December 4, 2023

Cost-of-Living Adjustments to Retirement Plans for 2024

The IRS recently announced that many of the key retirement plan limits will increase next year. These limit increases are more modest than the 2023 increases, with some limits remaining the same.

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan will increase to $23,000, up from $22,500. The contribution boost for 2024 is lower than the $2,000 jump that occurred for 2023, but the $500 increase is still significant for the many employees who are falling short of their retirement goals.

The catch-up contribution for those 50 and older will remain at $7,500, adding up to a total allowed annual contribution of $30,500 for qualifying plans.

The super catch-up contribution provision in the SECURE 2.0 Act of 2022 is introducing big changes to catch-up retirement plan contributions in the next few years. As of January 2025, individuals ages 60 through 63 will be permitted to make a special catch-up contribution. This contribution will be limited to the greater of $10,000 or 150% of the standard catch-up contribution for 2024 and will be indexed to inflation.

Starting in 2026, taxpayers who earn over $145,000 in the prior calendar year and want to make catch-up contributions will have to do so with after-tax dollars in a Roth account. Individuals earning $145,000 or less, adjusted for inflation going forward, will be exempt from the Roth requirement. Many employers do not currently offer a Roth 401(k) plan and setting them up can take time. Employers that want to offer this option to their employees should start planning now.

Individual retirement accounts (IRAs) currently have a $1,000 catch-up contribution limit for people aged 50 and over. Starting in 2024, that limit will be indexed to inflation with the other cost-of-living adjustments.

The Social Security Administration (SSA) also announced key numbers that affect workers and retirees for 2024 – an increase in the taxable wage base for workers and to the benefits for retirees. The Social Security Wage Base, which is the maximum amount of earnings subject to Social Security tax, will increase by $8,400 from $160,200 to $168,600 in 2024.

For retirees, the SSA announced a 3.2% increase to monthly Social Security and Supplemental Security Income benefits. This is good news for the 71 million Americans currently receiving benefits. On average, that translates to approximately $50 more per month. The average monthly benefit check for retirees in 2023 was $1,840.27 ($22,083.24 annually) according to the Social Security Administration. Further highlighting the importance of saving for retirement.

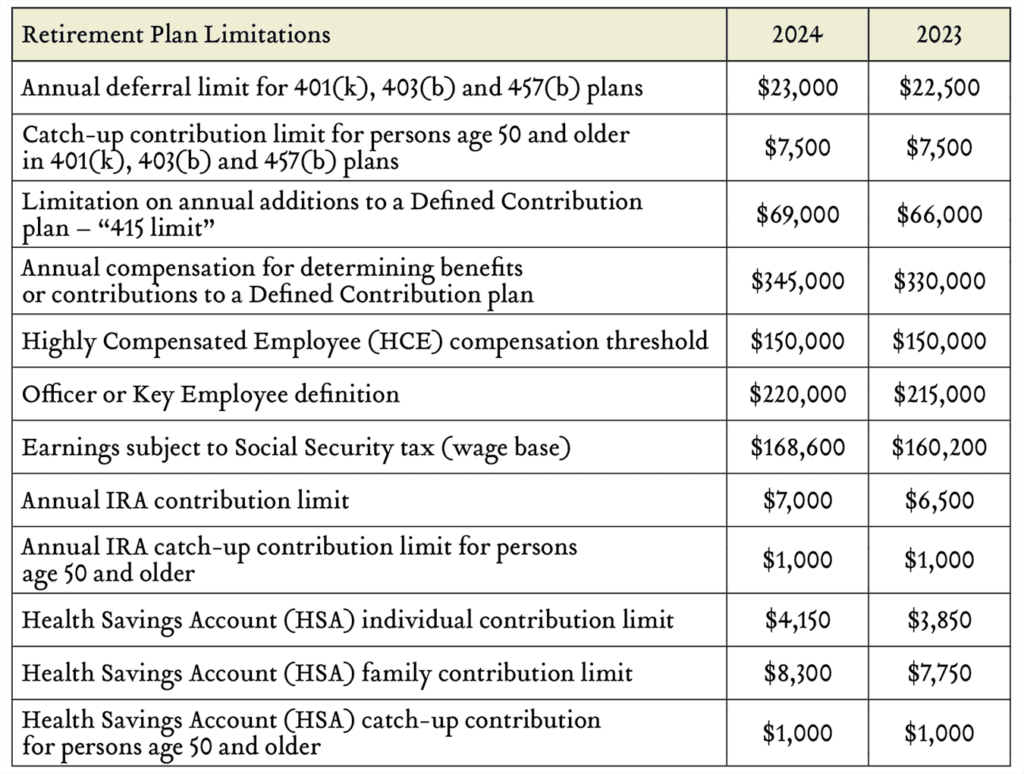

The chart below reflects the key limits, along with other frequently used benefit and compensation items for 2024.

The Saver’s Credit helps lower- and middle-income workers who contribute to a retirement plan by cutting up to $1,000 ($2,000 for married couples) off their tax bill when they file their annual tax returns. It’s a particularly good incentive to get young people started saving early and assist taxpayers with modest incomes to make their money work harder for them. The income limit for the credit for 2024 is $76,500 for married couples filing jointly; $57,375 for head of household; and $38,250 for singles.

The Saver’s Credit as it exists today is also in for some significant changes, particularly with respect to how it’s paid. The SECURE 2.0 Act converts the current tax credit into a government matching program for retirement plan contributions dubbed the “Saver’s Match.” The new Saver’s Match isn’t effective until 2027, so the existing tax credit will be around for a few years yet.

Should you have any questions regarding the various limitations that apply to retirement plans, including some that are not included in the above table, please contact our Greenleaf Trust Retirement Plan Division.