October 12, 2023

September Inflation - Another Brisk Month

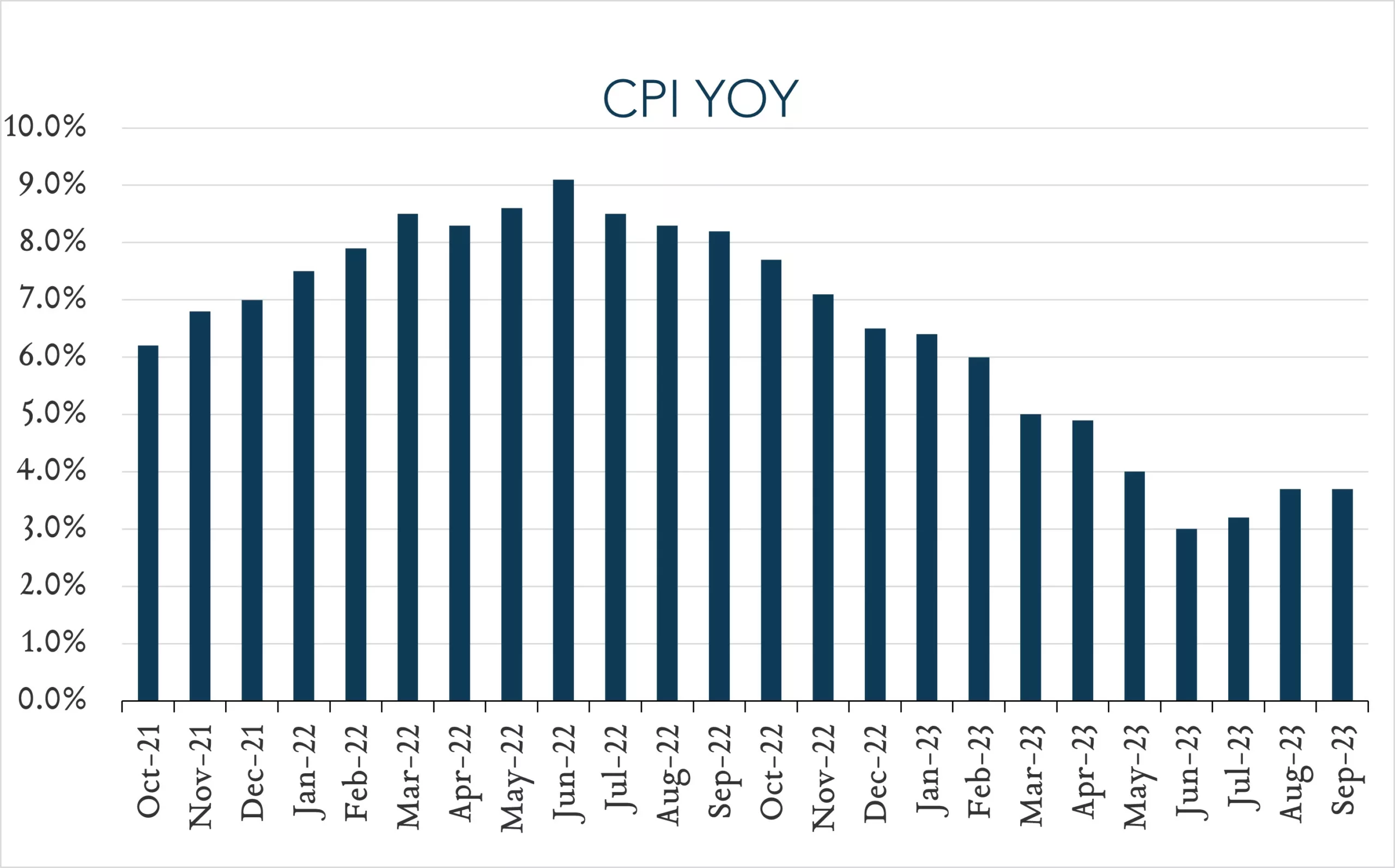

Underlying inflation came in at a brisk 3.7% (year-over-year) pace for a second straight month in September underscoring how a resilient labor market continues to support consumer demand which threatens to keep inflation levels above the Fed’s 2% target. It remains unseen whether today’s print will influence policymakers to implement an additional rate increase this year, but it definitely supports the “higher for longer” narrative.

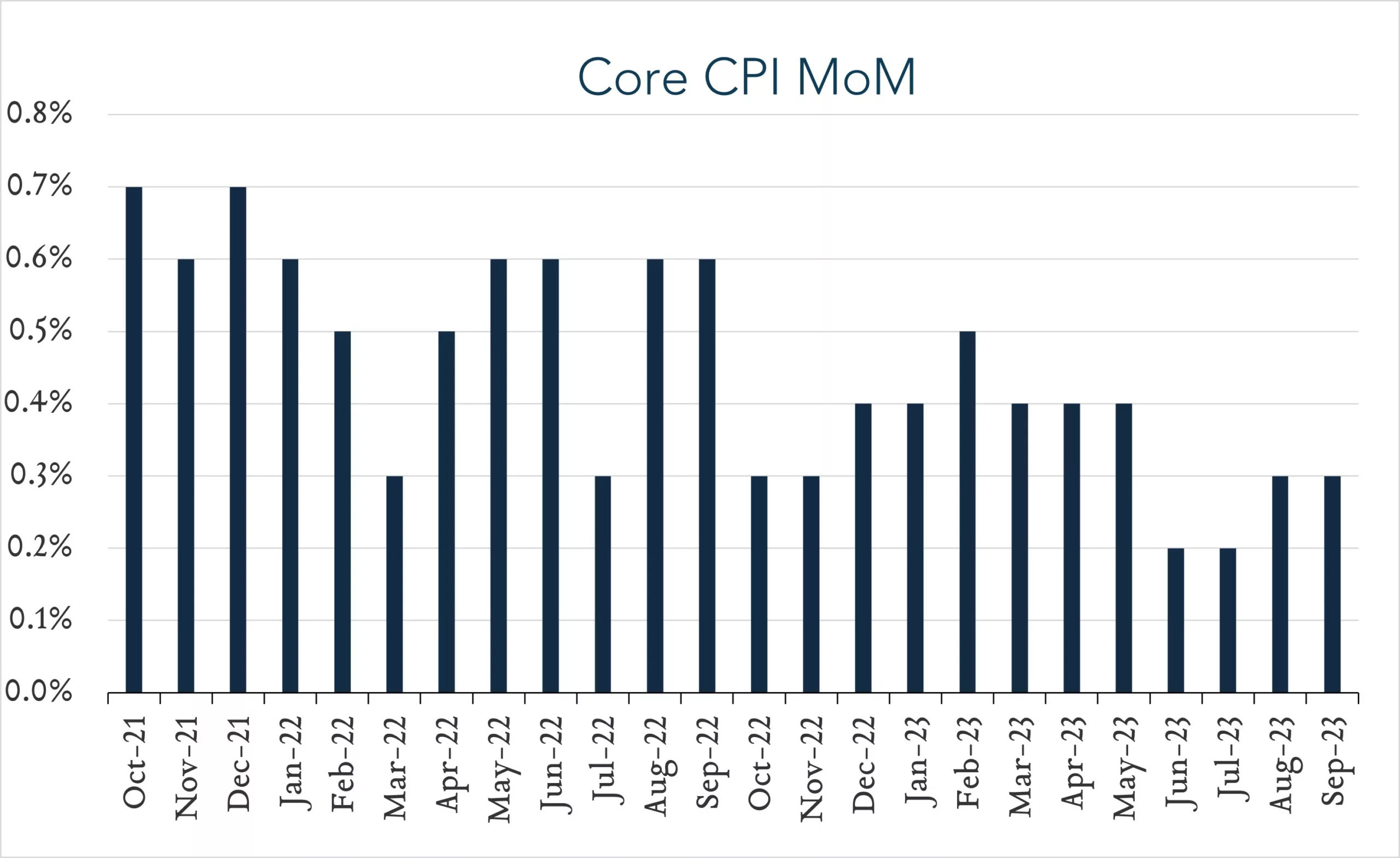

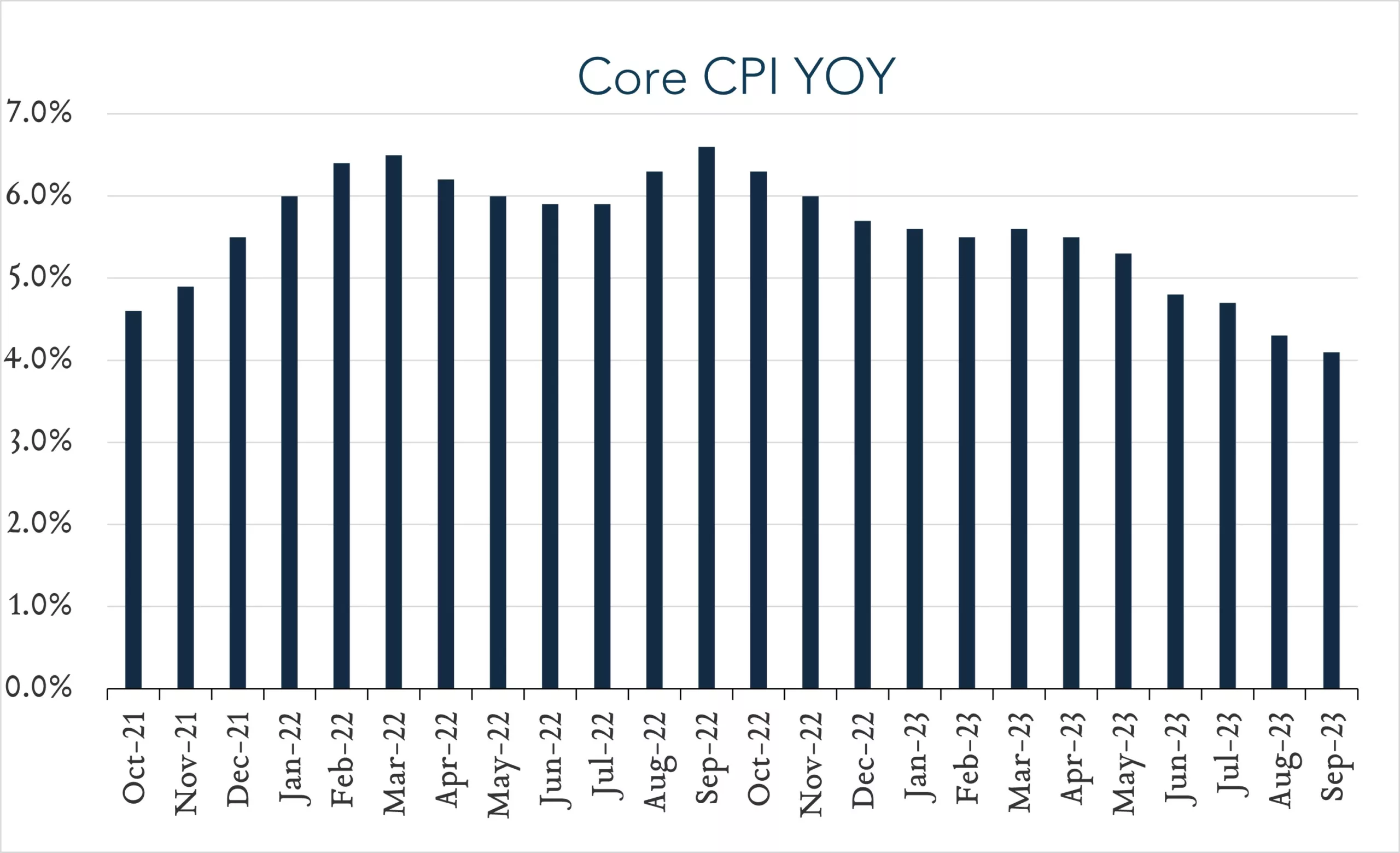

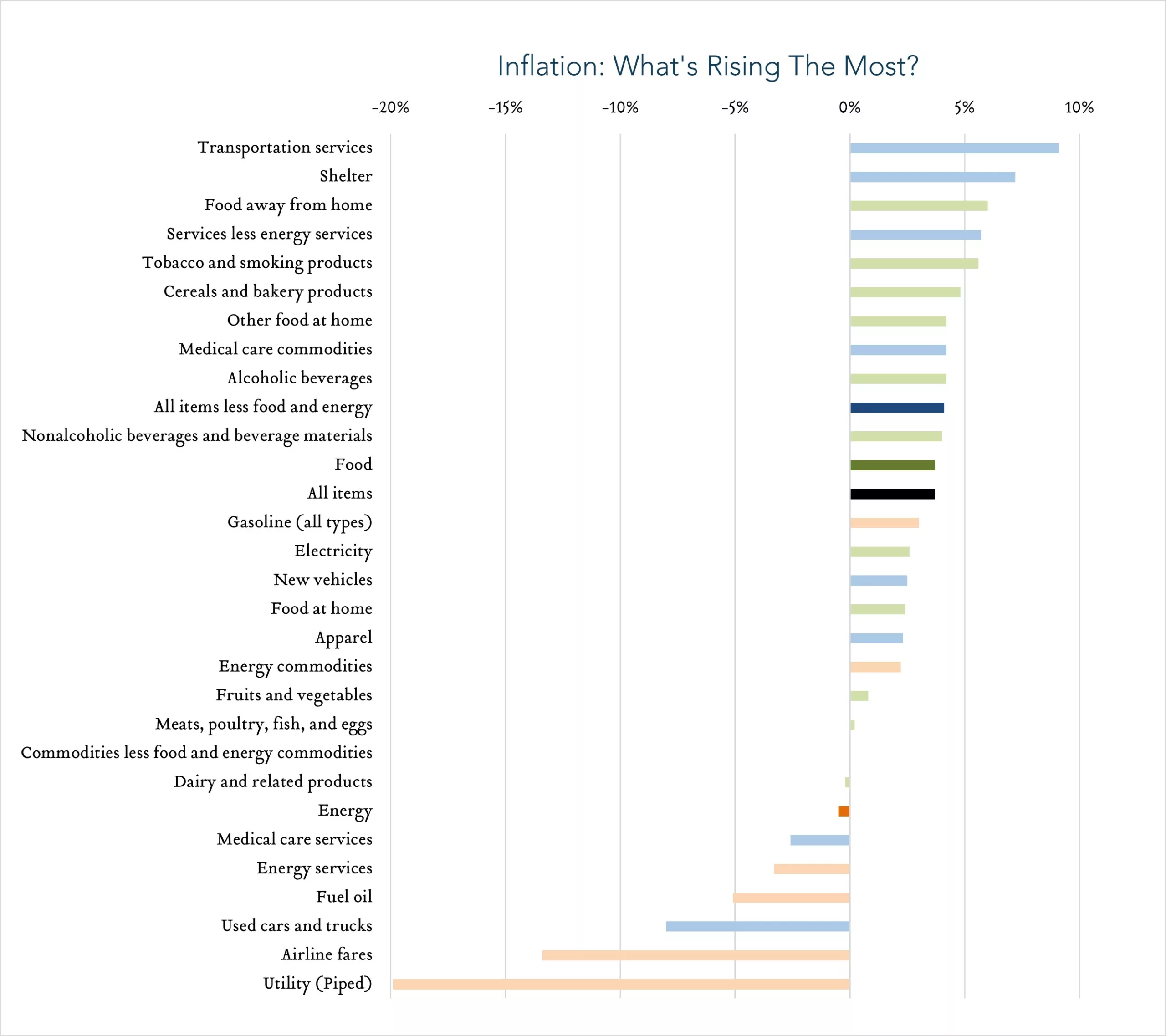

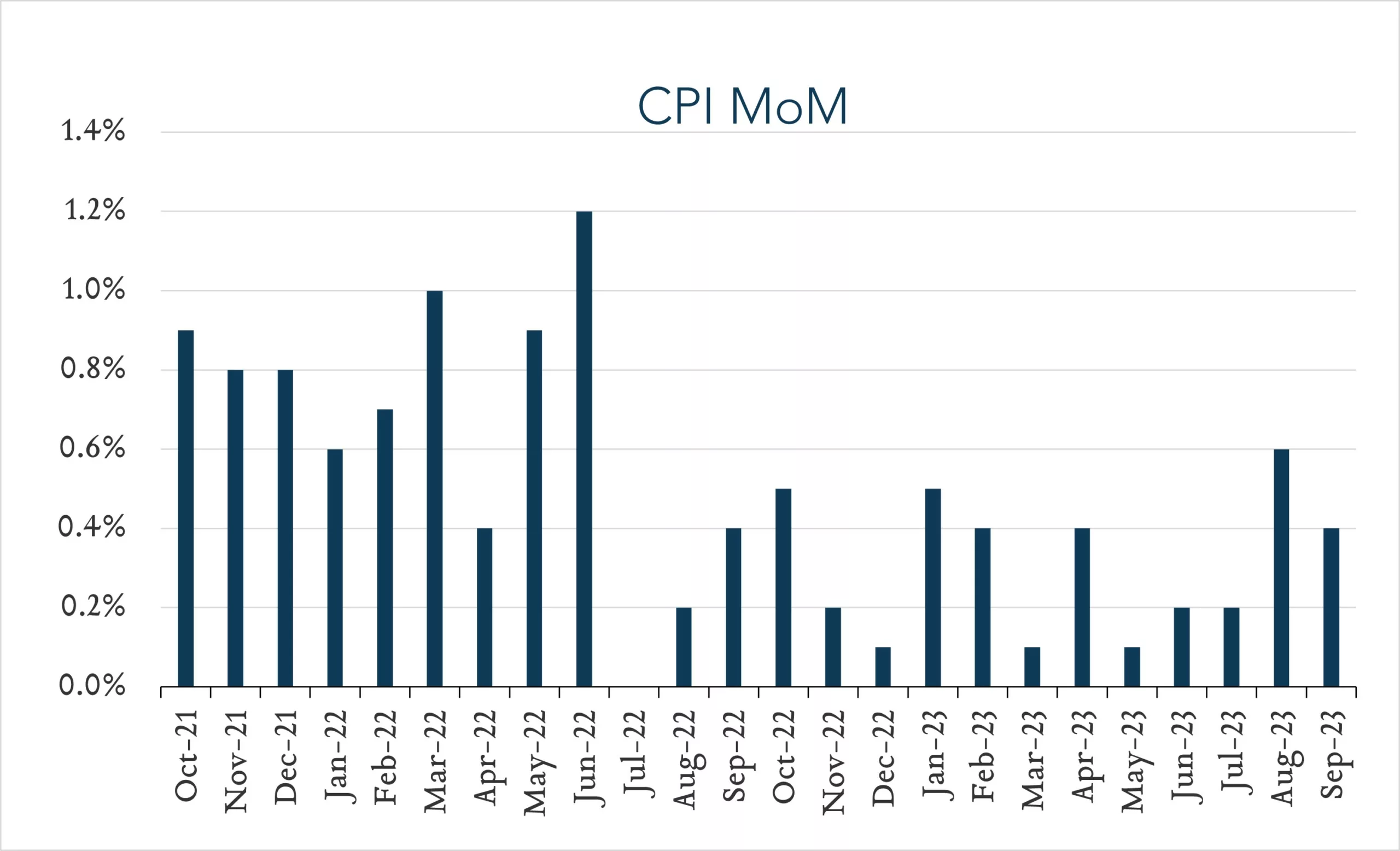

- Consumer prices (CPI) increased 3.7% year-over-year. In September, the consumer price index (CPI) increased 3.7%, unchanged from August, but above expectations of 3.6%. Transportation services (+9.1%) and shelter costs (+7.2%) were key contributors to the overall increase, more than offsetting declines in used vehicles (-8.0%), medical care services (-2.6%) and energy (-0.5%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +7.2% year-over-year, shelter costs decelerated slightly from +7.3% in August and a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 4.1% year-over-year, down from 4.3% in August and in line with expectations.

- Consumer prices (CPI) increased 0.4% month-over-month. In September, consumer prices rose 0.4% compared to August. Expectations ranged from -0.2% to +0.6% with a median of +0.3%. Prices for used cars and trucks declined 2.5% while shelter costs, which represent nearly one-third of the index, increased 0.6% for the month. Core CPI (excludes food and energy) increased 0.3% month-over-month, unchanged from August and in line with expectations.