August 9, 2021

State Fiduciary Income Tax Savings – Delaware Trusts

A fundamental goal in creating an irrevocable trust is to minimize the effect of taxes on trust assets. Besides shielding trust assets from estate, gift and/or generation-skipping taxes, creating an irrevocable trust can also shelter it from state income taxes. Establishing an irrevocable trust in Delaware allows trust assets to potentially grow free of state income tax coupled with greater growth potential of trust assets over time. Favorable income tax treatments make creating or moving a trust to Delaware attractive for many.

Delaware tax law allows a deduction for income accumulated for non-resident beneficiaries. Delaware does not impose state income tax on income and capital gains earned by an irrevocable trust when beneficiaries are non-Delaware residents. If there are both Delaware and non-Delaware resident beneficiaries, the amount of Delaware fiduciary income tax assessed will be reduced proportionately. However, it’s vital to note that beneficiaries who receive trust distributions may still be subject to state income taxation based on their state of residency.

Who can benefit from creating a Delaware Irrevocable Trust? Fundamentally a Michigan resident who desires to create an irrevocable trust while living or at death for non-resident Michigan beneficiaries. A simple example would be:

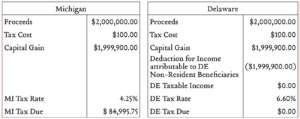

Jon Martin is a Michigan resident who is looking to create an Irrevocable Trust for his grandchildren, Jack and Jill, who reside in Pennsylvania. Jon will fund the trust with highly appreciated stock, 100 shares of Pear Inc., with a tax cost of $100 and a fair market value of $2,000,000. If Jon were to appoint Greenleaf Trust Delaware as the corporate Trustee, the initial tax savings when the assets of the Trust are fully diversified would be roughly $85,000. The trust assets will continue to grow free from state income tax.

Key Aspects of Current State Income Tax Savings

The Trust is irrevocable and taxed as a non-grantor trust for income tax purposes.

MICHIGAN

4.25% tax on taxable income

Tax is imposed on accumulated income of a Trust IF the trust is created under the Will of a Michigan resident or the settlor of the Trust was a Michigan resident at the time the trust become irrevocable, when ANY of the following conditions are met:

The Trustees are not Michigan residents

The assets of the Trust are neither held, located nor administered in Michigan

All beneficiaries of the Trust are nonresidents

DELAWARE

6.60% tax on taxable income over $60,000

Delaware tax law provides a deduction for income accumulated for non-resident beneficiaries IF the trust is a Delaware resident Trust. The trust become irrevocable when ANY of the following conditions are met during more than one-half of any taxable year:

The trust has only one trustee who or which is (i) a resident individual of DE (ii) a corporation, partnership, or other organization having an office to conduct trust business in DE

The trust has more than one trustee, and at least one of the trustees is a corporation, partnership, or other organization having an office to conduct trust business in DE

The trust has more than one trustee, all of whom are individuals and one-half or more of whom are resident individuals of DE

The state of Delaware has a proven track record as a trust-friendly jurisdiction with substantial tax benefits for nonresidents. When it comes to state tax savings Delaware is an excellent option. Creating or moving an irrevocable trust to Delaware is possible by way of Greenleaf Trust Delaware.