October 24, 2025

September CPI - Delayed Report Shows Lighter-Than-Expected Increase

Note: This morning, the Bureau of Labor Statistics (BLS) released the September CPI report on a delayed basis. The report was originally scheduled to come out on October 15 but was delayed because of the ongoing federal government shutdown. While most BLS operations have ceased since the October 1 closure, the agency recalled staff to prepare this release so the Social Security Administration could tally its annual cost-of-living adjustment.

In September, consumer prices as measured by CPI, rose 3.0% compared to a year ago, up from +2.9% in August but below expectations for +3.1%. Core CPI (“underlying inflation”; excludes volatile food and energy prices) also rose 3.0%, down from +3.1% in August and below +3.1% forecast. Lower-than-expected price increases are a welcome surprise for a subset of Fed policymakers who have voiced concerns about additional rate cuts. While the FOMC is widely expected to implement a 0.25% cut next week – its second this year – today’s report adds support for a third cut in December especially in the absence of other official reports should the shutdown continue. Following the release, investors reaffirmed bets on two additional 0.25% cuts this year.

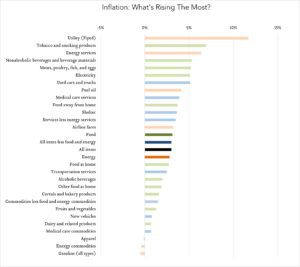

- Consumer prices (CPI) increased 3.0% year-over-year. In September, the consumer price index (CPI) increased 3.0%, up from 2.9% in August but below expectations for +3.1%. The cost of used vehicles (+5.1%), medical care services (+3.9%) and shelter (+3.6%) were key contributors to the overall increase, more than offsetting a decline in gasoline (-0.5%). Core CPI (excludes food and energy) also increased 3.0% year-over-year, down from +3.1% in August and below expectations for the same.

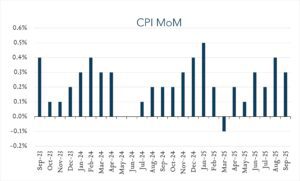

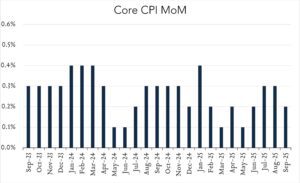

- Consumer prices (CPI) rose 0.3% month-over-month. In September, consumer prices rose 0.3% month-over-month down from +0.4% in August and below expectations for the same. Core CPI (excludes food and energy) increased 0.2% month-over-month, down from +0.3% in August and below expectations for the same.