February 11, 2025

Will Social Security Run Out? Balancing Your Three-Legged Stool During Uncertain Times

The Traditional Three-Legged Stool

From its origin, Social Security has been likened to one leg of a three-legged stool. By definition, a three-legged stool, is a system, concept or situation that relies on three equally important components, where if any one of them is missing or weak, the whole thing becomes unstable and cannot function properly.

When we speak of the three “legs” of income in retirement they are pensions, Social Security, and personal savings. Unfortunately, over the years, two of the legs have become unstable. Employer pensions have been largely scaled back as they face challenges with regulatory changes, costs and increased life expectancies. Social Security and the trust fund reserves that support it face serious headwinds.

Understanding the 2035 Timeline

Social Security benefits are vital components to the retirement of millions of Americans. According to the latest annual report of the board of trustees of the Social Security trust funds, the trust funds reserves are currently estimated to become insolvent in 2035. This is one year later than previously projected. The Trustees note that this is because of low unemployment, a strong economy and higher job and wage growth. Before we all start panicking, let me assure you that this does not mean that Social Security payments will be coming to an end. It is estimated that when the fund is depleted, that benefits will not go away, but that only 83% of benefits will be payable. The estimate is that at the current pace, this 83% could drop to 73% of benefits by 2098. While this is a significant cut for those who rely on Social Security as their primary source of retirement income, it does not mean that Social Security will be gone. Yes, it is facing serious obstacles, but there are solutions.

Current State of Social Security

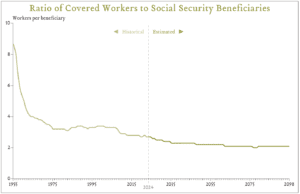

A US population that is living longer combined with a declining birth rate are the main stressors on Social Security. In 1950, the ratio of workers paying into Social Security to those collecting was 8.6:1. Today it is 2.7:1 and is expected to decline to 2.3 :1 by 2036. Social Security is currently funded through the Federal Insurance Contributions Act (FICA) taxes and Self-Employment Contributions Act (SECA) taxes. FICA payroll taxes are what both employers and employees currently pay and is currently 6.2% each (12.4% total). Self-employed individuals pay the total amount for both employers and employees but do receive a special tax deduction that reduces this higher rate. FICA is only taxed on up to $176,100 (for 2025) of a person’s income.

SOURCE: 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Disability Insurance Trust Funds

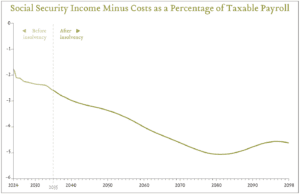

With these changes in demographics Social Security is paying out more than it is taking in, hence the potential shortfall. In 2023, Social Security paid out benefits to over 71 million Americans to the tune of about $1.39 trillion but only received $1.35 trillion in revenue. In 2024, those figures were estimated to be expenses of $1.48 trillion offset by revenue of $1.38 trillion.

SOURCE: 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Disability Insurance Trust Funds

Potential Solutions

With FICA being the primary source of funding for Social Security, one option to help replenish Social Security Trust funds is to increase current FICA rates from the current 12.4%. When FICA originated in 1937, it was 2%. It has slowly increased over the years. In 1950 we saw the first increase to 3%, by 1960 we were at 6%, 1970 it was 8.4% and 1980 at 10.10%. In 1990 it was raised to 12.4% and has not been raised since.

Another solution tied to FICA is to raise the current wage cap that FICA is assessed. The wage cap is updated annually based on the increases in the average wage. In 2023, 6% of workers had income that exceeded this threshold, as compared to 3% of workers at its inception. Overall, about 83% of earnings were taxed in 2023 as compared with 92% in 1937. Currently, any income over $176,100 (for 2025) is not assessed the 12.4% FICA tax. This option would raise or remove the current wage cap.

In addition to changes to FICA, other options that have been vetted are changing the formulas used to determine an individual’s benefits, reducing the cost-of-living adjustments (COLA), and changing retirement ages, or some combination, to name a few.

Action Steps

So what does this mean for you? If you are currently receiving Social Security benefits, it is likely that you will not see any change for the next 10 years. After that, a reduction in benefits may occur unless the systemic issues are addressed.

If you are like me and still working, it is likely that when we do file, we will still receive benefits from Social Security, but they may be less than what we were expecting. It could also mean that depending on what course of action is chosen to remedy the problem, we could face higher taxes, reduced after-tax income, or a delay on when we can file for benefits.

No matter where you are in your Social Security timeline, if you are concerned about how this will affect your current and or future lifestyle, ask your financial advisor to run an analysis and model your retirement with a reduction in Social Security benefits and or reduced after-tax income. What you might find is that, while it is not ideal to face reduced benefits, you are still able to live comfortably. If not, start planning now to address that shortfall and bring balance back to your three-legged stool.