November 7, 2022

Planning Strategies for a Rising Rate Environment

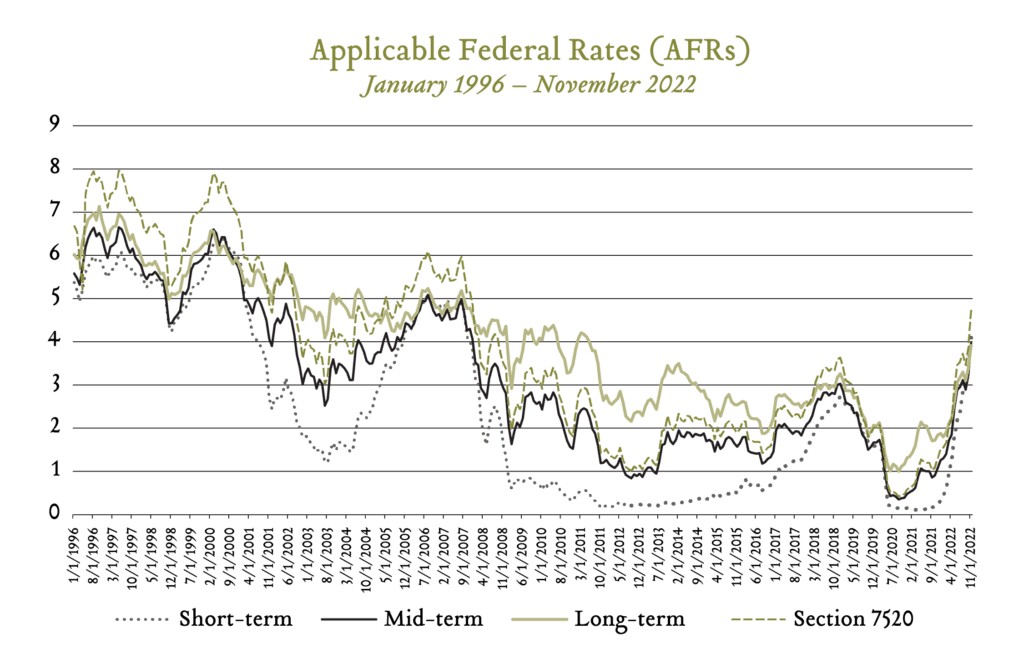

Over the past decade, we have become accustomed to a low interest rate environment which has favored certain estate planning techniques and wealth transfer strategies. A number of these strategies use interest rates which are published monthly by the Internal Revenue Service (IRS); the Applicable Federal Rate (AFR) reflects the minimum interest rate that the IRS allows for private loans in order to avoid triggering potential tax consequences, and the §7520 Interest Rate is 120% of the applicable federal midterm rate (compounded annually), traditionally referred to as the “hurdle rate,” and is used to value long-term or future property interests.

Interest rates fell to historic lows in 2020 and 2021 due to the Federal Reserve reducing short-term rates in response to the economic contraction caused by the COVID-19 pandemic; however, rates have risen significantly in 2022 as the Federal Reserve attempts to fight inflation. From a historical perspective, the November long-term AFR is in line with historical averages calculated from 1996; however, November’s short-term and mid-term AFRs are well above historical averages; 4.1% vs 2.4% and 3.97% vs 3.18%, respectively. Below is a chart which represents the Applicable Federal Rates and §7520 rate since 1996.

In late 2019, Dan Baker published an article in the Perspectives newsletter related to planning in low and high interest rate environments. As Applicable Federal Rates have risen to their highest point in approximately 10 years, this article will revisit a couple of the planning strategies presented for a higher interest rate environment as well as present opportunities that may still exist in a rising interest rate environment.

Estate Planning Strategies for Higher Interest Rates

Certain estate planning strategies are more favorable with higher interest rates as the higher the rate, the more benefit the strategy may provide. Two strategies which provide greater benefit as rates rise are Charitable Remainder Annuity Trusts (CRATs) and Qualified Personal Residence Trusts (QPRTs):

Charitable Remainder Annuity Trust (CRAT)

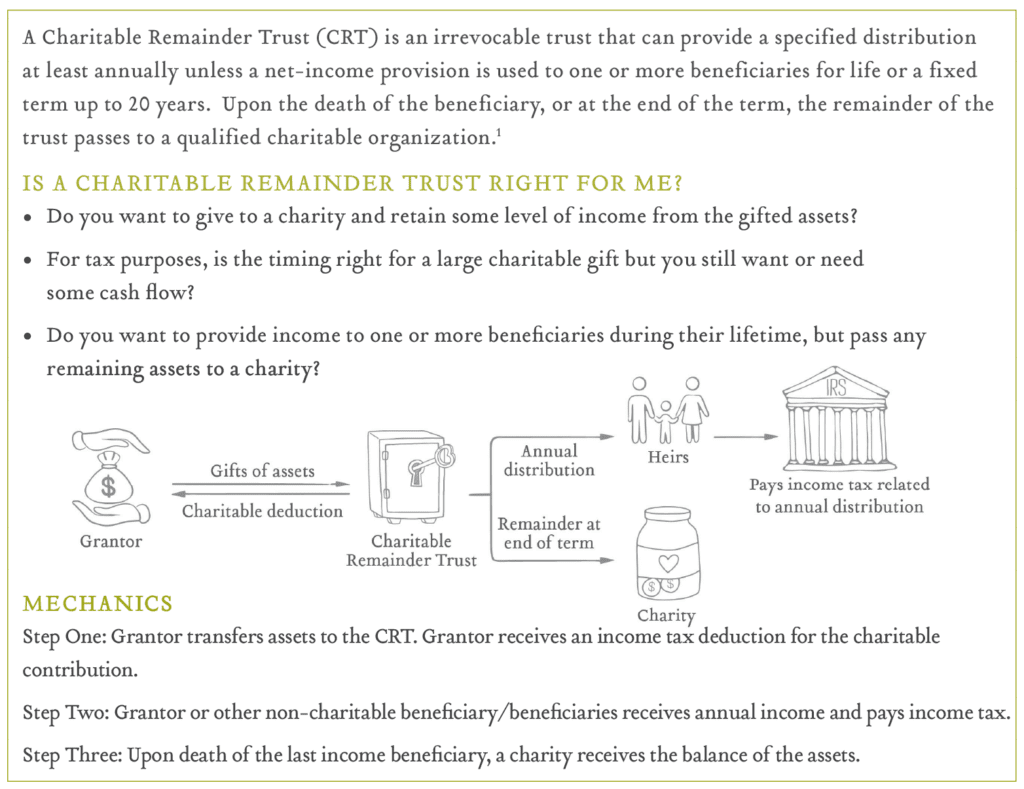

The purpose of a CRAT is to provide income to a current beneficiary during his or her lifetime or for a specified term of years, with the remaining balance as a gift to a tax-exempt charity or charities (as recognized by the IRS). The funding of the CRAT reduces the value of the grantor’s estate while providing income and estate tax benefits to the grantor.

The current individual beneficiary receives a fixed amount (annuity) for a specified term of years or for the beneficiary’s lifetime. The income beneficiary pays income tax on the distributions from the trust, based on a tiered schedule. The annuity must be at least 5% of the initial gift, but less than 50% of the initial gift. The present value of the charitable remainder must be at least 10% of the value of the initial gift and the remainder beneficiary (a charity or charities) receives the remaining value of the trust outright.

The benefits of this strategy in a higher interest rate environment are a larger charitable deduction due to the assumptions for more rapid growth and the potential to fund a CRAT for a younger beneficiary and still meet the remainder interest criteria (10% of the value of the initial gift). Below is a visual representation for establishing a charitable remainder trust.

Qualified Personal Residence Trust (QPRT)

The purpose of a QPRT is to reduce the size of your taxable estate through the transfer of a residence to trust beneficiaries over a set period of time while maintaining the right to live in the residence (rent free over the set period of time and rented at fair market value following the expiration of the term).

The initial transfer of the property to the QPRT is a taxable gift of the remainder interest which is calculated using the §7520 Interest Rate. Assuming the grantor lives past the set period of time, the grantor is able to pay fair market rent to continue living in the property which further reduces the value of their estate. The primary benefit of this strategy in a higher interest rate environment is as the §7520 Interest Rate increases, the amount of the taxable gift decreases.

Estate Planning Strategy for Most Interest Rate Environments

While certain planning strategies are more favorable with higher interest rates, some strategies that are favored in low interest rate environments may work well with higher interest rates as well; however, the benefits may not be as great. These strategies often involve lending and provide a “freeze” to the value of assets which are loaned.

Intra-family Loans

Intra-family loans provide the opportunity to loan funds to family members at the relevant AFR based on the term of the loan. This strategy works best in low interest rate environments as the appreciation of the asset that the loan is used to purchase is able to more easily outperform the interest rate on the loan. However, in high interest rate environments, the loan may also allow the borrower to be able to purchase property at a much lower interest rate than through traditional bank financing. For example, let’s view the total interest paid on a $400,000 30-year fixed mortgage using the November 2022 long-term AFR, 3.92%, and a 30-year fixed rate mortgage, 7.00%. If the borrower were to use traditional bank financing, the total interest paid over the life of the loan would be approximately $558,000 versus the total interest paid over the life of the intra-family loan using the long-term AFR rate, approximately $281,000. The primary benefit of this strategy in a higher interest rate environment is to allow for purchases to be more affordable while freezing the value of the assets for the family member loaning the money.

Summary

Estate planning strategies and wealth transfer opportunities exist in all interest rate environments. We recommend consistently reviewing your goals with your team of advisors in order to design strategies that fit into your overall comprehensive wealth management plan, are tailored to your unique needs and benefit from the current financial landscape.