January 4, 2024

New Year, Same Deadlines for Defined Contribution Retirement Plans

Partnering with Greenleaf Trust means we prepare and provide most forms, filings, and notices for your retirement plan as part of our services. While our team takes care of these increasingly complex filings and notices, per the Internal Revenue Service, as the Plan Sponsor, it is your responsibility to understand what is happening with your business’s retirement plan. I am going to share some of the most important deadlines you should be aware of for 2024 and beyond.

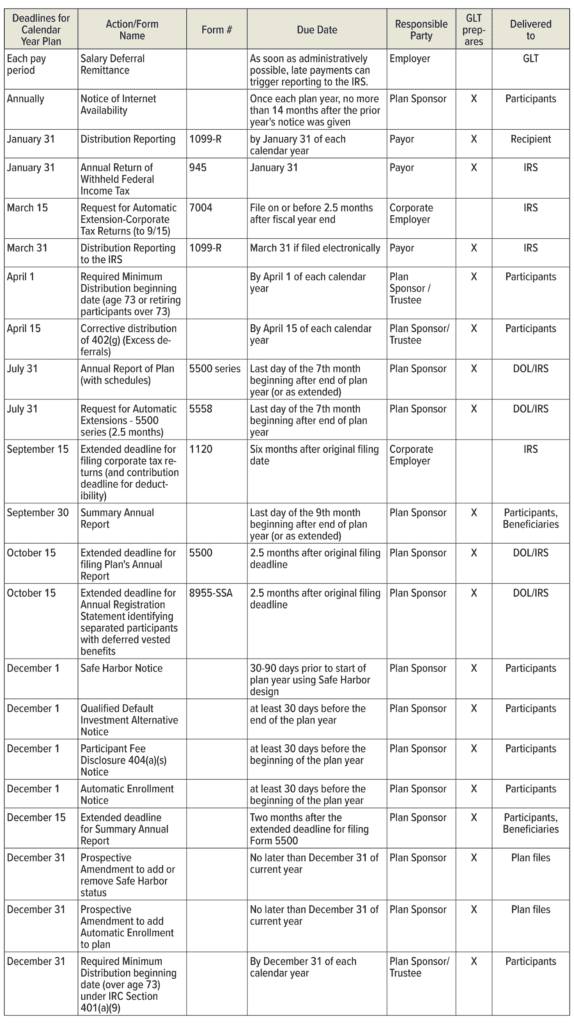

The following table is not an exhaustive list, as our retirement plans are customized to each plan sponsor’s requests, but is representative of the most common filings, forms, and notices. Looking at it can be a bit daunting. “What is that filing? What is that notice?” The wonderful news is your team in the Greenleaf Trust Retirement Plan Division is here to help you navigate them. In addition to staying on top of preparing and disseminating the various documents, we are willing to go deeper if you have the desire to understand why each one is required and what it entails.

Our relationship managers, participant services team, and record keeping team are here to answer questions, talk through plan design details, and ensure your participants are educated and informed to use the plan to meet their personal retirement goals.