June 7, 2024

May Jobs Report - Very Strong Hiring Might Slow Fed Plans to Lower Rates

Job gains exceed even the highest forecast. U.S. employers accelerated hiring in May and wage growth reaccelerated after a relatively weak report in April. The labor market added just 272K jobs in May, significantly above consensus expectations of +180K, and the unemployment rate ticked up 0.1% to 4.0%. The May jobs report is one of the last significant economic data releases prior to the Federal Open Market Committee (FOMC)’s meeting on June 12th. The strong hiring and wage growth may leave the Fed seeking additional evidence that inflation is decelerating sustainably to their 2.0% target. The FOMC will release a revised Summary of Economic Projections at its June meeting and this jobs report may influence the Dot Plot higher in 2024. In response to today’s report, yields reversed some of their downward moves since the May 1st Fed meeting, with the 2 year treasury rising 0.14% to 4.86% and the 10 year treasury rising 0.14% to 4.43%.

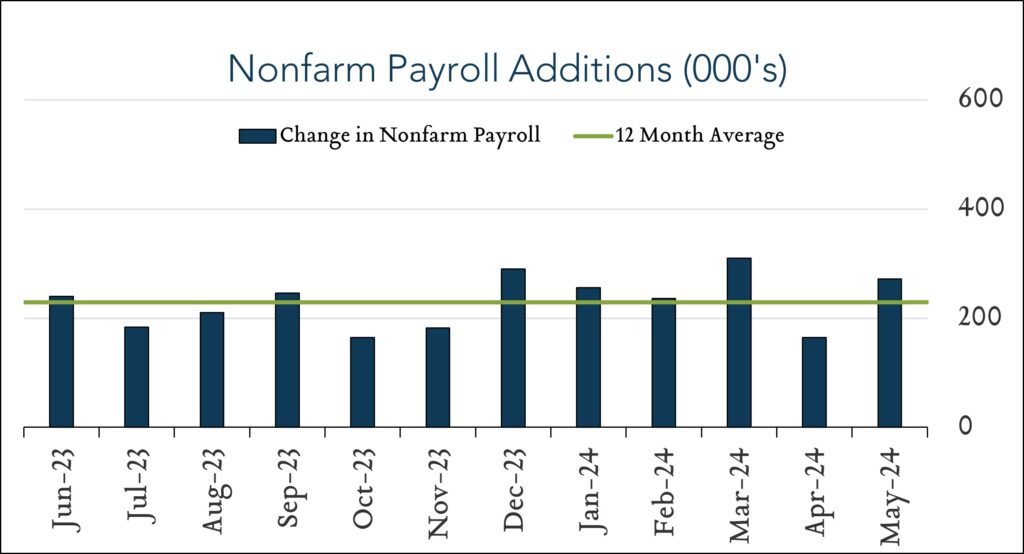

· 272K jobs added in May – Higher than all forecasts. The U.S. labor market added 272K jobs in May, up from +165K (revised) in April and above the trailing twelve month average of +232K. Forecasts ranged from +120K to +258K with a median of +180K. Hiring was more pronounced in health care (+68K), government (+42k), and professional, scientific, and technical services (+32k).

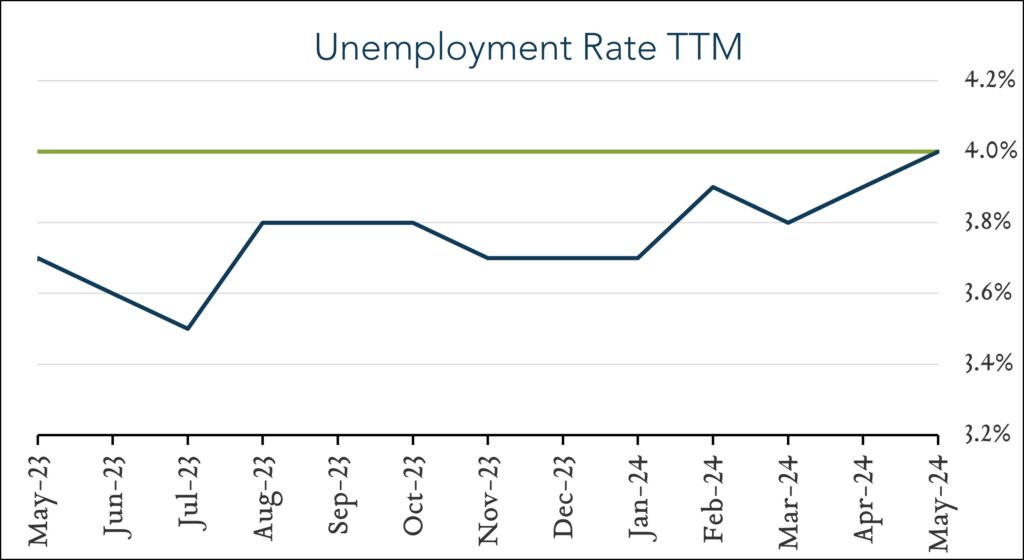

· 4.0% unemployment – up from 3.9%. The U.S. unemployment rate rose 0.1% to 4.0% in May. Forecasts ranged from 3.8% to 4.0% with a median of 3.9%. The unemployment rate has been at 4.0% or lower since December, 2021, 30 consecutive months. The labor force participation rate was down slightly at 62.5% from 62.7% previously. Year-over-year, wage growth increased 4.1% accelerating modestly from 3.9% in April. Month-over-month, wages increased 0.4% compared to +0.2% in April.