accelerating. Initial jobless claims (released yesterday) were 249k, among the highest readings over the past 3 years. The bond market reacted sharply and is now pricing in 4 cuts by December 2024 which would take the Fed Funds rate from 5.25-5.50% currently down to 4.25-4.50% by year-end and would require at least one 50bp cut along the way. Average hourly earnings rose 0.2% month-over-month and 3.6% year-over-year. It should be noted that weather is playing a role in this report as Hurricane Beryl impacted the Houston area. One positive note was that labor force participation increased in the month.

- 114K jobs added in July; June revised lower. The U.S. labor market added 114K jobs in July compared to expectations for +175K. June job gains were revised down by 27K to +179K from +206K originally reported. Hiring was more pronounced in health care (+55K), and construction (+25k).

- 4.3% unemployment – up from 4.1%. The U.S. unemployment rate rose 0.2% to 4.3% in July, marking a third consecutive monthly increase. Forecasts ranged from 4.0% to 4.2% with a median of 4.1%. The labor force participation rate was rose slightly to 62.7% from 62.6% in June. Year-over-year, wage growth decelerated to 3.6% from +3.0% in June. Month-over-month, wages increased 0.2% compared to +0.3% in June.