November 20, 2025

September Jobs - Delayed Release Tops Expectations

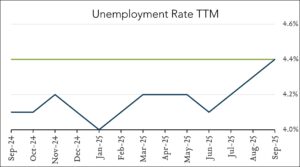

Stronger than expected pre-shutdown report. U.S. job growth picked up in September and the unemployment rate rose on increased participation suggesting the labor market showed signs of stabilizing before the government shutdown. Nonfarm payrolls increased 119K in September (vs. consensus of +51K) and the jobless rate rose to 4.4% from 4.3% a month earlier. Today’s report was originally scheduled for release on October 3 and was the first major economic data point missed due to the government shutdown. While a full October jobs report will not be produced, a portion of the data will be released with the November numbers on December 16. This means that Fed policymakers will not have the benefit of additional labor market reporting before announcing their next rate decision on December 10. Markets are pricing in a 35% likelihood that officials will implement a third 0.25% cut next month.

- 119k jobs added in September – well above forecast. The U.S. labor market added 119k jobs in September more than doubling expectations for +51K. Still, year-to-date results remain well below expectations entering the year. Job gains have averaged 76K per month in 2025 compared to expectations for +121K per month when the year began and compared to average monthly gains of +167K in 2024. Job gains trended higher in health care (+43K) and hospitality (+37K) while Federal government employment declined by 3K and is down 97K since January. Employment showed little change in other major industries.

- 4.4% unemployment – up 0.1% month over month. The U.S. unemployment rate rose 0.1% to 4.4% in September compared to expectations for 4.3%. The increase was largely due to rising labor force participation. While still historically low, the unemployment has risen for three straight months to the highest level since October 2021. The labor force participation rate rose slightly to 62.4% from 62.3% in August. Wage growth accelerated slightly to 3.8% year-over-year (vs. 3.7% in August and 3.7% forecast) but decelerated to 0.2% month-over-month (from +0.4% month-over-month in August).