May 6, 2025

U.S. Retirement System: Friend or Foe?

The U.S. retirement system is a complex blend of Social Security benefits, private employer-sponsored benefit plans like 401(k)s and 403(b)s, and individual investment accounts like Individual Retirement Accounts (IRA)s. This complexity often leads to scrutiny and criticism, which begs the question: Is the criticism based on fact or fiction?

The media and academia often present the U.S. retirement system through a lens of misunderstanding regarding both its historical context and its current state. These misperceptions can lead to a skewed evaluation of the system. Furthermore, financial issues tend to be emotionally charged, which can complicate objective analysis even more.

The golden age of pensions

Many people believe there was a “golden age” of pensions in the past. Pension plans, also known as defined-benefit (DB) plans, are often viewed through the lens of the benefits they can provide rather than the actual benefits received. There is a common perception that once upon a time everyone had a pension and that a flaw of defined contribution (DC) plans, like 401(k)s, is that they are not widely available to everyone. According to various sources, about 38% of private sector workers had access to a pension plan in 1979, compared to approximately 72% of workers today who are reported to have access to defined contribution plans, like 401(k)s.

It is also important to understand the accrual formulas when evaluating the value of pension benefits. A common myth is that everyone receives full pension benefits, when it fact, the formula is based off factors such as years of service and average pay. Prior to the mid-1980s, 10-year cliff vesting schedules were common for DB plans, meaning if you worked for an employer for less than 10 years you would be entitled to receive $0 in benefits.

In conclusion, it is important to consider the facts about the replacement of pension plans being a reason retiree’s outcomes are considered by some less favorable today. One should ask themselves, is today’s outcome from my 401(k) indeed less favorable?

The good ole’ days of Social Security benefits are over

Social security has been a consistent source of income replacement in retirement since its inception into law by Franklin Roosevelt in 1935. The Social Security Act was born out of response to the needs of the aged brought about by the cataclysmic events of the Great Depression but was never intended to be a complete income replacement for older Americans retiring from the workforce. When signing the Social Security Bill into law, President Roosevelt noted that “This law, too, represents a cornerstone in a structure which is being built but is by no means complete.”

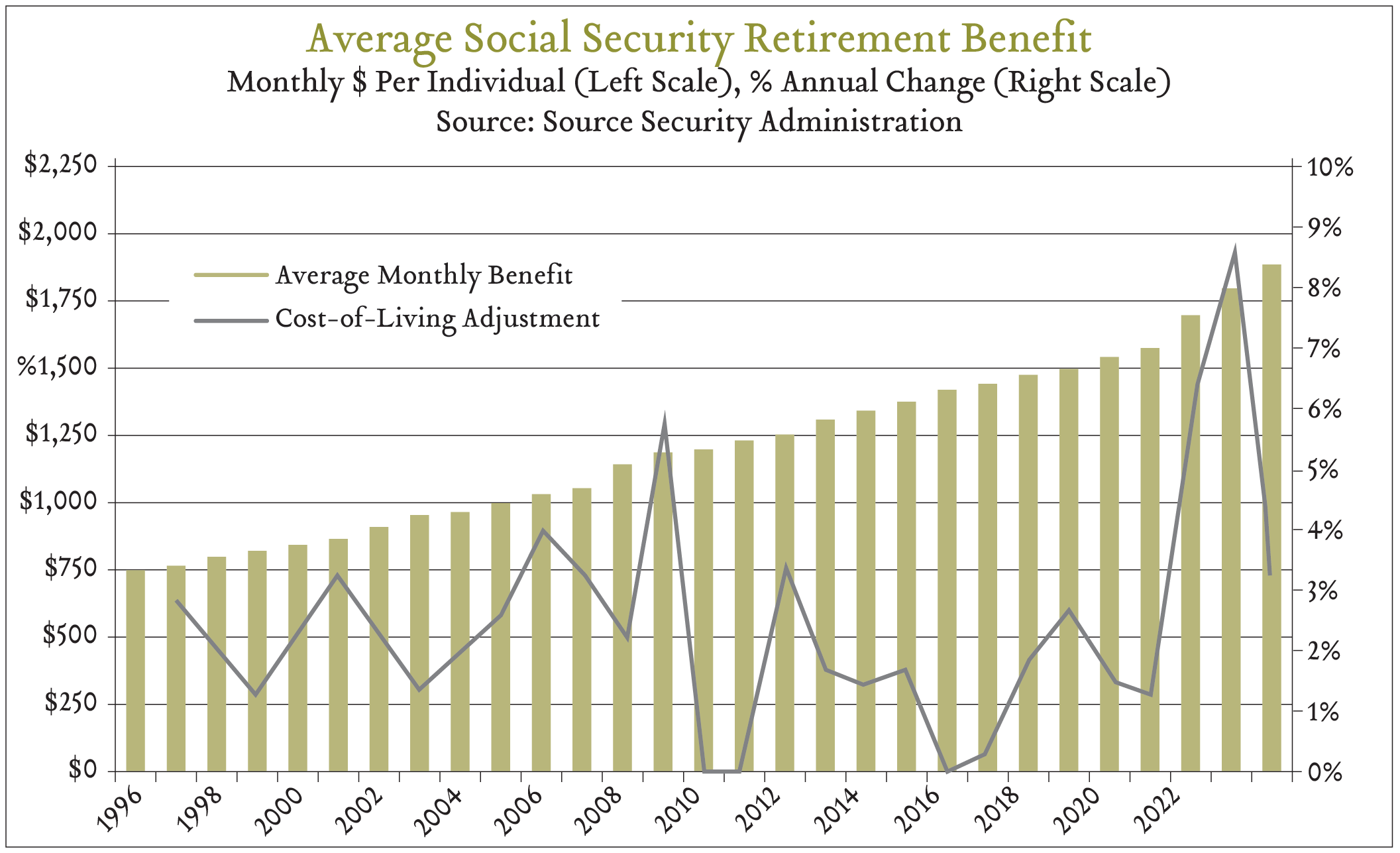

Following the conclusion of World War II, the number of Americans receiving benefits grew significantly from 222,000 at the end of 1940 to over three million in 1949. However, average monthly benefits grew only slightly during that time, and less than the rate of inflation. In 1972, Congress approved legislation that established automatic cost-of-living adjustments (COLAs) in benefits based on price increases as measured by the Consumer Price Index.

The Social Security benefit system has continued to be evaluated and subject to many amendments since it began. The amendments have consistently expanded the program to be more inclusive, keep up with changing economic factors such as cost of goods, and changes to retiree demographics and life expectancy. A common misconception is that Americans must work significantly longer now than they did when Social Security began and that benefit payments haven’t adjusted over time when in fact, even back in 1940 the average benefit claiming age was 68 and the benefit amount now is adjusted for cost-of-living today.

According to the Social Security Administration, about 51.8 million retired workers receive benefits today averaging $2,000/month, representing 40-45% of income replacement. Many would argue that those who are in a lower income range pre-retirement are well served by the Social Security benefit structure, as the benefit was intended to do. For those who desire to maintain a higher income level in retirement, employer benefit plans or individual retirement accounts are designed to be easily accessible to allow for individuals to do that.

Taking advantage of defined-contribution plans and IRAs

Defined contribution plans, like 401(k)s, 403(b)s and 457(b)s are a great way for employers to attract and retain a motivated, productive workforce. Partnering with the right fiduciary can alleviate the administrative burden of these plans. These plans are typically designed to be easily set up, administered, and maintained with the outcome being less turnover and higher employee satisfaction. While this is an advantage to employers, there are also many significant advantages for employees such as:

- Convenient contributions through payroll deferrals. Adjustments are typically allowed at any time, making the benefit very flexible.

- Contribution limits are much higher than individual retirement accounts and Roth contributions are not subject to income limits, like a Roth IRA.

- Employers often make matching or profit-sharing contributions to employee’s accounts to help them save for retirement.

- Contributions can be made tax-deferred, avoiding income taxes now until retirement when income need is lower.

- Investment options in employer benefit plans are well-researched and highly regulated options, making them a good choice for investors.

- Defined contribution plans are sheltered from creditors so even if an individual is experiencing financial strife their 401(k) balance is a secure place to maintain funds for the future.

In addition to employer benefit plans, individual retirement accounts are widely available in today’s marketplace. Individuals can contribute to a Traditional or Roth IRA if they don’t have an employer benefit or in addition to their employer’s retirement plan. While it is important to consider aspects like investment options and IRA fees, these accounts are a great choice for those seeking to invest and compound their money outside of a DC plan.

So, next time you read a headline about the “retirement crisis” in America today, you might consider whether there really is a retirement crisis compared to the past and whether you are reading factoids or facts.