June 5, 2023

May Update

As I begin to write this article, I find myself in an awkward position. The elephant in the room, the debt ceiling crisis, has no regard for my monthly publishing timeline and, unfortunately, my crystal ball is still on the fritz. Today is May 22. This article is due on May 23 and with a little luck, this edition of Perspectives will circulate on June 1. If you’ve been following the headlines, June 1 is also Treasury Secretary Janet Yellen’s estimate of the date when the federal government will run out of money. So what’s an author to do? As I see them, my options are as follows:

- Predict the future: Write the article for the most likely outcome and cross my fingers.

- Ignore the issue: Write on some other topic and avoid the uncertain but highly salient issue.

- Offer (hopefully unneeded) perspective: Provide a thorough overview of potential scenarios today, knowing that the article may be highly relevant or grossly out of date when it goes to print.

Putting myself in our clients’ shoes, it strikes me that the third option probably adds the most value. If the issue is resolved by the X date, wonderful. If not, you will certainly hear much more from our team.

Background

The US Department of the Treasury manages payments for the federal government. Congress, by law, limits the maximum amount of debt that the Department of Treasury can issue to finance budget deficits. This limit is commonly referred to as the “debt ceiling.”

The current debt ceiling is $31.4 trillion. The US hit this limit on January 19, 2023. Since that time, the Treasury Secretary has been using “extraordinary measures” to continue making payments on obligations of the federal government.

However, these extraordinary measures only provide a limited amount of funds. Without the ability to issue new debt, the Treasury Department will eventually run out of funds to make payments on legal obligations of the federal government.

The Treasury Secretary, along with private and public economists, estimate that in early June, the Treasury Department will no longer have sufficient funds to satisfy all legal obligations of the federal government. This date is being referred to as the “X date.”

Estimates of the X date range from June 1st to August and are subject to some level of uncertainty. The Treasury Department receives quarterly tax payments in mid-June that may provide some cushion depending on the level of receipts and outlays. However, the X date may occur before mid-June.

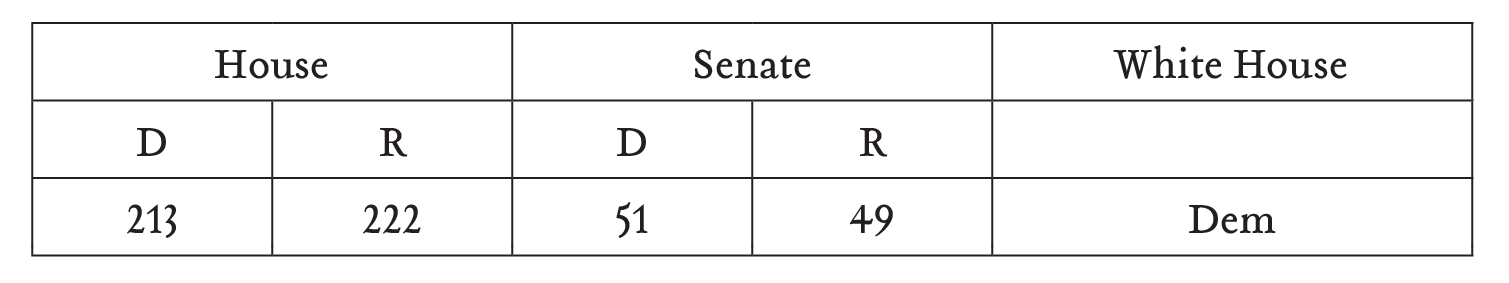

The approaching X date has created some urgency for Congress to consider legislation to raise the debt ceiling. Congress is currently divided, with Republicans holding the majority in the House of Representatives and Democrats holding the Senate and the Presidency.

The president and congressional leaders are currently negotiating and the first official meeting occurred on May 9. Democrats want a “clean” debt ceiling increase. Republicans want to limit federal spending in exchange for increasing the debt ceiling. At the moment, leaders in both parties are reportedly against any short-term debt limit suspensions or increases and do not want to “kick the can.”

Market Reaction

The market reaction to the upcoming X date has been muted so far. There has been evidence of some stress in the securities that would be most directly impacted if the federal government breaches the X date, such as T-bills maturing around that date and credit default swaps (CDS), but broader equity, credit, and currency markets have been resilient.

Looking ahead, we find it difficult to anticipate how the market may respond to the varied potential outcomes. We are evaluating several plausible scenarios:

Plausible Scenarios

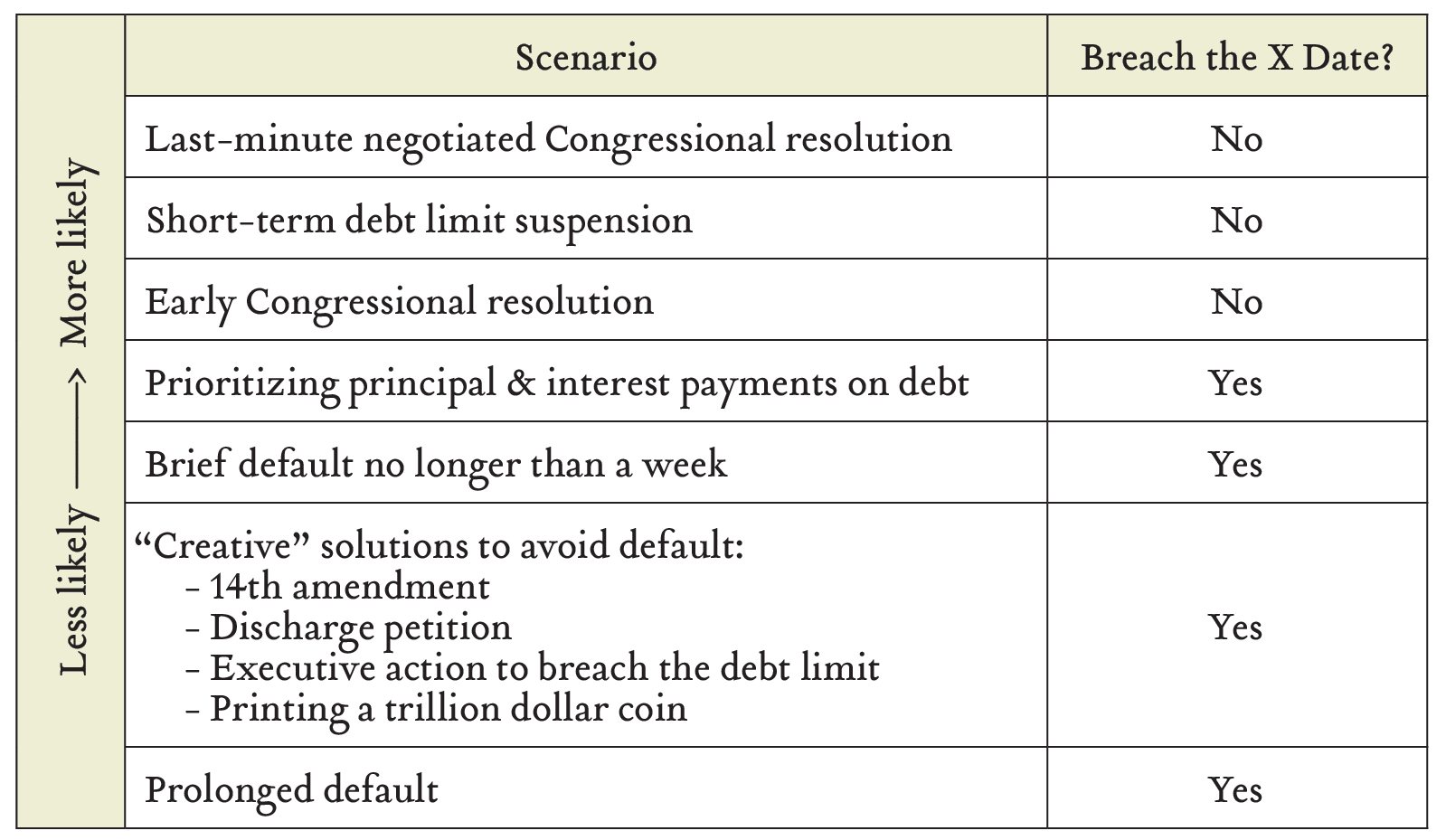

In our view, a federal default remains a remote possibility. The most probable outcomes are that Congress raises the debt ceiling and that the federal government satisfies all its obligations in a timely fashion.

Last-minute negotiated congressional resolution: We believe this is the most-likely outcome. In this scenario, within a week of the oncoming X date, Congress passes resolutions to raise the debt ceiling and to limit future federal spending.

This is similar to 2011, when Congress passed legislation just two days before the Treasury-estimated X date. Markets could be volatile in this scenario. In 2011, the S&P 500 fell around 17% in the week leading up to & following the X date. However, in today’s environment, it appears that investors are anticipating a last-minute solution and, as a result, volatility could be more muted.

The investment implications of this scenario will depend on the timing and the details of the negotiations. The economic implications of austerity would depend on the specific spending cuts contemplated in the legislation.

Short-term debt limit suspension: This is the “kick the can” scenario. This scenario is plausible because Congress has limited time to negotiate a solution and avoid breaching the X date. Before the April tax receipts were tallied, many private economists believed that Congress would have until August to avoid a default. Legislators may have been caught flat-footed by the earlier deadline and may prefer a short-term debt limit suspension, perhaps beyond the June 15th quarterly tax receipt period, to negotiate a more comprehensive legislative package.

This scenario would require investors to be attentive to debt ceiling risks over a more prolonged period but may be welcomed in the short term.

Early congressional resolution: We can hope, right? In this scenario, a resolution to raise the debt ceiling passes without a last-minute showdown. This could occur if the X date actually arrives later than currently anticipated or if negotiations progress faster than expected.

This scenario could provide a short-term boost to investment sentiment, but the ultimate implications would depend on the details of the negotiations.

Prioritizing payments on debt securities: In this scenario, congressional leaders fail to pass a debt ceiling increase prior to the X date. This would be unprecedented. It is difficult to anticipate how the president, Treasury Department, and Federal Reserve might respond to such a development.

However, we believe it is probable that payments on the national debt might be prioritized over other payments such as Social Security, Medicare, and Department of Defense spending. Indeed, in 2011, this type of prioritization was discussed in a Federal Open Market Committee conference call. The constitutionality of this type of prioritization is debatable.

This scenario would constitute an instance of “default” in the eyes of ratings agencies, but debt holders would receive timely payment. The federal government would be required to delay payment of other legal obligations.

Such a scenario could be sharply negative for the economy because of the significance of Social Security, Medicare, and other federal outlays. If those payments are missed, consumer spending could be significantly curtailed.

Brief default: In this scenario, the X date is breached and payments to federal debtholders are delayed. Again, this would be unprecedented, but the anticipated consequences would be severe. In a 2013 analysis, the FOMC projected that a brief default could result in recession, elevated unemployment for a period of years, and deflation.

There are open questions about operational processes for defaulted treasury securities. It is likely that market trading in delayed securities would be impaired. It is possible that the Federal Reserve would offer to purchase defaulted securities to maintain market function.

The investment implications of such a scenario would depend on the duration of the delay in payments. In the intermediate term, the dollar’s reserve currency status and treasury securities being considered the world’s benchmark “safe asset” would likely be impaired.

Creative solutions: In this scenario, Congress does not raise the debt ceiling prior to the X date in a negotiated resolution. The dire implications of missing debt or Social Security payments induce the executive branch or congressional leaders to engage in constitutionally questionable solutions to avoid missing payments. We have seen reporting on several possible responses, including:

- The 14th amendment: The 14th amendment to the constitution reads, in part, “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” Some constitutional scholars argue this amendment renders the debt ceiling unconstitutional. In this scenario, the Treasury Department continues to borrow to make payments and breaches the debt ceiling until the constitutional question is resolved by the courts.

- Discharge petition: This is the least creative “creative solution.” A discharge petition would allow minority-party Democrats in the house to force a vote on the debt ceiling. However, they would need 218 signatures and, so far, we have not seen reporting on five House Republicans who would be willing to join in the effort. Reporting has been skeptical about the plausibility of the discharge petition option.

- Executive action to breach the debt limit: In this scenario, the president instructs the Department of Treasury to continue making payments and unilaterally breaches the debt limit. This would be a bit of a constitutional crisis.

- Printing the trillion dollar coin: In 1997, Congress passed legislation allowing the U.S. Mint to print platinum coins of any denomination. The theory would be to have the U.S. Mint print a trillion dollar coin, deposit it at the Treasury General Account at the Federal Reserve, and then use the newly-replenished account to continue making payments.

These “creative solutions” would all accompany significant legal questions and uncertainty for debtholders. There would certainly be political pressure to avoid the negative consequences of default, so we cannot rule them out. The investment implications would be highly uncertain for any of these scenarios other than the discharge petition, which is a recognized legal pathway for raising the debt ceiling.

prolonged default: This is the worst-case scenario. Payments to debtholders and payments on other federal obligations are made only as the Treasury Department receives funds. This would likely result in a severe recession, high unemployment, spikes in interest rates, and financial market turmoil.

The probable implications of a prolonged default would be so negative that it is difficult to imagine Congressional leaders allowing it to transpire.

Summary

We continue to believe that the federal government will honor its obligations in-full and on-time. However, the most likely scenario involves a last-minute negotiation and some significant uncertainty about how Congress will reach an agreement. Clients can probably anticipate some apocalyptic headlines in the coming weeks.

We hope by laying out the most plausible scenarios we have demonstrated that, although the current debt ceiling debates are likely to have some level of market impact, adjusting investment strategies by speculating on possible outcomes is unlikely to help clients achieve their long-term objectives. Rather, we believe the best approach for managing through this type of uncertainty is to remain disciplined, maintain proper diversification, and ensure that portfolios align with a client’s long-term goals and risk tolerance.