June 17, 2025

May Retail Sales - Post Surge Moderation

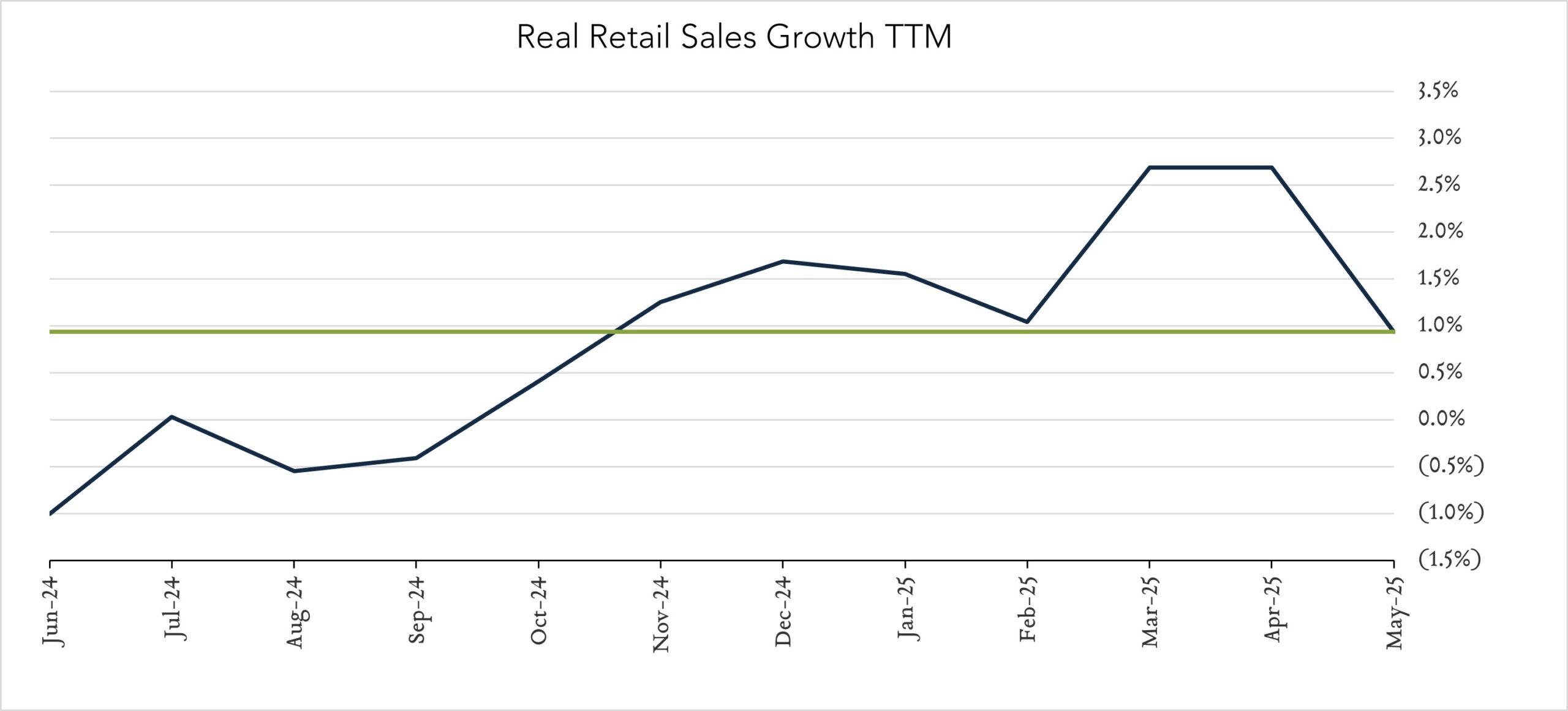

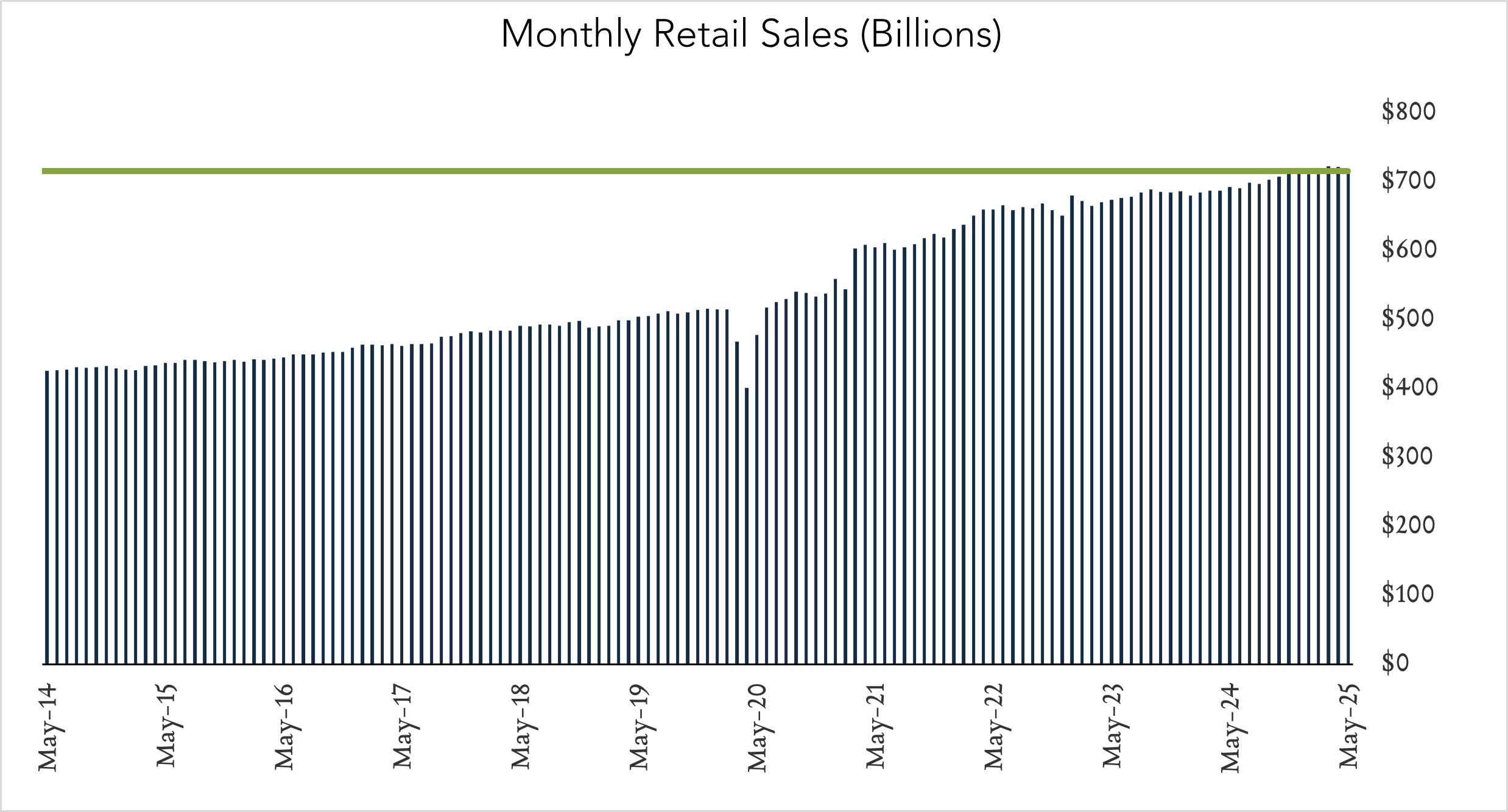

In nominal terms, U.S. retail sales advanced 3.3% year-over-year and declined 0.9% month-over-month. Adjusting for inflation, spending advanced 0.9% year-over-year and retreated 1.0% month-over-month. In March and April, consumers rushed to make big-ticket purchases in an effort to get out ahead of potential tariffs. We noted that the elevated spending observed in March and April would likely be followed by more subdued spending which is what we observed in May – in particular, motor vehicle purchases declined by 3.5% month-over-month. In spite of a trade policy narrative that has evolved favorably since liberation day, the eventual breadth and severity of tariffs remains highly uncertain and has weighed heavily on consumer and business sentiment in recent weeks.

- Real (inflation adjusted) retail sales advanced 0.9% year-over-year. In May, retail sales grew 3.3% nominally netting growth of 0.9% after adjusting for 2.4% inflation. Higher spending at online retailers (+8.3%) and restaurant dining (+5.3%) was partially offset by a declines at the pump (-6.9%). Ten of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales declined 1.0% month-over-month. In May, nominal retail sales levels contracted 0.9% compared to April, worse than forecasts for a 0.6% contraction and netting a 1.0% decline after adjusting for 0.1% inflation in the month. Higher spending at brick and mortar (+2.9%) and online retail (+0.9%) was offset by lower spending on motor vehicles (-3.5%) and declines at the pump (-2.0%). Five of thirteen categories advanced in real terms.