June 18, 2024

May Retail Sales - Below Expectations

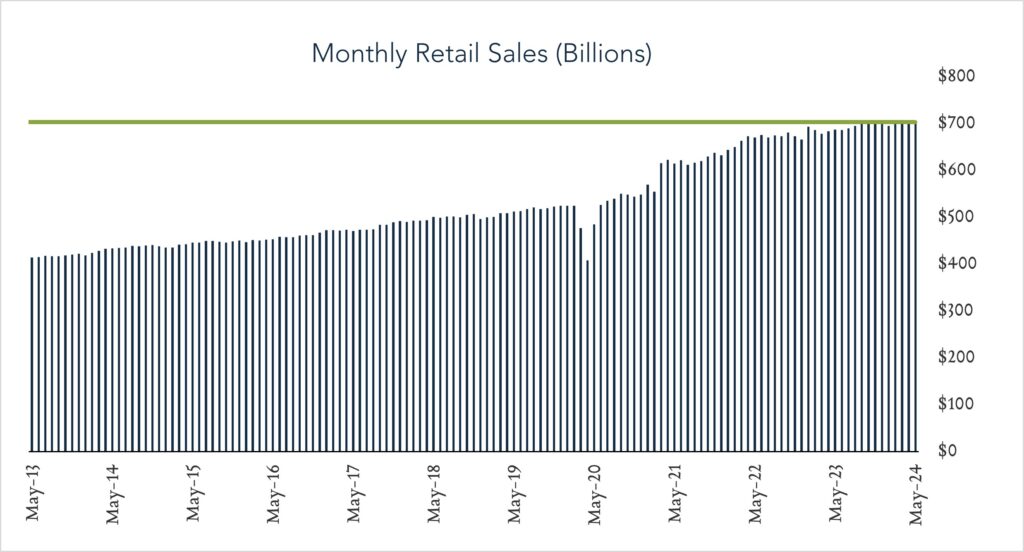

U.S. retail sales barely changed in May and prior months were revised lower, pointing to ongoing erosion of consumer strength. It appears that a gradually cooling job market, persistent inflation and more limited access to credit are causing consumers to exercise greater prudence in discretionary categories. Following last week’s FOMC meeting, policymakers remain on the look out for indications that inflation is cooling or unexpected weakness in the economy, either of which could justify a rate cut. While Fed projections call for just one 0.25% rate cut in 2024, investors continue to price for two. On the margin, today’s report might provide an additional nudge towards accommodation from the Fed.

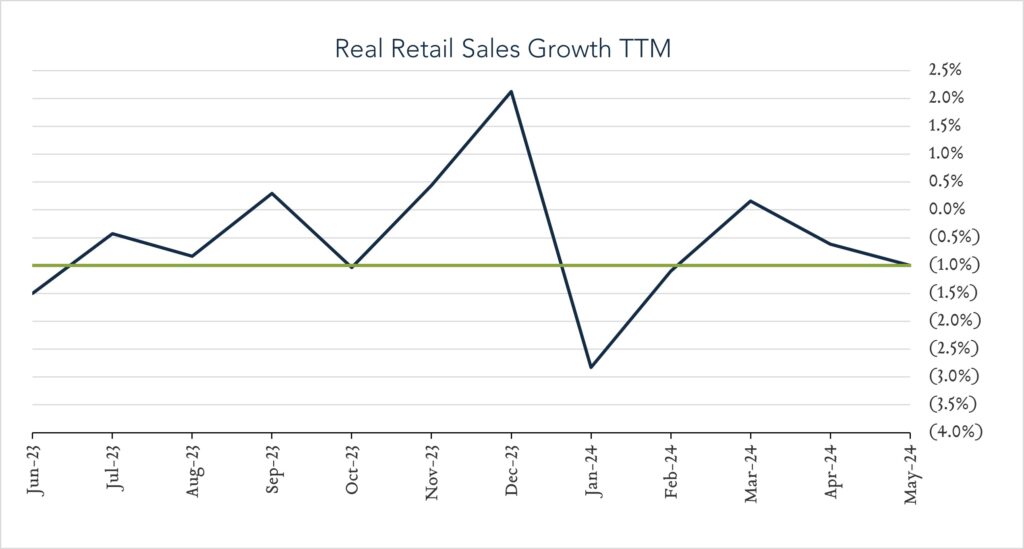

- Real (inflation adjusted) retail sales declined 1.0% year-over-year. In May, retail sales grew 2.3% nominally netting a decline of 1.0% after adjusting for 3.3% inflation. Faster growth in spending at online retailers (+6.8%) and on restaurant dining (+3.8%) was partially offset by lower spending on building materials (-4.3%) and home furnishings (-6.8%). Ten out of thirteen categories posted declines in real terms.

- Real (inflation adjusted) retail sales declined 0.1% month-over-month. In May, nominal retail sales levels increased 0.1% compared to April (consensus +0.3%) netting a 0.1% decline in real terms. Faster growth in spending at online retailers (+0.8%) and on motor vehicles (+0.8%) was offset by lower spending at gas stations (-2.2%) and restaurants (-0.4%). Seven out of thirteen categories slowed in real terms.