December 15, 2021

November Retail Sales - Tempered By Inflation or Christmas Came Early?

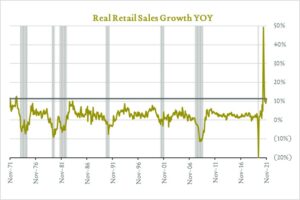

November retail sales rose 0.3% month-over-month (-0.5% adjusted for inflation); missing forecasts. Retail spending increased 0.3% in November, following an upwardly revised 1.8% increase in October. In recent communications, we highlighted expectations for month-over-month figures to continue to be a bit noisy (+/-1%) despite spending levels that remain decidedly robust in absolute terms. November data showed softer spending in electronics and appliance stores as well as general merchandise/department stores compared to October, when both of these categories posted strong increases. While higher inflation levels may be starting to temper purchases, these dynamics also support the idea that consumers got an early start on holiday shopping to get out ahead of potential shipping delays and additional price increases.

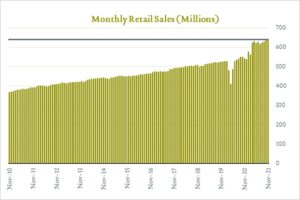

November retail sales (real) up 11.1% year-over-year. The value of retail sales has risen sharply this year, supported by government stimulus, elevated savings, and economic reopening enabled by the ongoing vaccine campaign. For perspective, the total value of retail sales in November was $639B. This represents an all-time high in absolute terms and is 21% higher than the $526B reported in February 2020 (pre-pandemic) and 18% higher than the $541B reported in November 2020 – see chart below.