November 14, 2023

October Inflation - Broad Slowdown, Good Sign for Policymakers

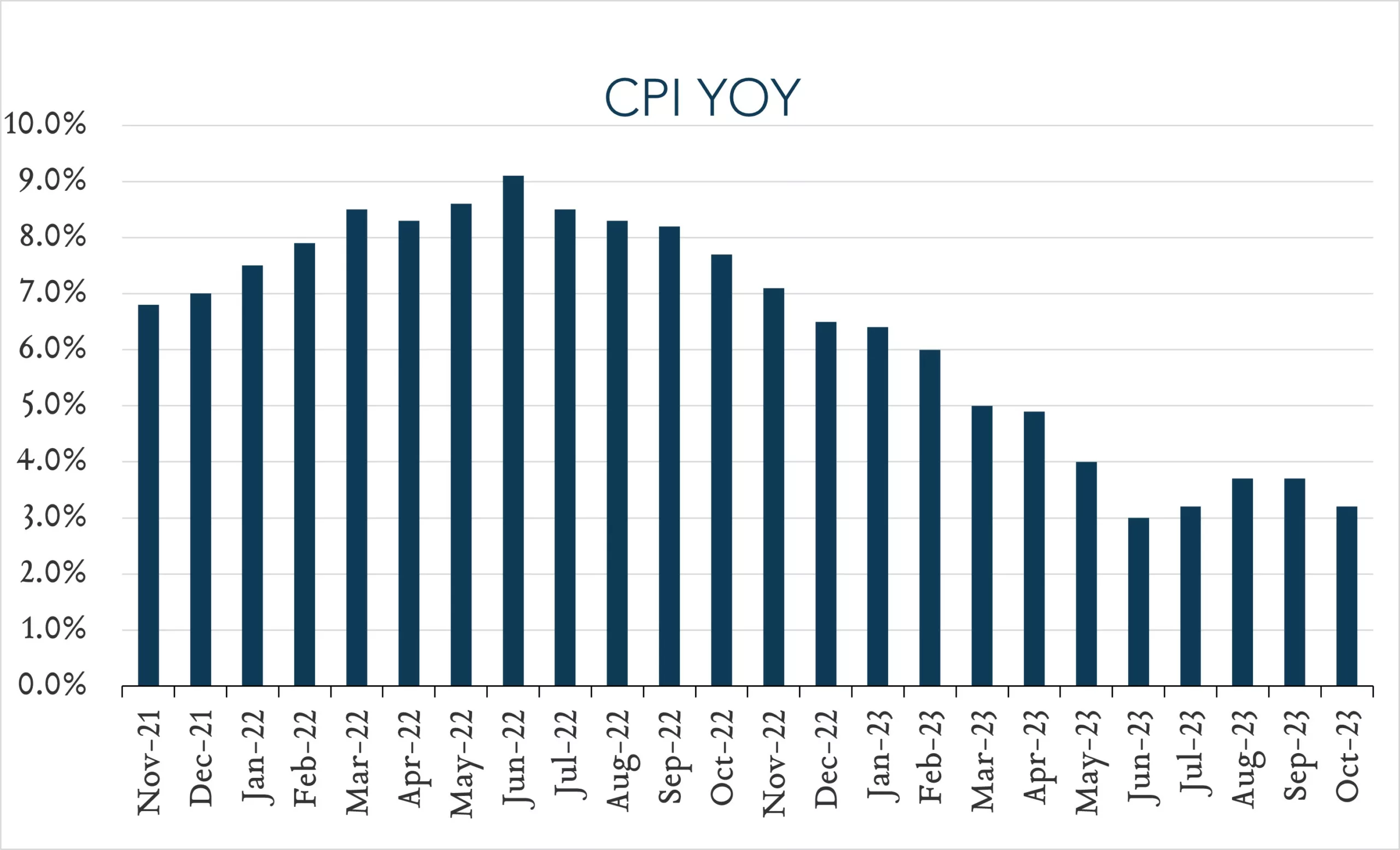

Inflation broadly moderated in October, decelerating to +3.2% from +3.7% in the prior two months. Overall, this is an encouraging sign of progress for monetary policymakers aiming to tame inflation. Despite volatility in recent months, inflation has declined substantially from a 40-year high of 9.1% reached last year. Some Fed policymakers have suggested the committee should be done raising interest rates, while Chair Jerome Powell has maintained that the central bank could hike again if needed. Today’s report validates the Fed’s decision to hold rates steady earlier this month and supports the notion that further rate increases may be off the table.

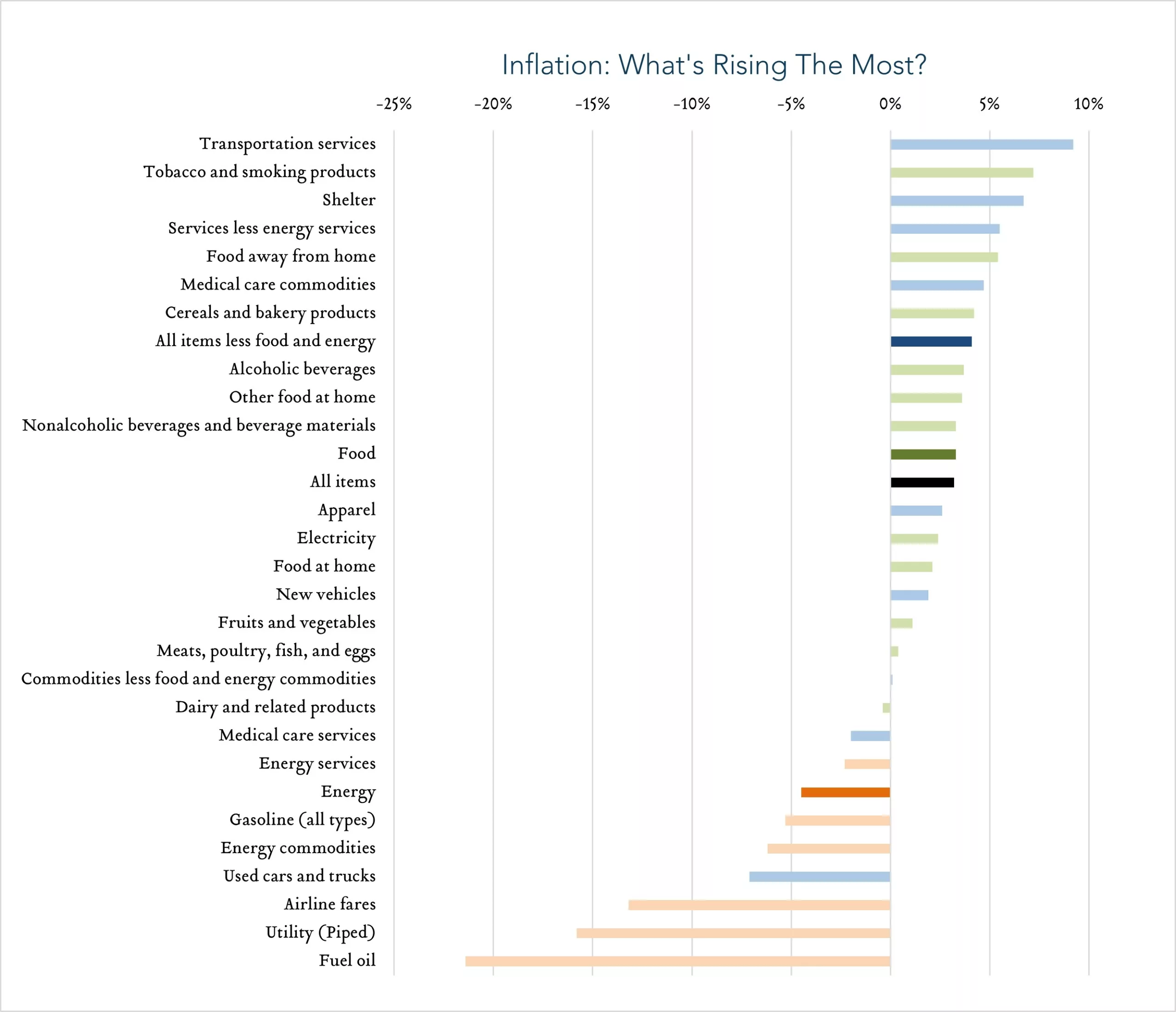

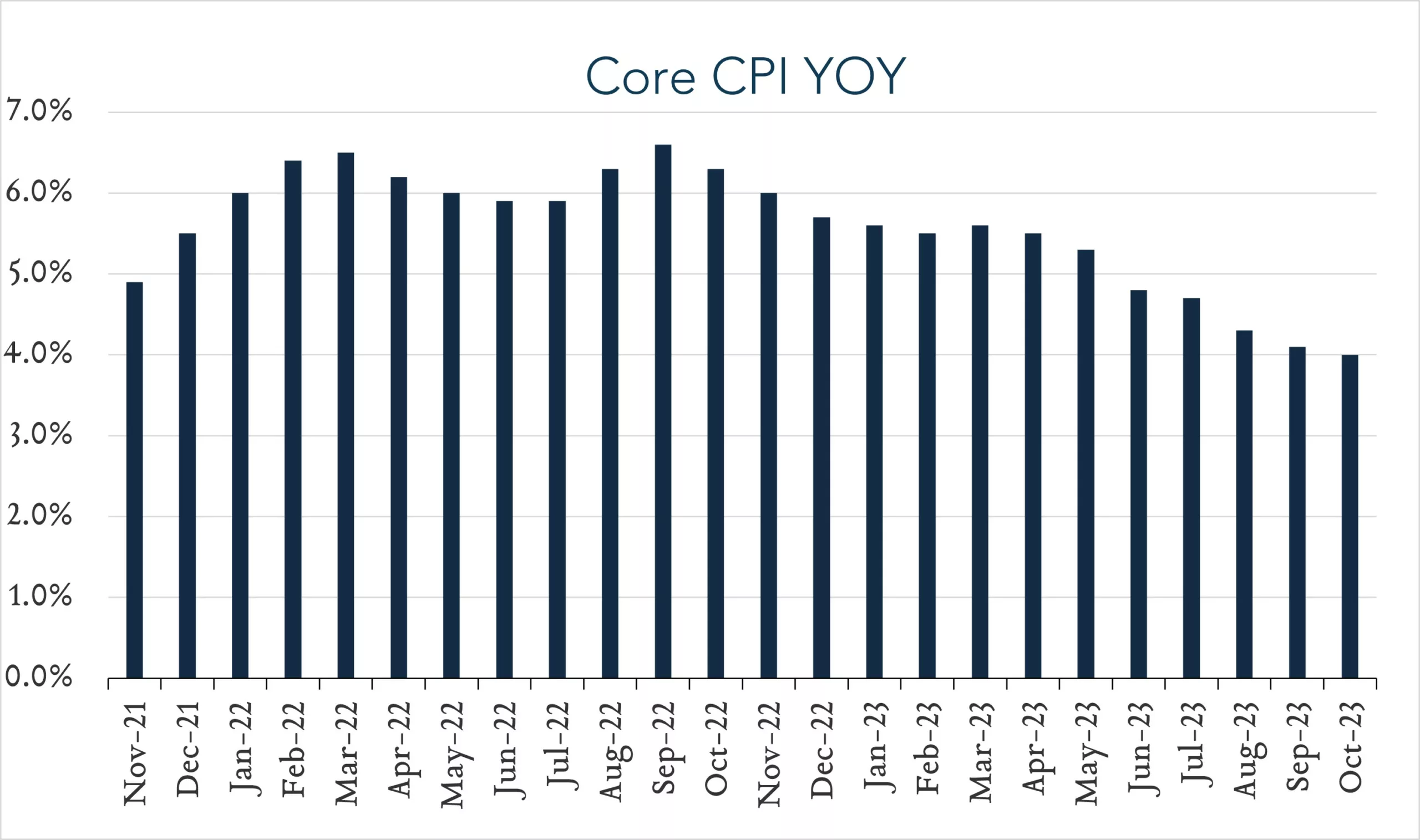

- Consumer prices (CPI) increased 3.2% year-over-year. In October, the consumer price index (CPI) increased 3.2%, decelerating from 3.7% in September and below expectations of 3.3%. Transportation services (+9.2%) and shelter costs (+6.7%) were key contributors to the overall increase, more than offsetting declines in used vehicles (-7.1%) and energy (-4.5%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +6.7% year-over-year, shelter costs decelerated from +7.2% in September and a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 4.0% year-over-year, down from 4.1% in September and below expectations of 4.1%.

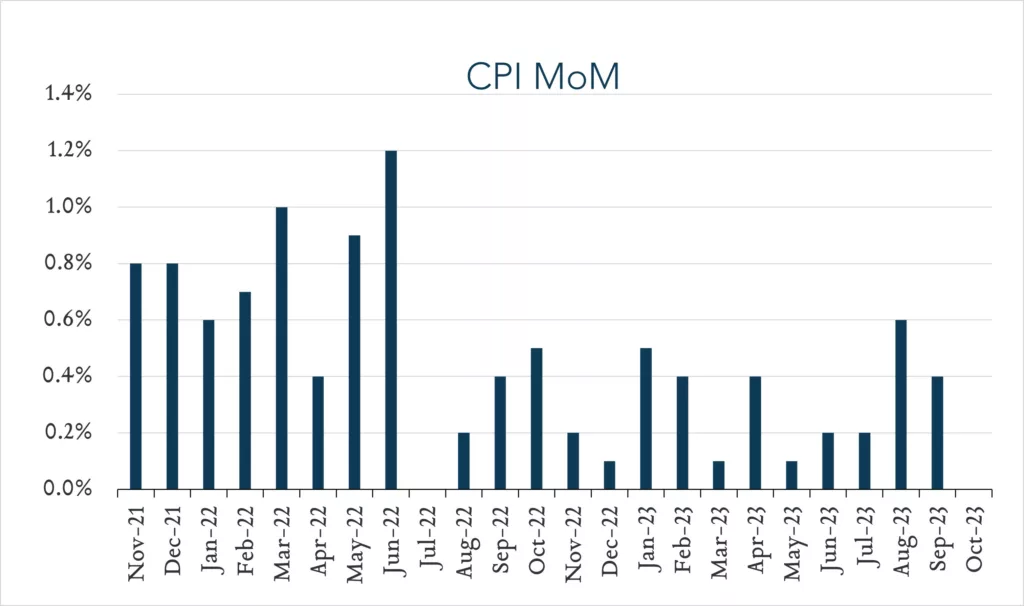

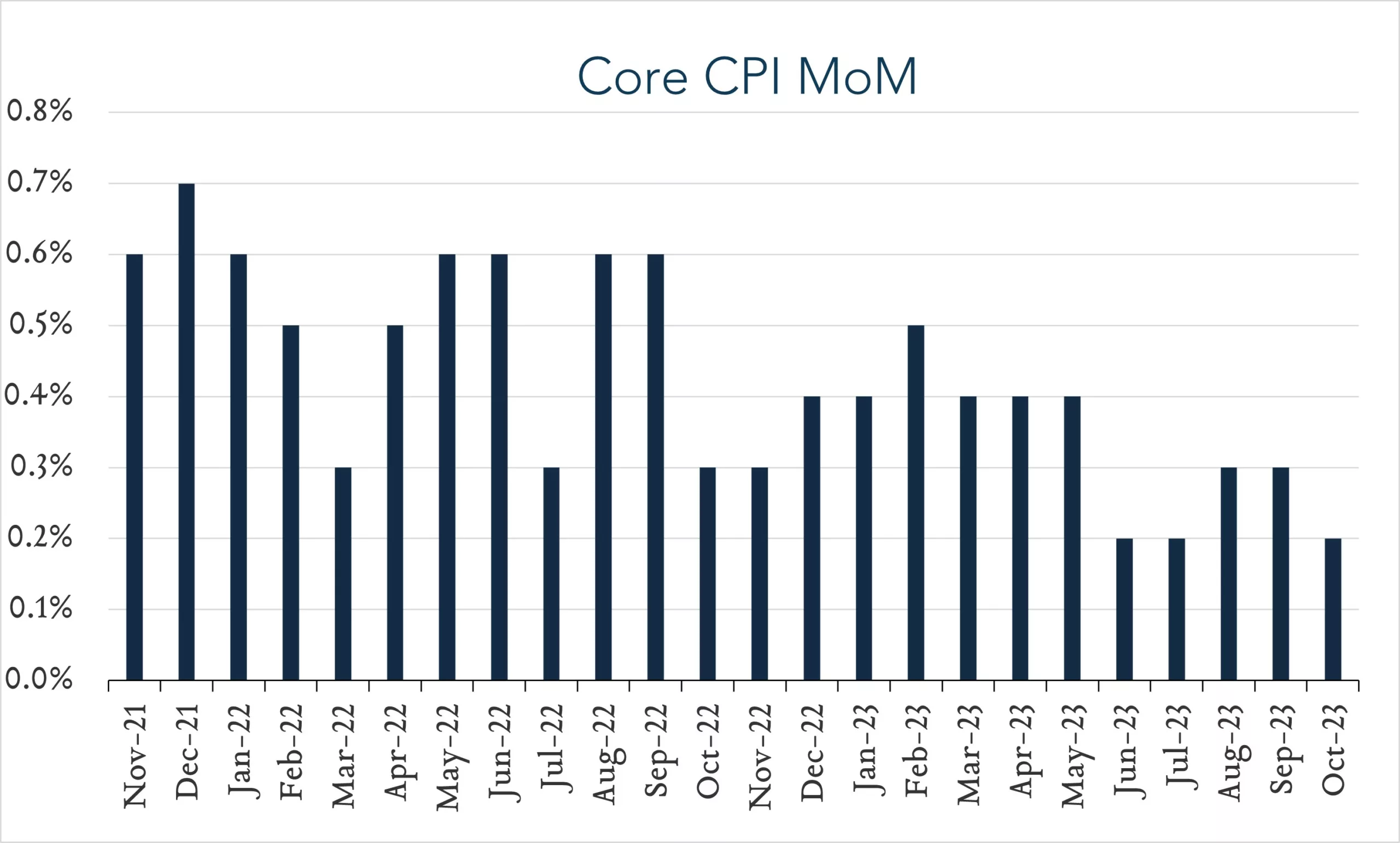

- Consumer prices (CPI) unchanged month-over-month. In October, consumer price levels were unchanged compared to September. Expectations ranged from -+0.0% to +0.2% with a median of +0.1%. Prices for used cars and trucks declined 0.8%, energy prices declined 2.5%, and shelter costs, which represent nearly one-third of the index, increased 0.3% for the month. Core CPI (excludes food and energy) increased 0.2% month-over-month, down from +0.3% in September and below expectations of +0.3%.