November 10, 2023

Temporary Landing Money Market Mutual Funds

As advisors, we continuously seek to understand the willingness and ability of each individual client’s tolerance for investment risk. As we navigate through the four phases of financial management — accumulation, distribution, preservation, and legacy — alongside our clients, the willingness to accept risk often shifts. Feelings toward risk are often triggered by life events such as work or family changes. Alternatively, acceptability of risk is often tilted as a result of market conditions, news headlines or as simple as a friend’s opinion. No matter the driver, it remains a priority to understand the drawbacks and benefits of risk, and the correlating asset classes within a portfolio, at any given time and setting expectations for such. During each market cycle, and cycles within cycles, our team strives to find the optimal alignment between each client’s goals, willingness and ability to accept risk, and ultimately an appropriate asset allocation. For those risk-averse investors, business owners with accumulating cash reserves, individuals with a mid- or short-term time horizon, or simply liquidity which needs a temporary landing, market conditions have presented an attractive opportunity via a money market mutual fund.

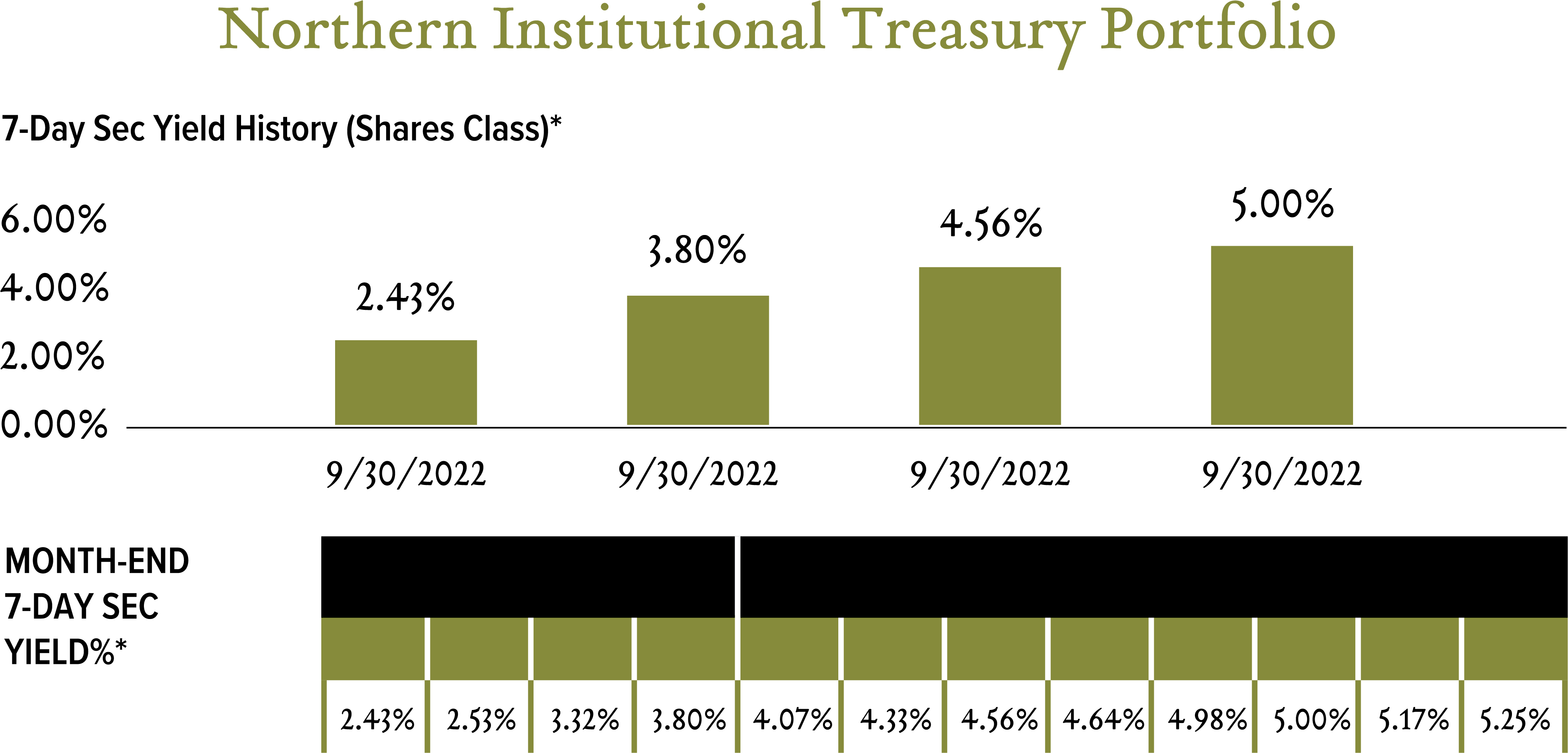

Money market mutual funds are a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. The exposure to this asset class serves as an important component to all Greenleaf Trust portfolios, which now carries a significant yield of 5.25% via our Treasury-backed vehicle, Northern Institutional Treasury Portfolio (NITXX).

A dramatic push, largely due to higher rates, into money market funds has led to an all-time high balance of $5.4 trillion. One recent cause for the acceleration and shift of money market flows was the Silicon Valley Bank failure, leading to broader investor concerns across the regional banking landscape. Additionally, the Federal Reserve’s policy actions and rapid push of increasing short-term interest rates in an effort to combat inflation have largely driven money market yields higher. As money market securities are considered to have the lowest default risk, yields will consistently remain more attractive than interest rates on your standard bank savings account. Risky assets typically move in the opposite direction when money market yields are strong, such as dollars flowing out of risky assets for many of the reasons alluded to earlier and into money market instruments like Treasury bills, certificates of deposit, and commercial paper. This shift reduces demand for those volatile assets, which results in downward pressure on prices. High money market yields provide investors with a modestly safe alternative for dollars that would otherwise be unused on the sidelines. Part of the Fed’s job to combat a rising inflation environment is to incentivize investors to migrate their funds out of some of the most sensitive, or volatile, assets. A shift of wealth is vital to a transition back to 2% inflation…someday.

It is obvious more investors are seeking attractive yields with very little risk when nerves are high, goals are near, or cash simply needs a temporary landing with little risk, high liquidity and a steady return. Exiting the stock market entirely is rarely ever the right answer. An investor’s vision must remain focused on long-term goals as opportunities within risky asset classes remain present and long-term investing is important to financial success. But investors, and advisors alike, can now become more selective based on individual circumstances. It has been almost two decades since the market presented an opportunity to earn an attractive yield on a very low-risk investment like a money market mutual fund.

Our team continues to lead with conversations surrounding client goals and comfort with risk, to ensure alignment. When unique circumstances arise, however, a temporary landing within a money market mutual fund may just be the answer, as cash remains king.