June 15, 2022

May Retail Sales - More at the Pump, Less at the Dealership

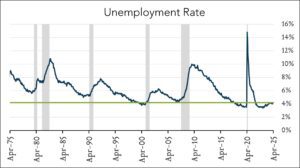

Job gains top estimates, unemployment rate holds at 3.6%. S. employers added more jobs than expected in May and wage growth (while still elevated) moderated slightly. A sustained softening in wage growth would be welcome by the Fed as it endeavors to tamp down the highest inflation levels observed in 40 years. The central bank hopes to temper demand for workers in order to slow wage growth and inflation without going so far as to cause a recession, which would be accompanied by higher unemployment. As the labor market reaches pre-pandemic employment levels and the unemployment rate holds at a historically low level, we would have to expect overall job growth to slow in the months ahead.

390K payrolls added in May – 70k more than expected. The U.S. labor market added 390k jobs in May, coming in stronger than expected and extending momentum in 2022. Forecasts ranged from +220K to +450K with a median of +318K. Job gains were led by leisure & hospitality (+84K), professional & business services (+75K), transportation & warehousing (+47K) and construction (+36K) while employment in retail trade declined by 61K. At this point, the economy counts just 822K fewer jobs than before the pandemic and essentially all of the change can be attributed to the leisure & hospitality sector which counts 1.3M fewer jobs. Employment in many other sectors is now well above February 2020 levels.

3.6% unemployment – unchanged from April. The U.S. unemployment rate held steady at 3.6% in May. Forecasts ranged from 3.4% to 3.7% with a median of 3.5%. The labor force participation rate rose slightly from 62.2% to 62.4% (compared to 63.4% pre-pandemic). Hourly earnings increased 5.2% over the last year, down from 5.5% in April. On a month-over-month basis, hourly earnings grew 0.3%, down from 0.5% in April and below expectations of 0.4%.