June 3, 2022

May Jobs - Payroll Adds Top Estimates; Unemployment Steady at 3.6%

U.S. inflation unexpectedly accelerated to hit a new 40-year high in May. Record gasoline prices and geopolitical factors threaten to keep inflation high in the coming months suggesting the Fed – which has already committed to half-point rate increases at each of its next two meetings (starting next week) – will need to apply more pressure on the economy for longer. In May, prices for necessities continued to rise at double digit rates. Energy prices climbed nearly 35% including a near 50% jump in gasoline costs while grocery prices rose nearly 12% and rent on a primary residence climbed more than 5% from a year ago. Gas prices have climbed higher in June, signaling more upward pressure in coming CPI reports. Meanwhile, Russia’s ongoing war in Ukraine and Covid-related lockdowns in China present growing risks that price pressures in necessity categories will continue to build. The job market remains a bright spot fro now, though rising prices are crippling confidence among American workers.

- Consumer prices (CPI) increased 8.6% year-over-year. In May, the consumer price index (CPI) increased 8.6% compared to the same period a year ago, up from 8.3% in April. Expectations ranged from 8.0% to 8.5% with a median of 8.3%. Core CPI (excludes food and energy) increased 6.0% year-over-year, down from 6.2% in April. While price increases were broad-based, energy costs (+35%) including gasoline (+49%), new and used vehicles (+13% and +16%) and food (+10%) including groceries (+12%) were among the larger contributors to the year-over-year change.

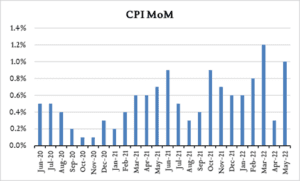

- Consumer prices (CPI) increased 1.0% month-over-month. In May, consumer prices as measured by CPI increased 1.0% compared to April, and accelerating from a 0.3% increase last month. Expectations ranged from 0.6% to 0.9% with a median of 0.7%. Core CPI (excludes food and energy) increased 0.6% year-over-year. The month-over-month increase was led by energy costs (+3.9%), used vehicles (+1.8%), and food (+1.2%).